S2N spotlight

I get a real buzz when I see long-dated charts.

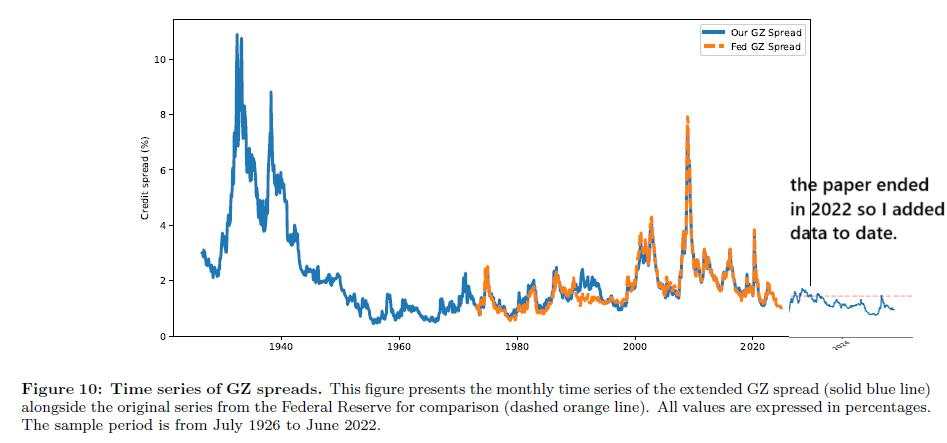

In April of this year, authors Mohammad Ghaderi, Sebastien Plante, Nikolai Roussanov, and Sang Byung Seo published a 128-year database titled “Pricing of Corporate Bonds: Evidence from a Century-Long Cross-Section.”

The data in the database is up to June 2022. I have appended to their chart the most recent data for corporate bond yields.

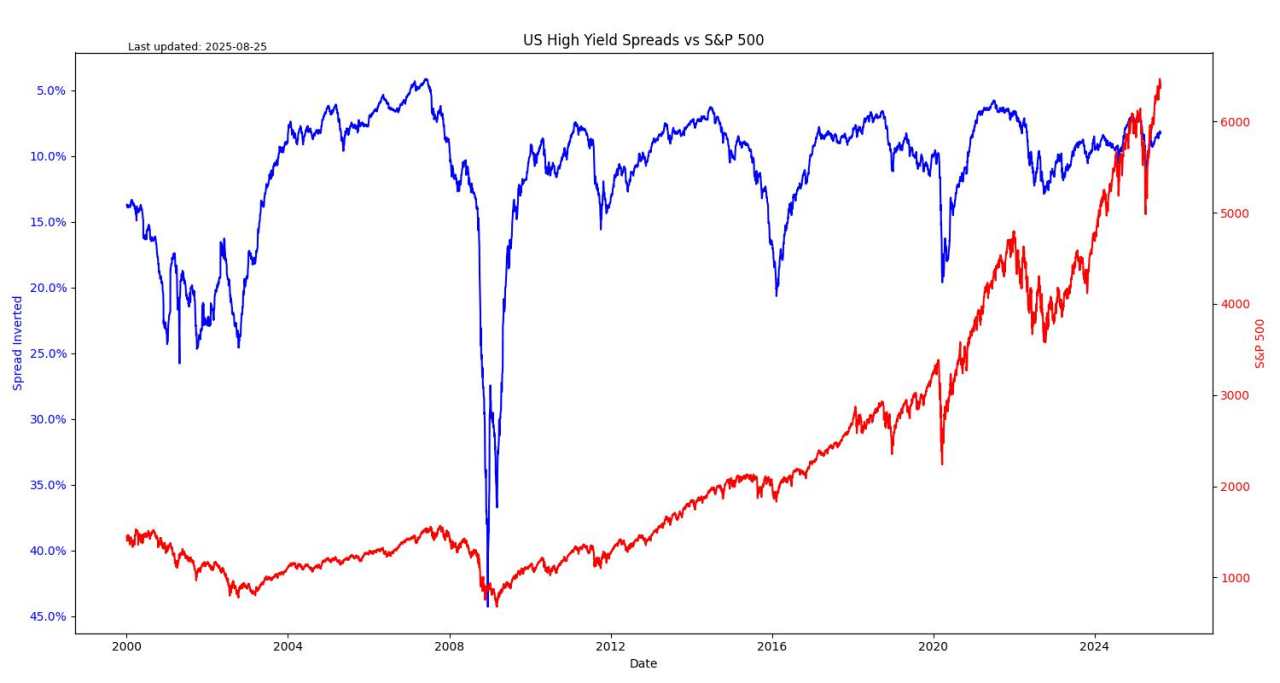

Below I invert the high-yield spreads series and plot them alongside the S&P 500 index. One can see a very close relationship over the last 25 years. I am sure this relationship is present for much longer as well.

