Traders kicked off Tuesday in wait-and-see mode ahead of the U.S. CPI report, with Asian stocks rallying on an extended US-China tariff truce and Europe treading water on weak German sentiment.

Once the inflation data hit in line with forecasts, risk appetite roared back, sending U.S. equities to fresh highs and the dollar sliding.

Here are headlines you may have missed in the last trading sessions!

Headlines:

- U.K. BRC retail sales monitor for July: 1.8% y/y (2.5% forecast; 2.7% previous)

- Australia NAB business confidence for July: 7.0 (3.0 forecast; 5.0 previous)

- RBA interest rate decision for August: 3.6% (3.6% forecast; 3.85% previous)

- RBA Gov. Bullock said their forecasts are “conditioned on a couple more cuts,” repeated that the board is “preemptive and data dependent”

- ECB member Nagel said interest rates at a “very good level,” ECB can “remove inflation from the list of major challenges”

-

U.K. claimant count change for July: -6.2K (15.0K forecast; 25.9K previous)

- U.K. employment change for June: 238.0K (65.0K forecast; 134.0K previous)

- U.K. unemployment rate for June: 4.7% (4.7% forecast; 4.7% previous)

- U.K. average earnings incl. bonus for June: 4.6% 3m/y (5.0% forecast; 5.0% previous)

- Germany ZEW economic sentiment index for August: 34.7 (45.0 forecast; 52.7 previous)

- Euro Area ZEW economic sentiment index for August: 25.1 (30.0 forecast; 36.1 previous)

- U.S. NFIB business optimism index for July: 100.3 (98.7 forecast; 98.6 previous)

- Canada building permits for June: -9.0% m/m (0.7% forecast; 12.0% previous)

- U.S. CPI for July: 0.2% m/m (0.2% forecast; 0.3% previous); Core inflation at 0.3% m/m (0.2% forecast; 0.2% previous)

- U.S. annual CPI for July: 2.7% y/y (2.7% forecast; 2.7% previous); Core inflation at 3.1% y/y (3.0% forecast; 2.9% previous)

- U.S. monthly budget statement for July: -291.0B (-260.0B forecast; 27.0B previous)

- Germany current account for June: 18.6B (12.5B forecast; 9.6B previous)

- FOMC member Schmid favors keeping policy modestly restrictive for now, citing persistent inflation and limited tariff effects

- Richmond Fed President Barkin hints the Fed can adjust if needed, but strong jobs and steady spending mean rate cuts may not come soon

- U.S. API crude oil stock change for August 8: 1.5M (-4.2M previous)

- OPEC kept 2025 demand forecasts unchanged for, lifts 2026 expectations to 1.38M bpd – up 100K bpd from the previous forecast

- BLS commissioner nominee EJ Antoni considering suspending monthly jobs report

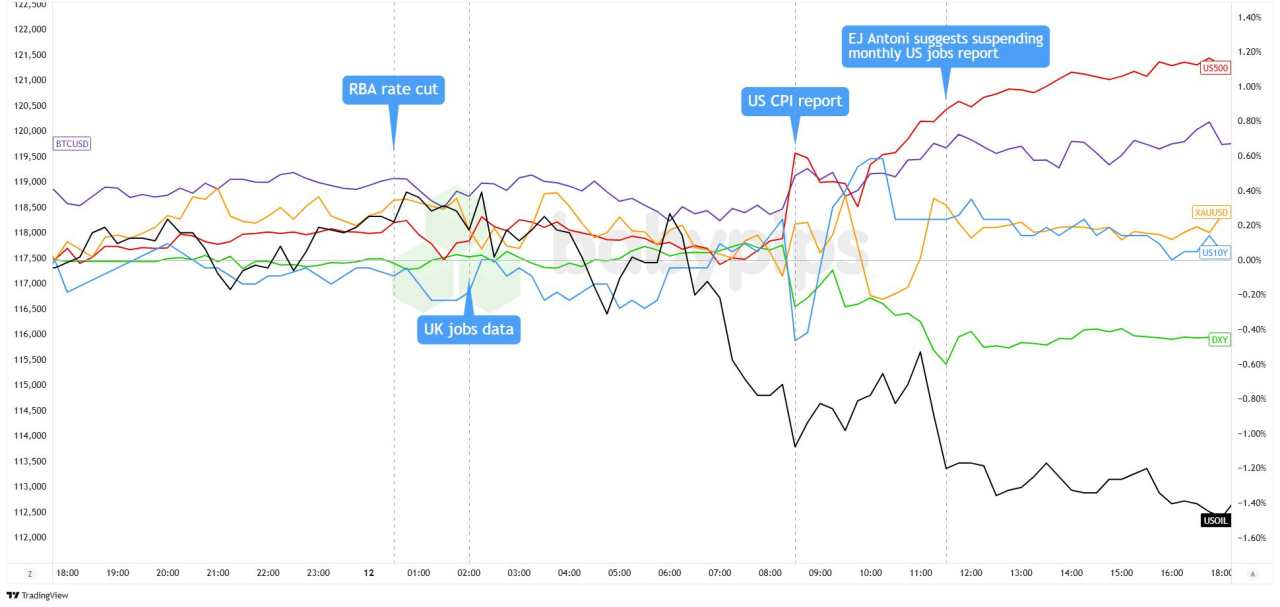

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Markets displayed cautious optimism ahead of the pivotal US inflation data, with Asian equities rallying on the extended US-China tariff truce that pushed Japan’s Nikkei to record highs. European stocks traded mixed as investors digested weak German ZEW sentiment that plunged to 34.7 from 52.7, though the Stoxx 600 managed a 0.21% gain while Germany’s DAX slipped 0.23%.

