The U.S. dollar fell to a four-week low after Federal Reserve Chair Jerome Powell signalled that risks to the labour market are mounting, reinforcing expectations for a September rate cut. At the same time, Bank of Japan Governor Kazuo Ueda pointed to broadening wage growth and sticky inflation in Japan, fuelling bets on another BoJ hike by October. The policy divergence has left USD/JPY at a crossroads, with traders watching whether the pair breaks toward 150 or reverses closer to 140.

Key takeaways

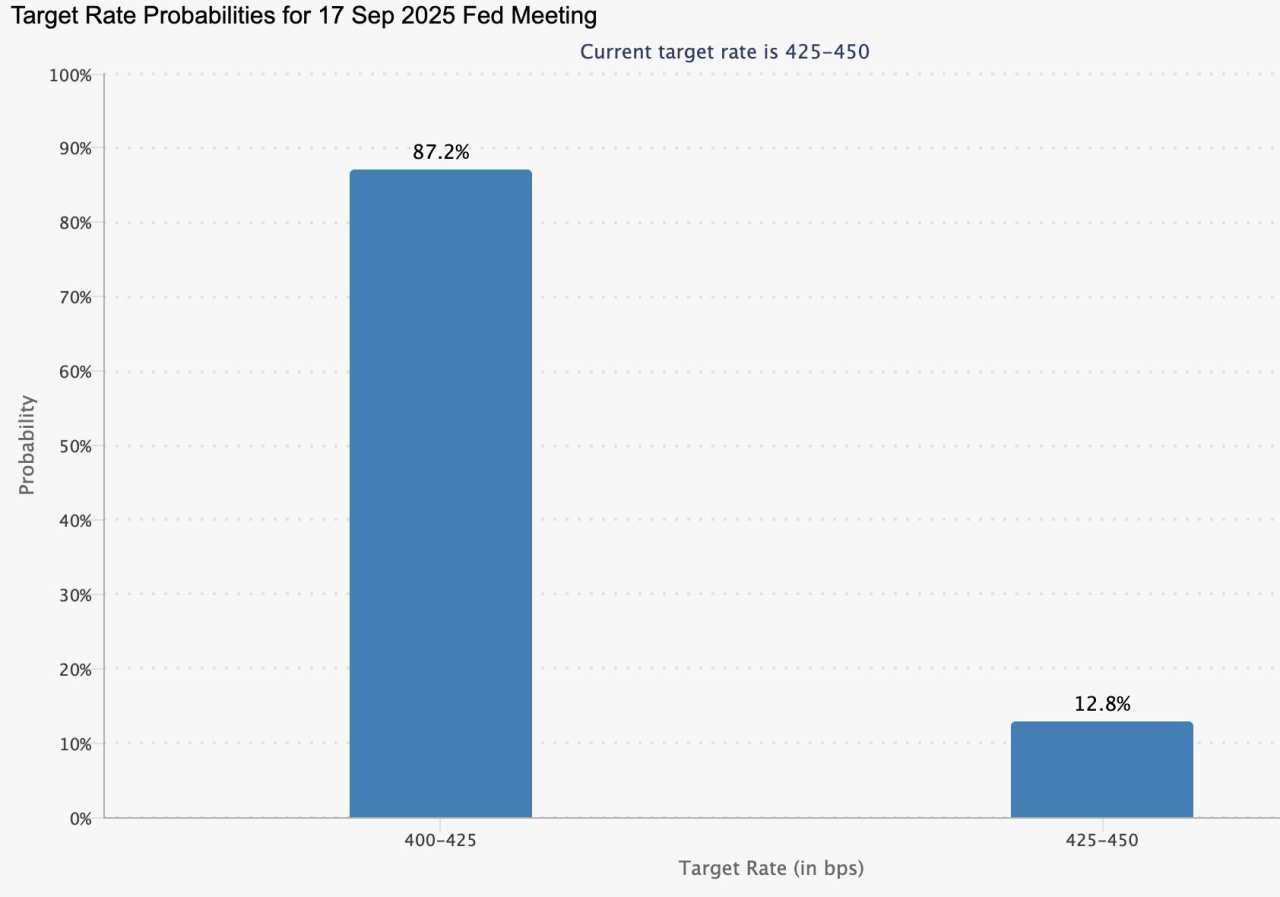

- Powell’s Jackson Hole remarks increased market conviction of a September rate cut, with traders pricing an 87% chance.

- Markets expect 53 basis points of easing by year-end, contingent on upcoming inflation and labour data.

- The dollar index dropped more than 1% on Powell’s comments, pulling USD/JPY lower before stabilising in Asia trading.