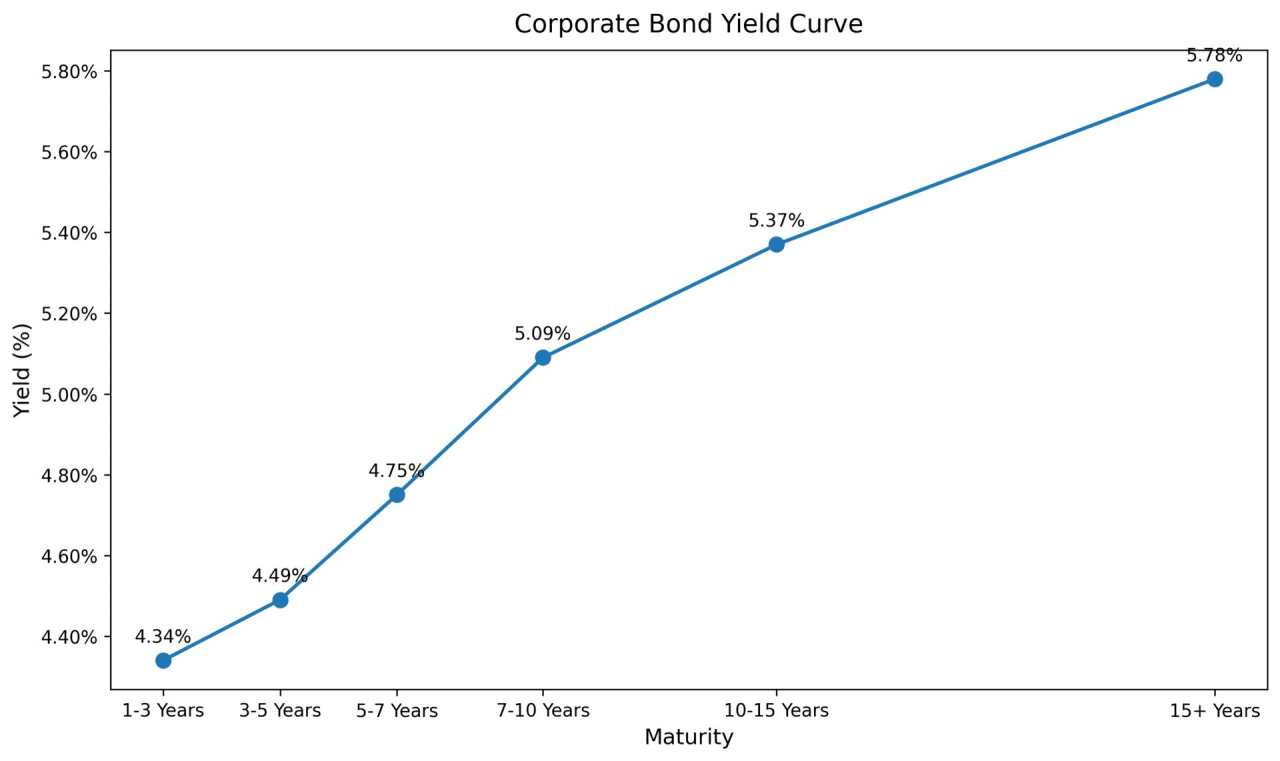

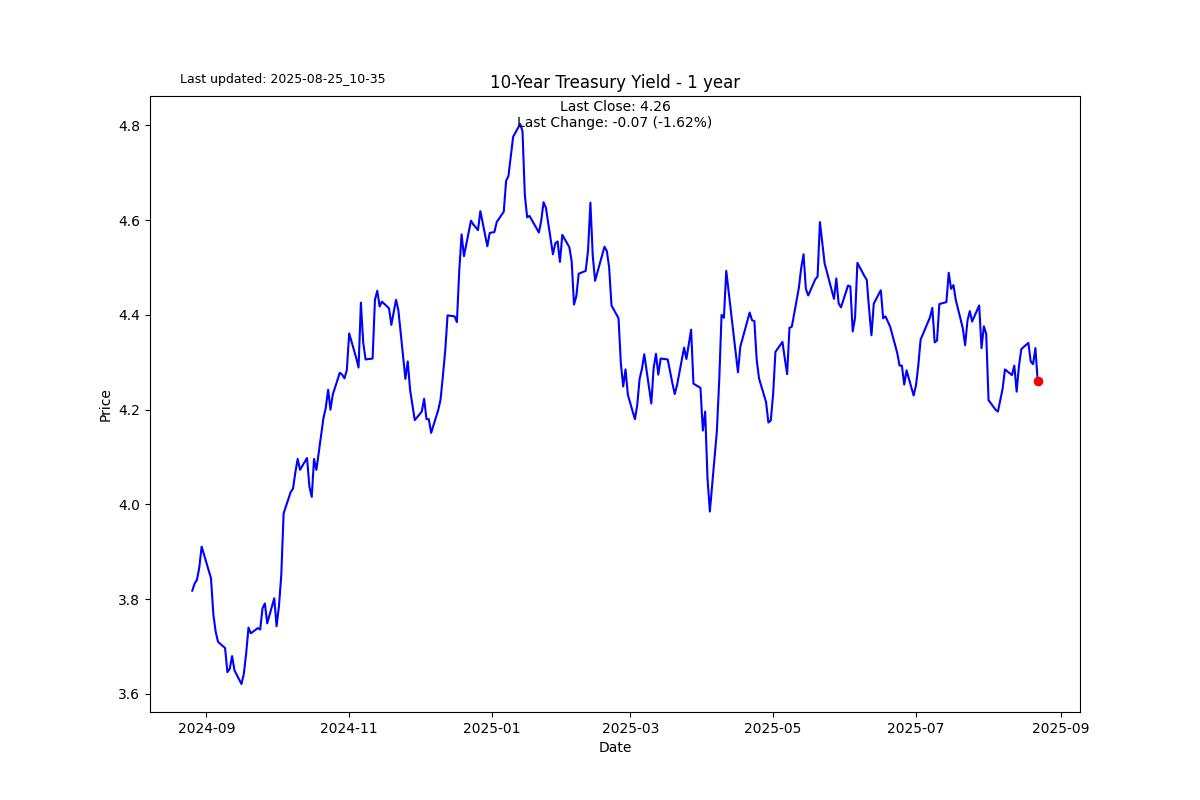

When I price a corporate bond yield curve, I see a very steep curve.

In short, I am short corporate debt spreads.

