Purpose

Change in price of goods and services purchased by consumers.

Key highlights

- The US CPI expected to rise further in July due to the impact of tariff driven price hikes.

- Core CPI MoM is estimated to rise to 0.3% in July while CPI YoY is anticipated to print 2.80%.

- June’s CPI hit 2.7%, it’s highest in four months, driven by tariffs and rising prices. July is expected to similar increase — around 0.2% for the month and 2.8% annually — as tariffs boost costs while falling gas prices and weak demand limit service price growth.

- July’s CPI will reveal ongoing tariff-driven inflation quietly eroding consumers’ buying power — a slow decline, not a crash.

- Rising CPI distances further from the Federal Reserve's 2% long-term target.

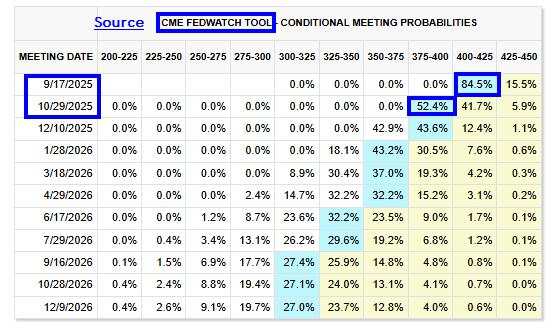

US interest rate probabilities

- CME Fed watch is pointing at 84.5% and 52.4% probability of a rate cut in September and October, respectively.

US 10Y yields technical view

- US 10Y yields formed a double top formation between April 2024 and January 2025 by failing to break 4.74% and 4.81%.

- 10Y yields are facing a robust obstacle around 4.35 – 4.40%.

- Below this resistance a dip to 4.2 -4.10% is likely.

Technical analysis perspective

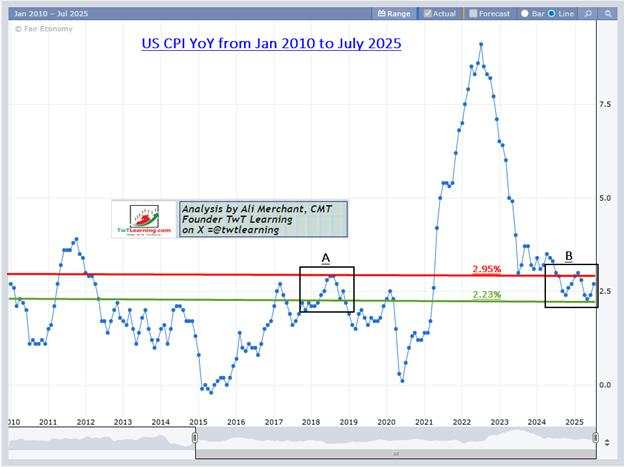

US CPI YoY

- US Core CPI Year-over-Year stayed below 2.2% from November 2012 to January 2017.

- Inflation rose to 2.7% by March 2017, then dropped to 1.6% in July 2017.

- Technically, past strong resistance, once broken upward, often becomes a solid support level in the future.

- YoY CPI has remained above 2.3% since October 2024.

- Inflation rebounded twice, from 2.4% in October 2024 to 2.3% in May 2025, forming a double bottom-like pattern.

- This formation suggests inflation could rise from 2.8% to 2.9% in the coming months.

- A similar pattern occurred between January and August 2018 (see rectangle A), which can be compared to the October 2024 - May 2025 pattern (rectangle B).

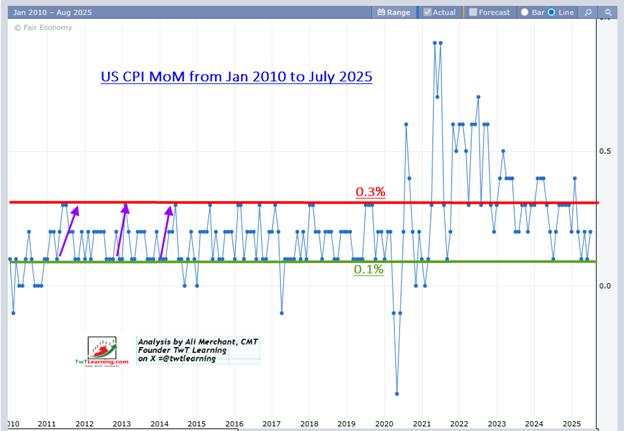

US Core CPI MoM:

Core CPI rises to 0.3% if it remains above 0.1% for a couple of months since April 2011 except on a few occasions where it cooled down.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Bạn thích bài viết này? Hãy thể hiện sự cảm kích của bạn bằng cách gửi tiền boa cho tác giả.

Tải thất bại ()