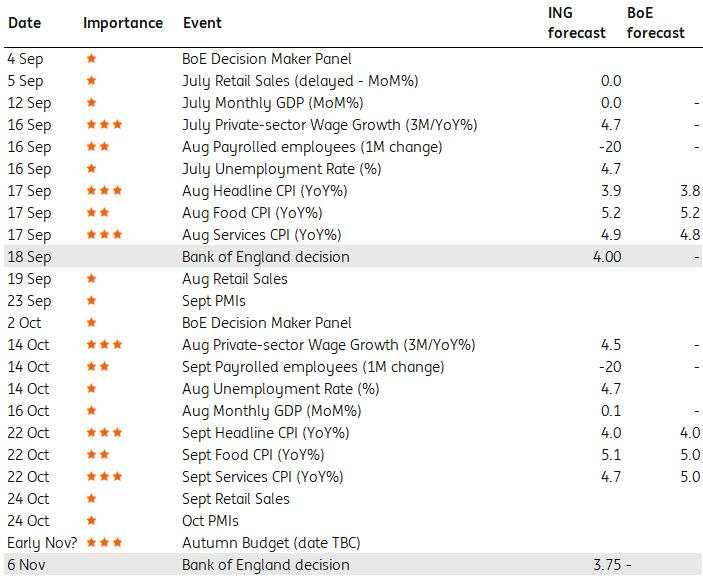

Unlike financial markets, we still think the odds are tilted slightly in favour of another Bank of England rate cut in November. Nothing is guaranteed, though, and these are the key data points that will decide the fate of the Bank's easing cycle later this year.

Three Bank of England MPC meetings remain this year – in September, November, and December. While we expect no change in September, we are leaning toward a 25bp cut in November. Here’s why.

Source: Refinitiv, ING

Inflation

We get two inflation readings between now and the 6 November Bank of England meeting, and at face value, the news won’t look good.

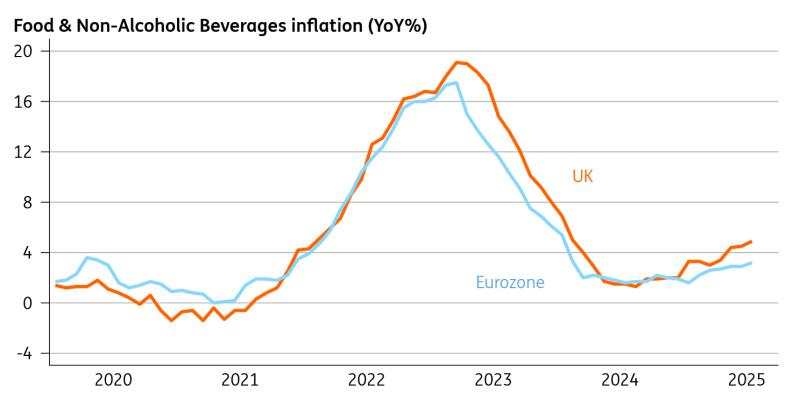

Headline inflation is set to reach 4% in September. And food inflation – a new obsession of the Bank of England – is set to notch above 5% too. The Bank expects it to reach 5.5% by year-end, and we don’t disagree with that. Input price pressures – notably for meat – are compounded by the cost pressure from payroll tax rises and minimum wage hikes. It has lifted food inflation above what we’ve seen in the eurozone.

The Bank is visibly concerned that food prices – which are particularly visible to consumers – risk feeding a spike in inflation expectations, which theoretically could feed back into wage growth further down the line. We’re less convinced, but we suspect the next couple of CPI releases are unlikely to ease those concerns.

Food inflation is picking up faster than in the eurozone

Source: Macrobond, ING

The Bank is also acutely aware that there’s a loose correlation between food and restaurant prices. Catering makes up roughly 40% of the Bank’s favoured measure of services inflation, which excludes volatile/indexed categories. And unlike supermarket prices, catering inflation tends to be highly persistent. There are hints that inflation is indeed rising here, and this will be a key area to watch in the autumn.