S2N observations

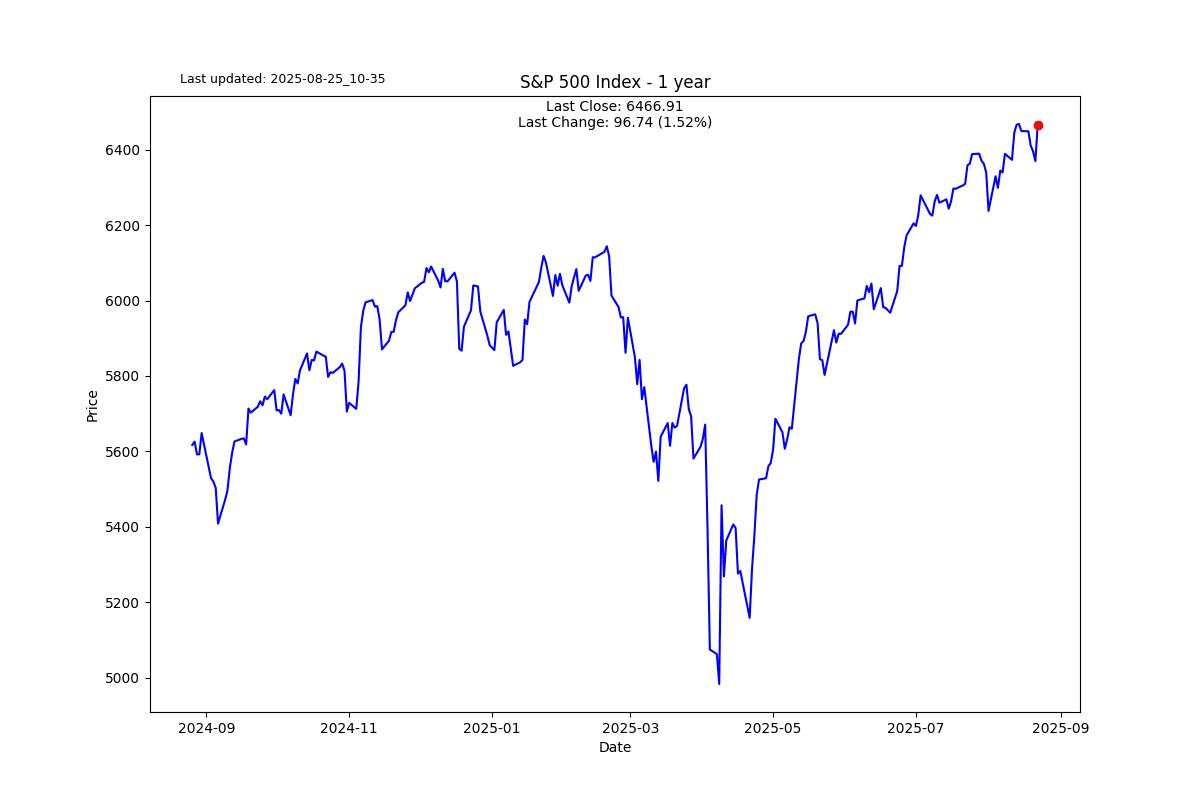

I want to place on the record that I am adding the SPY 500 PUT expiring in June 2026 to the portfolio. The price at 7.40 is trading at an implied 25%.

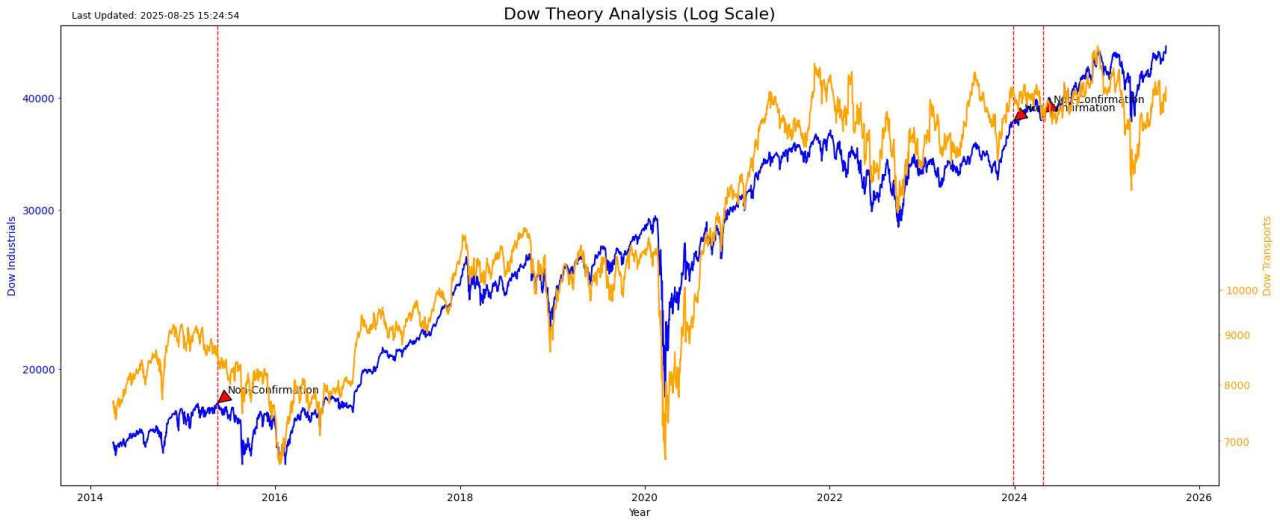

My increased bearishness makes me feel like a hammer who thinks everything looks like a nail. As a tribute to the late great Richard Russell from Dow Theory Letters fame, I updated my Dow Theory chart, and yes, the bearish non-confirmation in April 2024 is still in play.

The Dow Jones Transports are still a long way from confirming the Dow Jones Industrials. I am not suggesting this index has the influence over the markets it once did. But now as a growling bear, I will throw anything into the mix. Dow Theory was developed in the late 19th and early 20th centuries by Charles Dow, who founded the Dow Jones & Company and created the Dow Jones Industrial Average in 1896. However, the theory wasn't formally codified until after Dow's death in 1902. As you can see, I am into the vintage stuff. After all, King Solomon, the wisest of all, said there is nothing new under the sun.

