Markets head into the final week of August with a clear “cut-watch” bias after Chair Powell’s Jackson Hole remarks nudged major houses toward a September Fed easing call. With durable goods due today, Q2 GDP (2nd) later in the week, and July PCE on Friday, the dollar’s rallies look fragile unless the data re-accelerate. Nvidia’s results on Wednesday add a second macro-beta for equity risk.

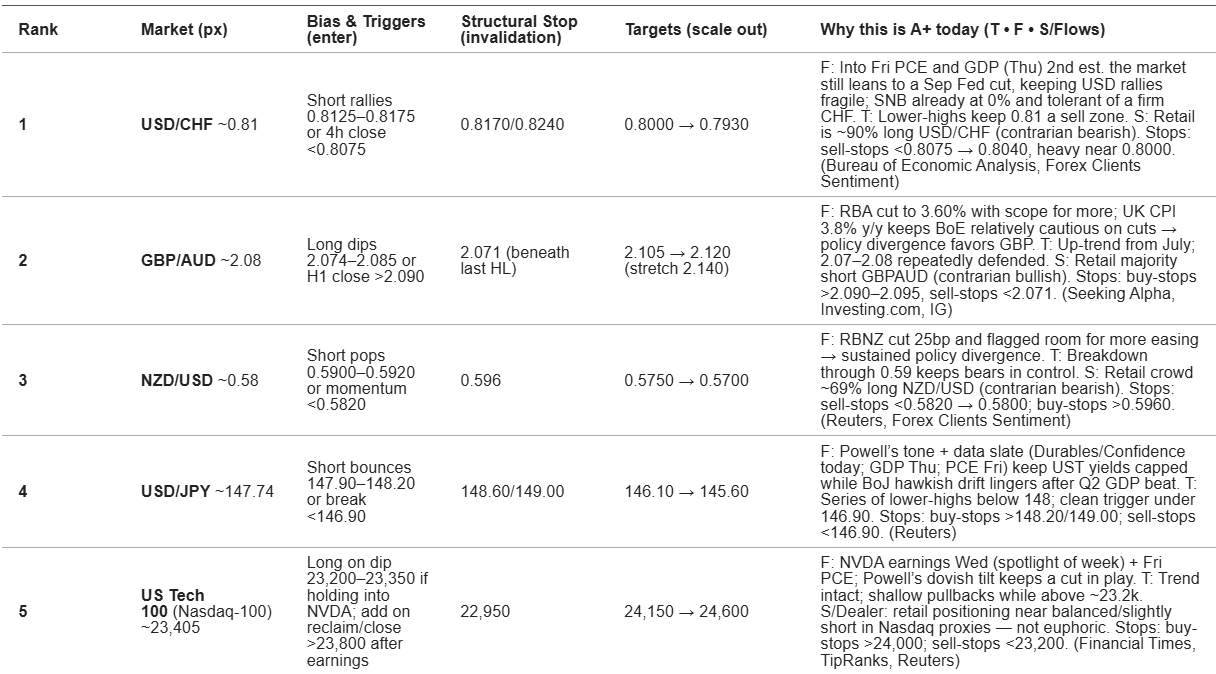

Trade setups analysis

USD/CHF – Short on strength. Policy divergence remains crisp: the SNB set rates to 0% in June and retains a tolerance for a firm franc, while U.S. markets lean to a September cut. Technically, 0.8125–0.8175 continues to cap; we like selling rallies or momentum below 0.8075, targeting 0.8000 then 0.7930. A daily close above 0.8170 invalidates.

GBP/AUD – Long on dips. The RBA’s 25 bp cut to 3.60% (12 Aug) and guidance that further easing is plausible contrasts with sticky U.K. inflation dynamics, leaving relative policy still GBP-supportive. Buy 2.074–2.085 or on an hourly close above 2.090; targets 2.105/2.120 (stretch 2.140). Invalidate below 2.071.

NZD/USD – Short into pops. The RBNZ’s majority vote to cut the OCR to 3.00% and dovish tone keep the kiwi on the back foot absent a USD shock. Fade bounces into 0.5900–0.5920 or add through 0.5820; look for 0.5750/0.5700. Risk above 0.5960.

USD/JPY – Sell rallies. With Fed easing odds elevated and this week’s U.S. data likely to dictate front-end yields, the topside looks heavy unless Treasury yields lurch higher. Fade 147.90–148.20 or sell a clean break under 146.90; targets 146.10/145.60; risk above 148.60–149.00. (A soft PCE would reinforce.)

Nasdaq-100 – Buy the dip, respect NVDA. AI leadership remains the market’s fulcrum; we prefer adding post-earnings on a reclaim/close above ~23,800, or buying 23,200–23,350 if breadth holds. Targets 24,150/24,600; risk ~22,950. NVIDIA reports Wednesday after the close—position sizing should reflect single-name gap risk.

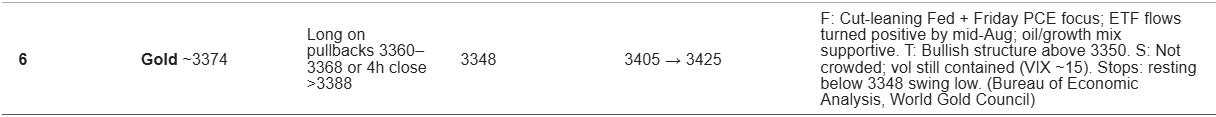

Gold – Accumulate on pullbacks. A benign PCE on Friday would validate the “real-yield drift lower” narrative and keep dips supported. Add 3,360–3,368 or on a 4-hour close >3,388; targets 3,405/3,425; risk below ~3,348. BEA lists Aug. 29 for the next Personal Income & Outlays/PCE release.

Dealer colour and retail positioning continue to skew long USD/CHF and short GBP/AUD, which complements these directions. Into the data, we’d scale rather than chase, use hard stops at the specified invalidation levels, and trim risk into the PCE print—then reassess the dollar path once the inflation anchor is known.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()