As for services inflation as a whole, though, the news is likely to be better. We think it’s more likely to undershoot the Bank’s forecasts, which have services CPI stuck at 5%, though this is more likely to happen in the 22 October inflation release than the one in September.

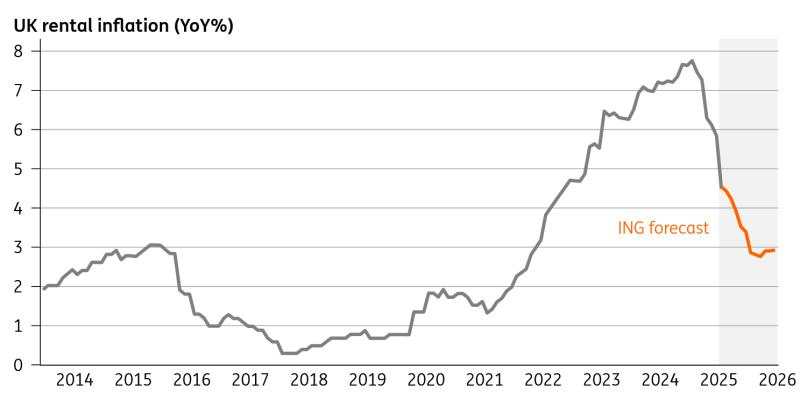

Rental inflation is slowing rapidly

Source: Macrobond, ING forecasts

Rental growth – a key service sector component – is slowing rapidly, owing to a much lower cap on social/local authority rental growth this year than last. But private sector rents are rising much less quickly now, too. After a significant shortage of properties post-pandemic, the market appears to be in much better balance. This is a major source of downside risk for inflation later this year.

Bottom line: More benign services inflation should tip the balance towards another cut in November, even if it’s unlikely to fundamentally reshape the view of officials on inflation more broadly.

Jobs market

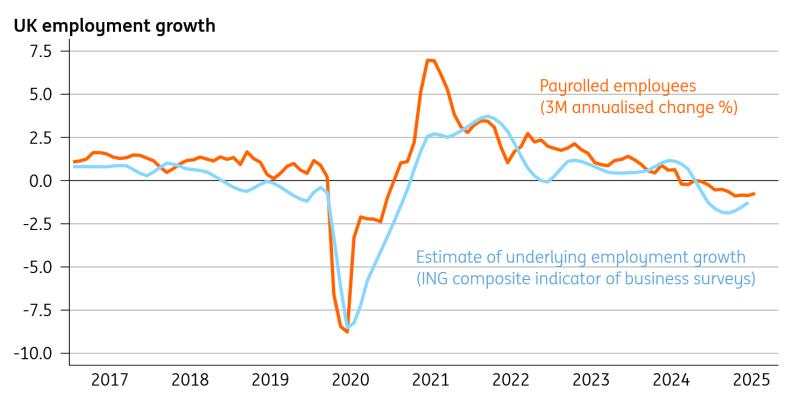

Employment has fallen in eight of the last nine months, judging by the monthly payroll numbers. Yet many were surprised by the lack of concern in the August BoE decision.

Partly that’s because the data is sketchy, to put it politely. The Labour Force Survey, which churns out the unemployment rate, does seem to be getting more reliable, though from a low base, and is still being downplayed by officials.

In the face of dubious data, the Bank is putting more faith in surveys. And those surveys are actually looking a bit better. Employment indicators sank after last year’s budget and the promised tax hikes, but there are signs we’ve passed the worst.

Hiring surveys have picked up slightly

Composite hiring index based on principal components analysis of various UK employment surveys

Source: Macrobond, ING

The Bank will also take some comfort from the fact that the bulk of recent job losses have been contained to the hospitality sector. We’re not seeing broader layoffs just yet.

Yet this is an area of significant risk. Vacancies are well below pre-Covid levels in most sectors and have been for some time. Openings have also fallen further than in other advanced economies. A more significant fall in employment ahead of November’s meeting would be a major curveball.

Admittedly, the Bank is acutely aware that the monthly payroll figures have a tendency to be revised up. We saw that most clearly in May, where a sharp 100k fall in hiring was revised up to a milder 25k loss.