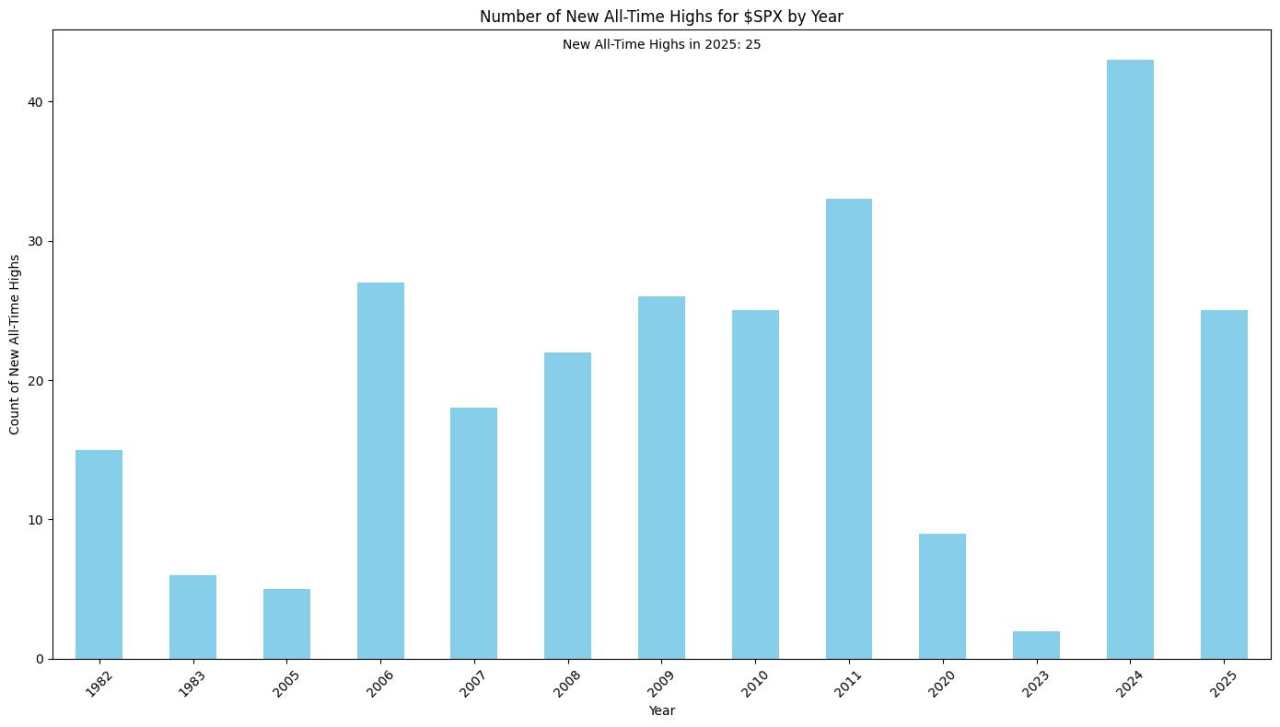

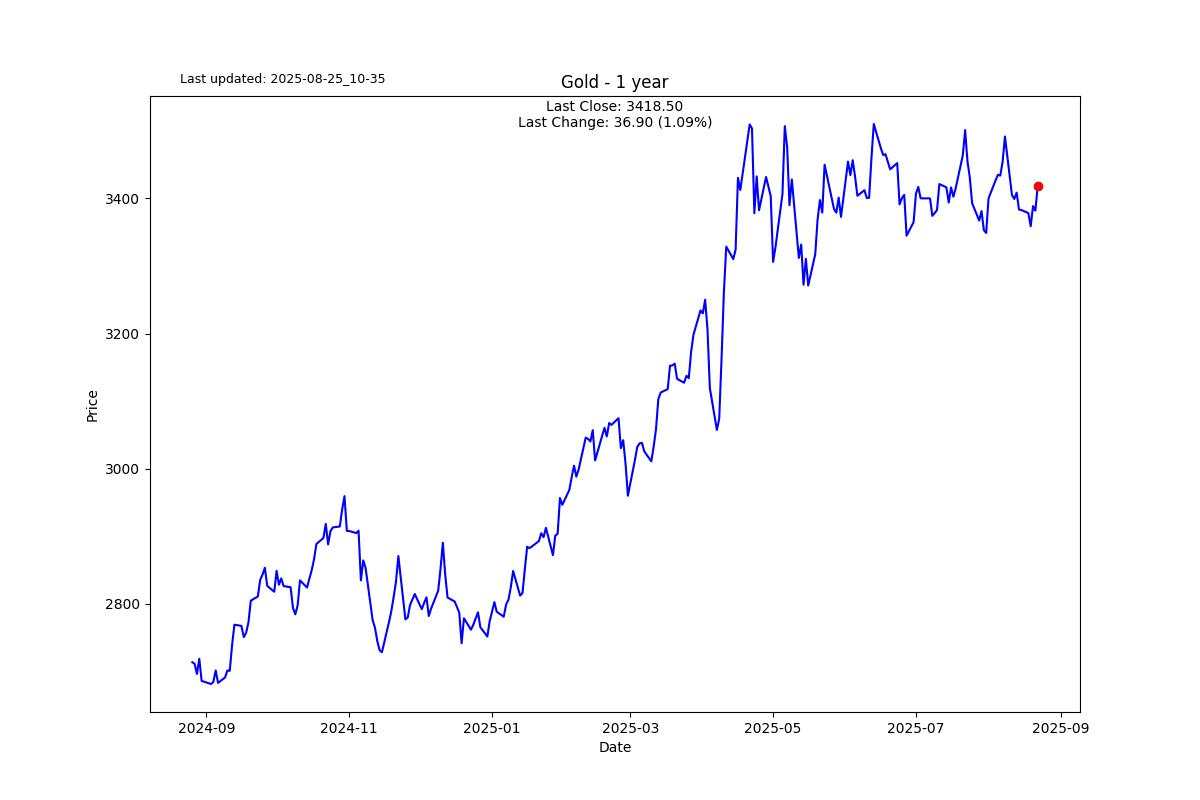

With gold registering its 25th all-time high for the year on Friday, I was expecting to see the next 2 indexes near ATHs.