Uncle Sam’s inflation report sparked a broad risk-on rally as the 0.2% monthly CPI rise matched expectations, solidifying September rate cut expectations. US indices surged to fresh records with the S&P 500 jumping 1.1% to 6,445 and the Nasdaq climbing 1.4%, while small-caps outperformed as the Russell 2000 soared 3%. Treasury yields initially dipped before the 10-year settled at 4.29%, likely reflecting mixed signals about the hot core CPI and the Fed’s easing path.

Gold edged down modestly to $3,347 despite dollar weakness, while WTI crude fell 1.4% to $63.08 ahead of Friday’s Trump-Putin summit on Ukraine. Bitcoin displayed remarkable strength, breaking above $120,000 as risk appetite improved, though it later consolidated near $119,800 as crypto enthusiasm aligned with the broader market rally.

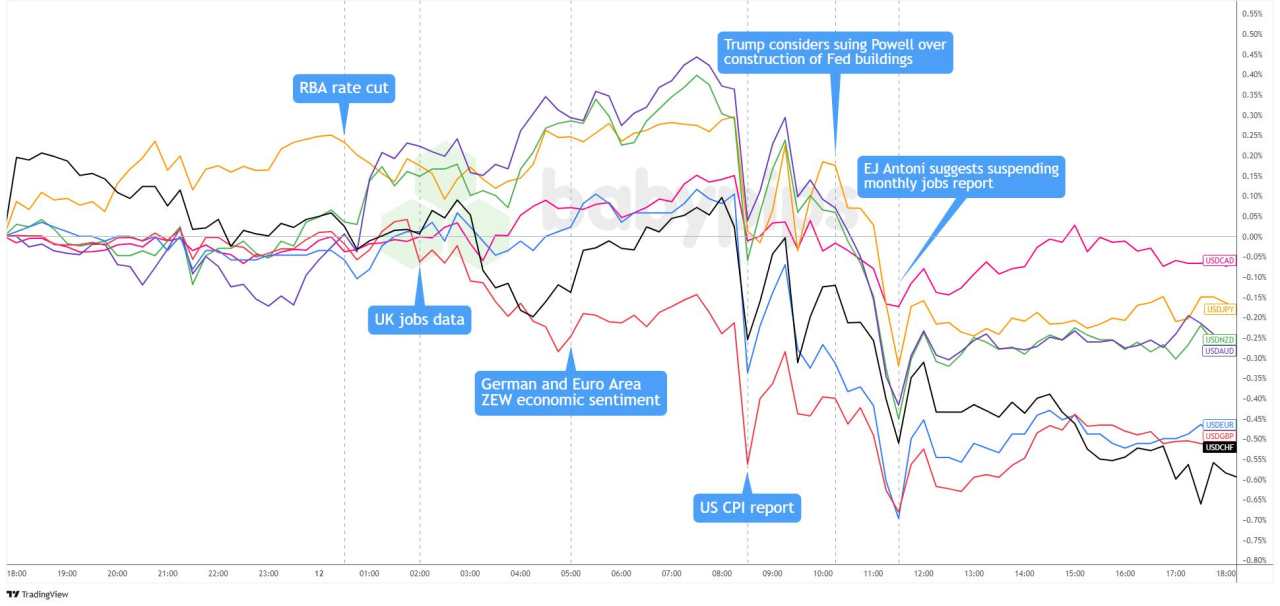

FX Market Behavior: U.S. Dollar vs. Majors:

Overlay of USD vs. Majors Chart by TradingView

The dollar maintained a steady tone through the Asian session as traders weighed Fed policy uncertainty against the extended US-China tariff truce, while the RBA’s expected 25bp rate cut to 3.60% provided limited spillover effects. The greenback found modest support during European hours when Germany’s ZEW economic sentiment plunged to 34.7 from 52.7, while UK employment data came in mixed with the jobless rate holding at 4.7% as expected.

The currency’s composure evaporated when US markets opened and the CPI report landed squarely in line with forecasts, showing a 0.2% monthly rise that bolstered September rate cut expectations. The dollar tumbled sharply as traders repriced Fed easing odds to nearly 90%, with the selling accelerating when Trump’s BLS nominee EJ Antoni suggested suspending monthly jobs reports, raising concerns about data transparency.

The greenback staged a partial recovery into the London close as profit-taking emerged, but the damage was done. By session’s end, the dollar closed broadly weaker against major peers, with the DXY index settling around 104.00 after briefly threatening to break below that psychological level. The currency’s weakness reflected growing conviction that the Fed would prioritize labor market concerns over modestly elevated core inflation.

Upcoming Potential Catalysts on the Economic Calendar

- Germany inflation rate final for July at 6:00 am GMT

- Germany wholesale prices m/m for July at 6:00 am GMT

- Japan machine tool orders y/y for July at 6:00 am GMT

- U.S. MBA mortgage applications for August 8 at 11:00 am GMT

- U.S. Fed Barkin speech at 11:30 am GMT

- U.S. EIA crude oil stocks change for August 8 at 2:30 pm GMT

- U.S. Fed Goolsbee speech at 5:00 pm GMT

- Canada BoC summary of deliberations at 5:30 pm GMT

- U.S. Fed Bostic speech at 5:30 pm GMT

- U.K. RICS house price balance for July at 11:01 pm GMT

- Australia labor market data for July 1:30 am GMT

It’s a relatively lighter day for FX news event traders, with Germany’s final inflation and wholesale price data likely swaying the European currencies during the London session.

In the U.S., mortgage and oil inventory data, plus comments from Fed and BOC officials could set the tone for policy expectations and USD and CAD moves.

As always, look out for global trade developments and geopolitical headlines that could influence overall market sentiment. Stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!

Tải thất bại ()