Equally, monetary policy acts with a much longer lag these days, owing to the vast majority of mortgages being fixed. The average rate on all outstanding mortgage debt is only now reaching a peak, despite five rate cuts over the past 12 months. If the jobs market really is worse than it looks right now, then there’s not a great deal the Bank will be able to do about it.

We’re not convinced the jobs market is heading into a recession. But wage growth should slow more materially by the end of the year. The Bank’s Decision Maker Panel survey suggests we’re headed to 3.5% on private sector pay growth, from roughly 5% now. The BoE’s own forecasts predict that too, and remember those forecasts are based on two further rate cuts over the coming months.

Bottom line: Lower wage growth, even if in line with BoE forecasts, would be reassuring for the Bank. A sharper fall in employment could prompt a bigger rethink.

Autumn budget

Last year’s Autumn Budget was historic. As we’ve discussed, it contained huge tax rises. But spending rose even more dramatically. That’s partly why GDP has been resilient through the first half of the year. And why rising public sector employment has continued to offset weakness in the private sector. Financial markets' initial response was to reprice the Bank of England curve higher after the budget last year, on the basis that it was likely to be pro-growth and inflation.

This year, the story could be the opposite. Yes, spending plans are likely to receive a modest boost. June’s spending review, which allocated budgets to individual government departments, made it clear there’s not enough cash to go around. U-turns on winter fuel payments and other social spending add cost pressure too.

But once you also factor in big downgrades to the Office for Budget Responsibility’s growth, productivity and immigration forecasts, the Treasury faces at least a £20bn shortfall, relative to where it was in March. We think it will have little choice but to raise at least one of the major taxes, despite ruling out hikes to income tax, employee National Insurance and VAT. We wouldn’t even rule out another round of hikes to employer National Insurance (payroll tax), despite the pressure it’s placed on the jobs market this year.

For the Bank of England, the prospect of a more restrictive budget argues for lower rates, though remember it can only factor it in once the measures have been announced. And at the moment, it’s not clear whether the budget will come before or after the 6 November meeting.

If it is before – eg 5 November – then a requirement to notify the OBR 10 weeks before the event means the government would have to announce it within the next couple of days.

Bottom line: At the margin, the Budget is likely to reinforce the case for further rate cuts, if it comes before November’s meeting.

Downside risks to Sterling if we’re right

Following the hawkish BoE rate meeting, expectations for the terminal rate have climbed by around 20bp since early August, now approaching 3.60%. That stands in stark contrast to developments in the US, where the soft July jobs report and political pressure on the Fed have seen the terminal rate falling 35bp towards 3.00%. That’s managed to pull back GBP/USD from 1.32 to 1.35.

Should UK price pressure or labour market data ease enough to allow the BoE to cut again in November, that would be a dovish surprise to markets and sterling negative. However, we don’t think GBP/USD needs to fall too far. This would come against a backdrop of a potentially more dovish Fed (we look for 25bp cuts at each of the September, October and December meetings) and presumably political pressure building on the Fed as the White House attempts to secure a majority of doves on the governing board.

GBP/USD versus the one-month GBP vs USD OIS spread, priced one-year forward

Source: Refinitiv, ING

And while there are plenty of downside risks to sterling, not only from a more dovish BoE, but also from tighter fiscal policy at the UK Autumn Budget, we think the dollar has more baggage. Our forecasts see GBP/USD towards the top end of a 1.33-1.38 trading range by the end of the year as the dollar bear trend dominates. But late October/early November looks like the vulnerable period for sterling.

We currently have a year-end forecast of 0.87 for EUR/GBP. Some independent sterling weakness might argue for higher levels, but the euro could be suffering some of its own baggage with French politics this September/October. A move towards 0.88 may have to wait until next year, when the BoE easing cycle should be weighing on sterling just as German fiscal stimulus starts to register in European activity data and supports the euro.

Read the original analysis: The Bank of England’s dilemma: Will the data justify a November rate cut?

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()