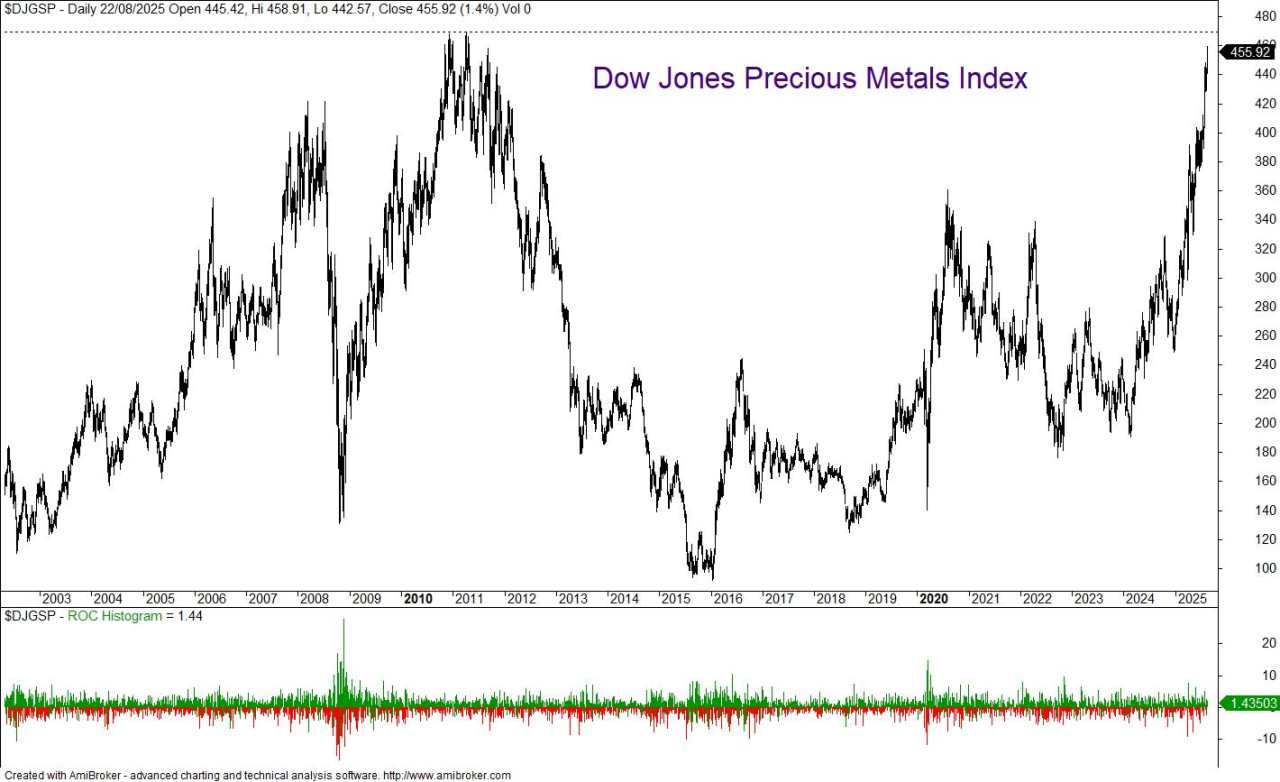

The Dow Jones Precious Metals Index is on the verge of reaching a new all-time high (ATH). However, I wasn’t anticipating that it would be the first in 15 years.

