Markets face a loaded docket this week: Powell’s Jackson Hole speech, Citron’s $40 price target for Palantir, and Nvidia’s long-awaited technical breakdown.

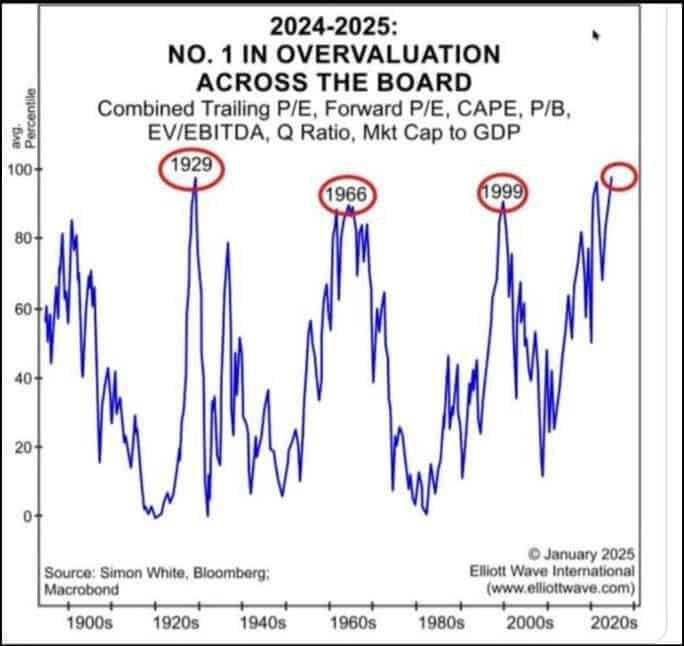

Behind the headlines, one chart is making the rounds — and it shows just how stretched equity valuations have become.

Nvidia breaks trend

Nvidia (NVDA) slipped under its rising channel, breaking below its daily trendline. The $170–$174 volume support zone is first in focus, but the more important level is the $150 – $153 support zone which aligns with a Value Area High, and Fibonacci levels at $146.78.

Given semiconductors have powered much of 2025’s rally, this breakdown puts the broader tech trade on watch.

Palantir hit by Citron

Citron Research (Hedge Fund) resurfaced with a rare short report, pegging Palantir’s fair value at $40. The stock tumbled roughly 8% in a single day, stoking questions over whether this was an overdue reality check or simply an excuse for traders to take profits across tech.

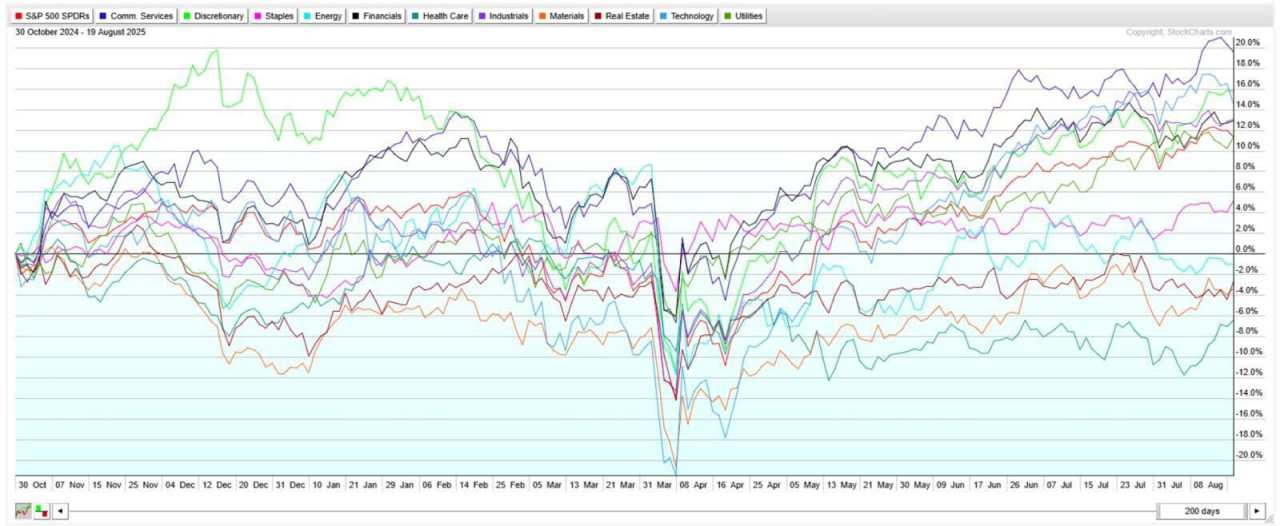

Tech weakness, broader rotation

The XLK and Nasdaq 100 both lost their trendlines, but rather than outright panic, the move looks more like rotation. Healthcare, homebuilders, and biotech outperformed over the last 24 hours, while tech dragged the indices. That’s classic late-cycle positioning.

For a better view of how each indice is performing.

Valuation concerns: A 2025 warning signal

The real backdrop to all this volatility is valuation. According to Elliott Wave International and Bloomberg data, 2024–2025 now ranks as the most overvalued market in history across combined metrics (P/E, CAPE, P/B, EV/EBITDA, Q Ratio, Market Cap-to-GDP).

The chart places today alongside 1929, 1966, and 1999: moments in time that preceded major corrections.

Eyes on Jackson Hole 2025

This all sets the stage for Powell at Jackson Hole. With bond markets still calm, the near-term setup could be seasonal chop into September–October before a potential year-end rally. But with valuations stretched, leverage rising among retail traders, and big tech under pressure, caution is warranted.

Closing thoughts

The selloff in Nvidia and Palantir may be short-term catalysts, but the real story is bigger: we are trading in one of the most overvalued environments ever recorded.

Powell’s words this week could decide whether that bubble stretches further or starts to deflate.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()