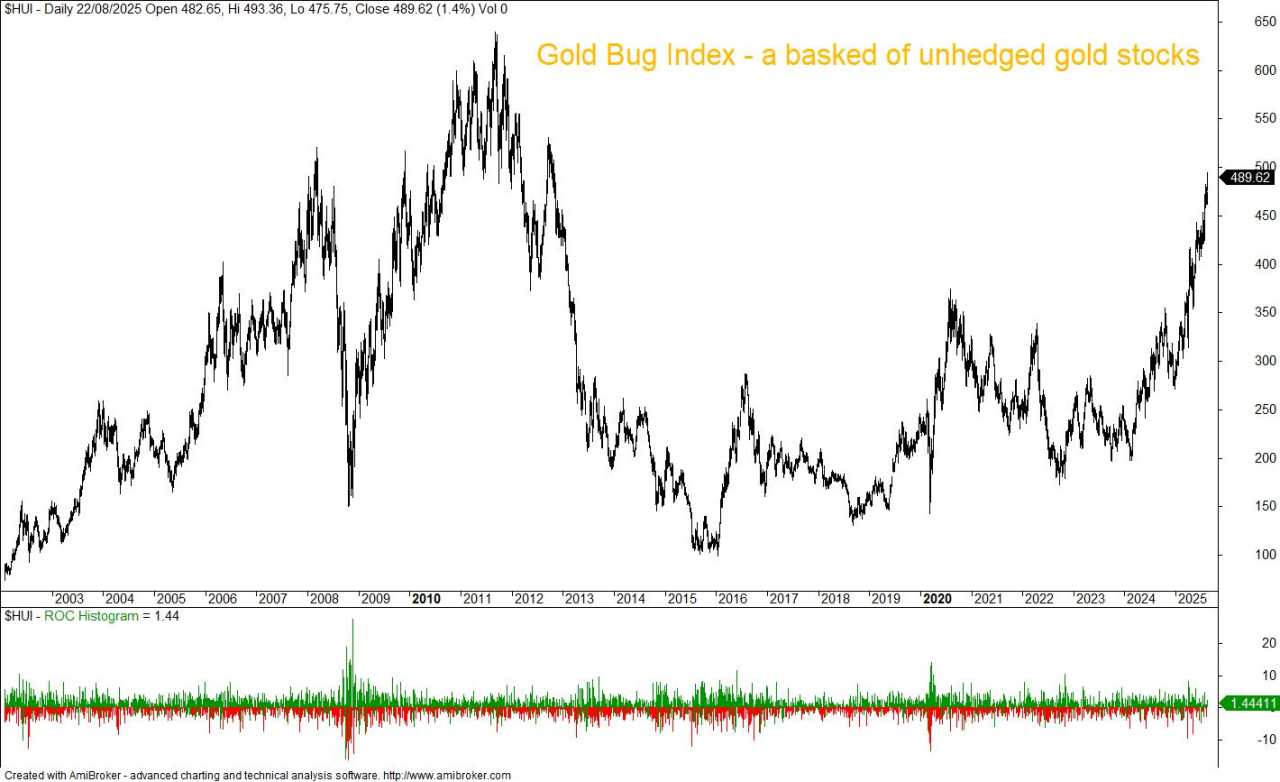

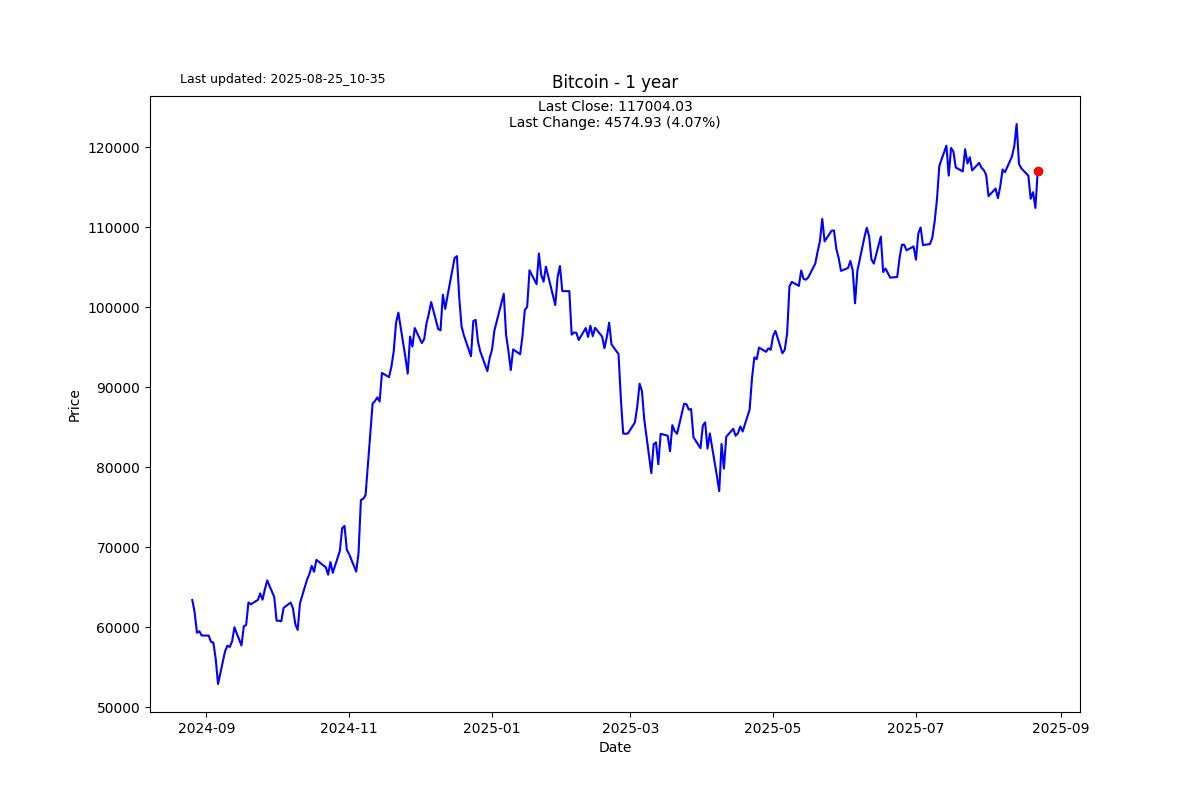

What surprised me even more was the Gold Bug Index. It is a long way from its ATH. The main reason is the massive inflation in the cost to produce gold. Despite the runaway cost of the underlying gold price, the miners producing gold are simply unable to maintain the profitability they achieved in the past. I think Bitcoin miners have suffered a similar fate.

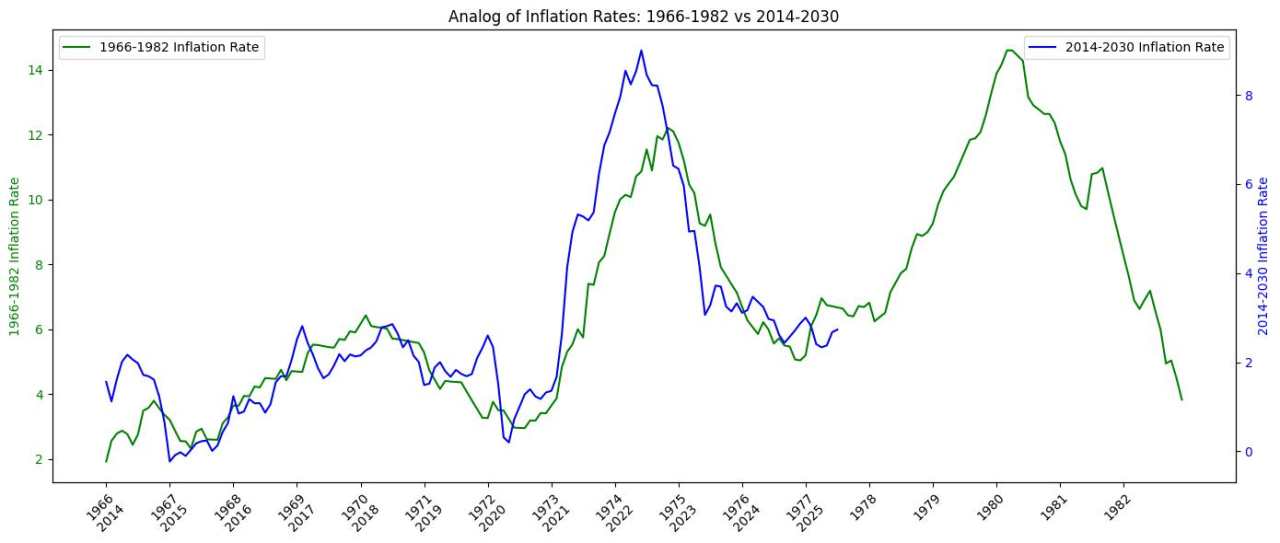

Speaking of inflation, I want to keep sharing this analog on inflation every few months. Prepare for inflation lift-off. The picture fits nicely with my stagflation call.

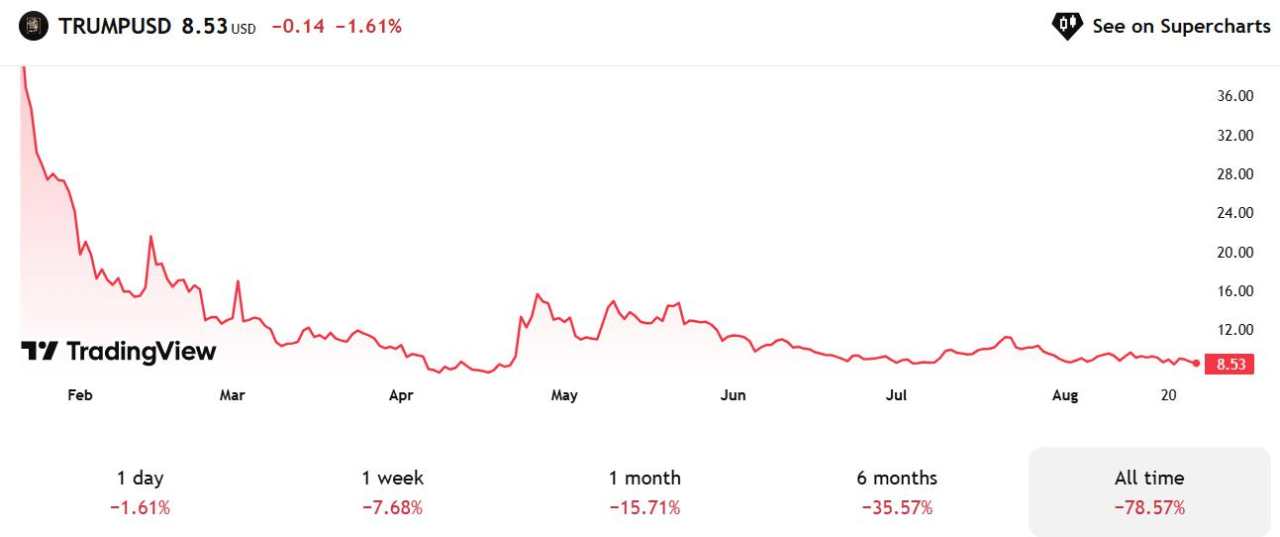

Final observation is Trump Media’s stock price. The truth be told, it has not been the best investment for investors who hopped on post the IPO. (If you are wondering why there was trading prior to the IPO, it’s because this was a SPAC IPO.)

The Trump Crypto Token is also down 78%. It's interesting that they are both down similar amounts.

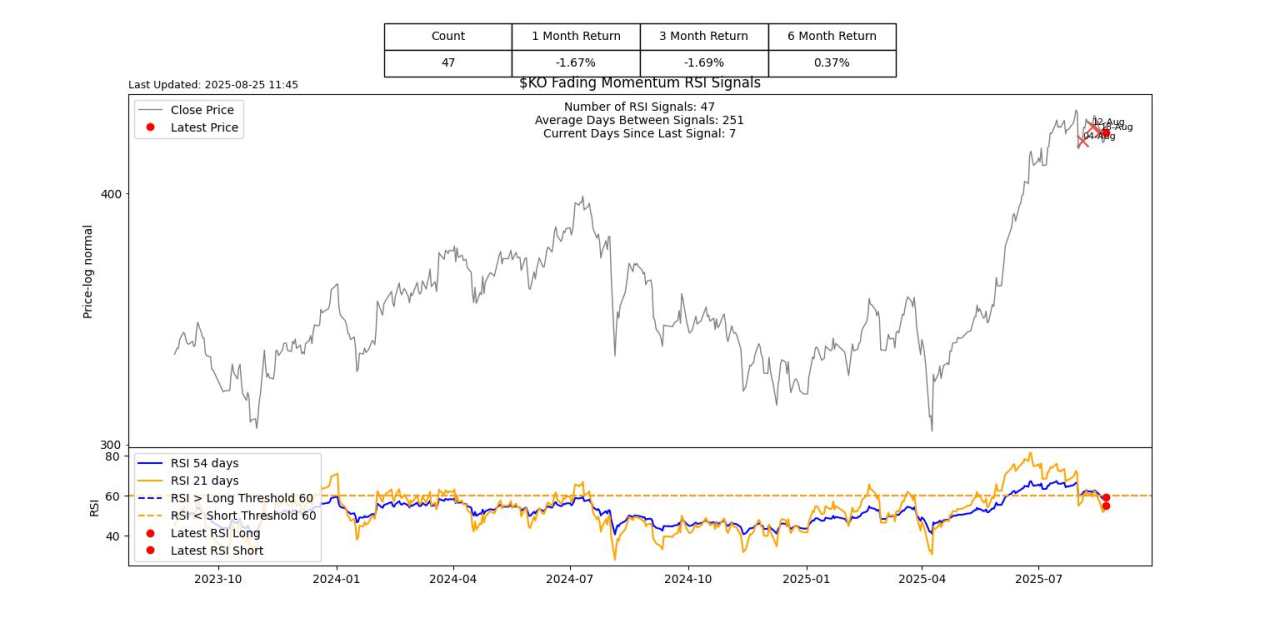

S2N screener alert

I am not suggesting this is the strongest signal for a softening market. A while back I created a fading momentum signal that triggered a week ago on the Kospi 200 Index in South Korea. I am just putting this index on our radar to keep a closer watch.

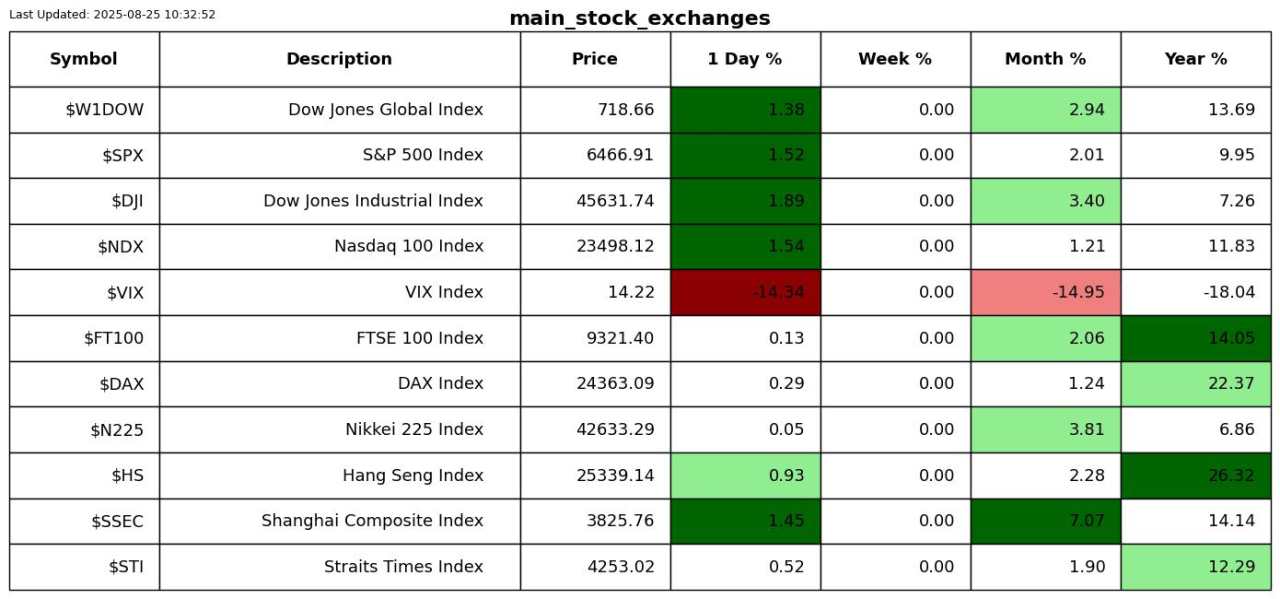

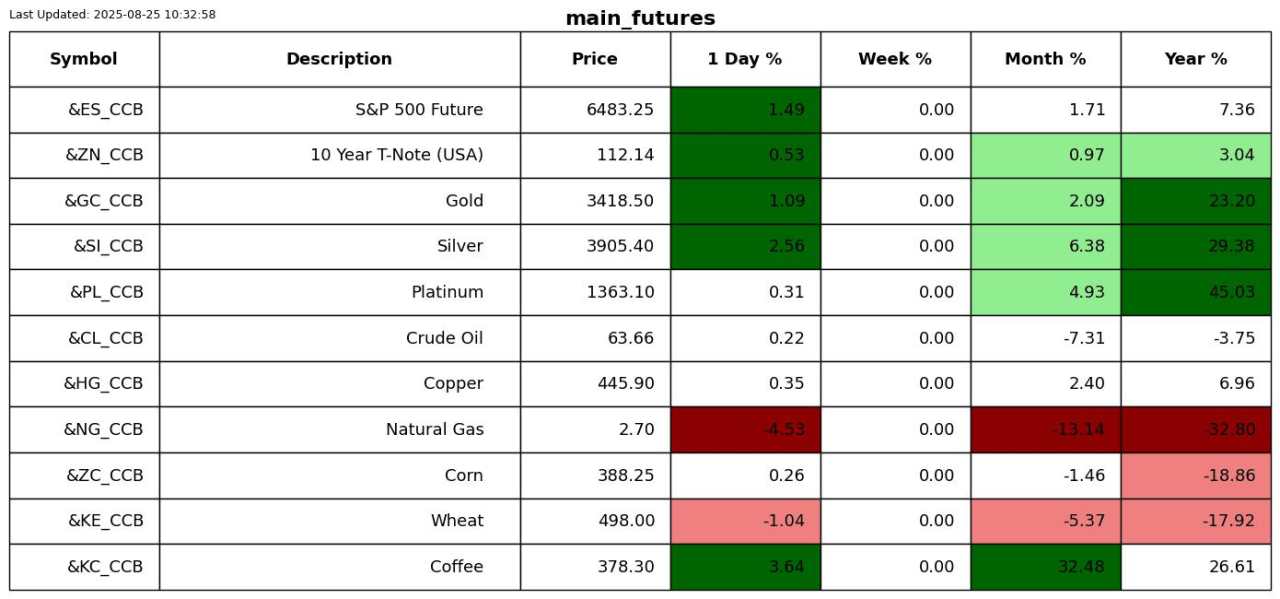

S2N performance review

S2N chart gallery

S2N news today

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()