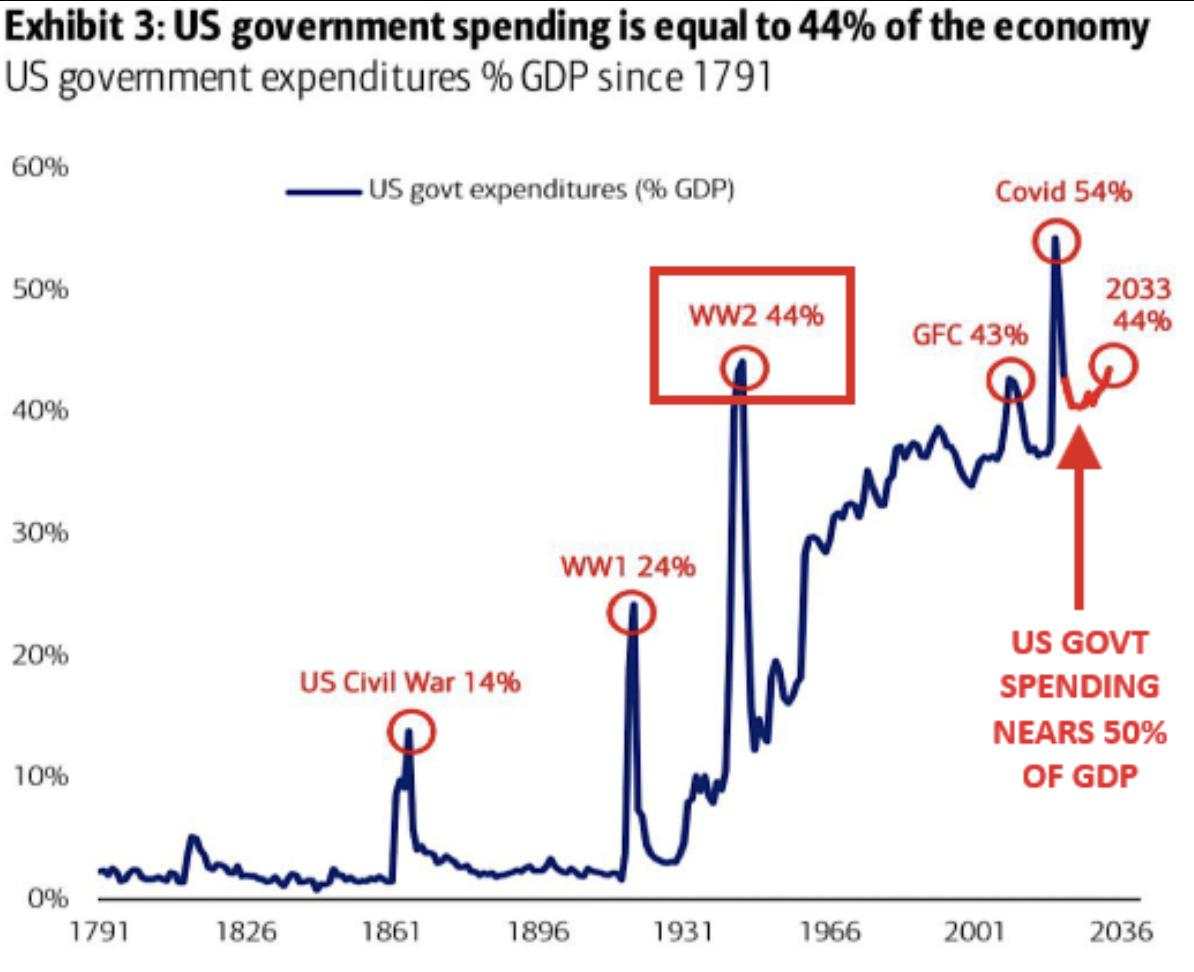

- U.S. federal debt has surged by $1 trillion in 48 days, raising questions about fiscal sustainability.

- Ueda flagged accelerating wage growth and inflation above target, keeping an October BoJ hike in play.

- USD/JPY is testing 147.50 resistance, with traders eyeing either a breakout toward 150 or a reversal toward 140.

Powell’s dovish tilt and Fed outlook

At Jackson Hole, Powell warned that “downside risks to employment are rising,” a remark investors interpreted as confirmation that the Fed is ready to cut rates. Markets now see an 87% probability of a quarter-point cut at the 17 September FOMC meeting, with more than 50 basis points of total easing priced in by year-end.

Source: CME

The path to cuts has shifted repeatedly in recent months. In early August, weak payrolls drove rate-cut bets higher, but hot producer prices and strong business surveys mid-month forced markets to scale them back. Powell’s speech reversed that trend, restoring confidence that easing is imminent. Analysts at Goldman Sachs noted that Powell’s message “cleared the market’s low bar for dovishness,” leaving the pace of cuts dependent on upcoming data.

US debt pressures weigh on the dollar

Beyond the Fed, the U.S. fiscal position is adding another layer of strain. Federal debt has expanded by $1 trillion in just 48 days, equivalent to $21 billion per day. The national total now stands near $38 trillion, with government spending consuming 44% of GDP - levels previously seen only in wartime or crisis conditions.

Source: BOFA Global Investment Strategy, Bloomberg

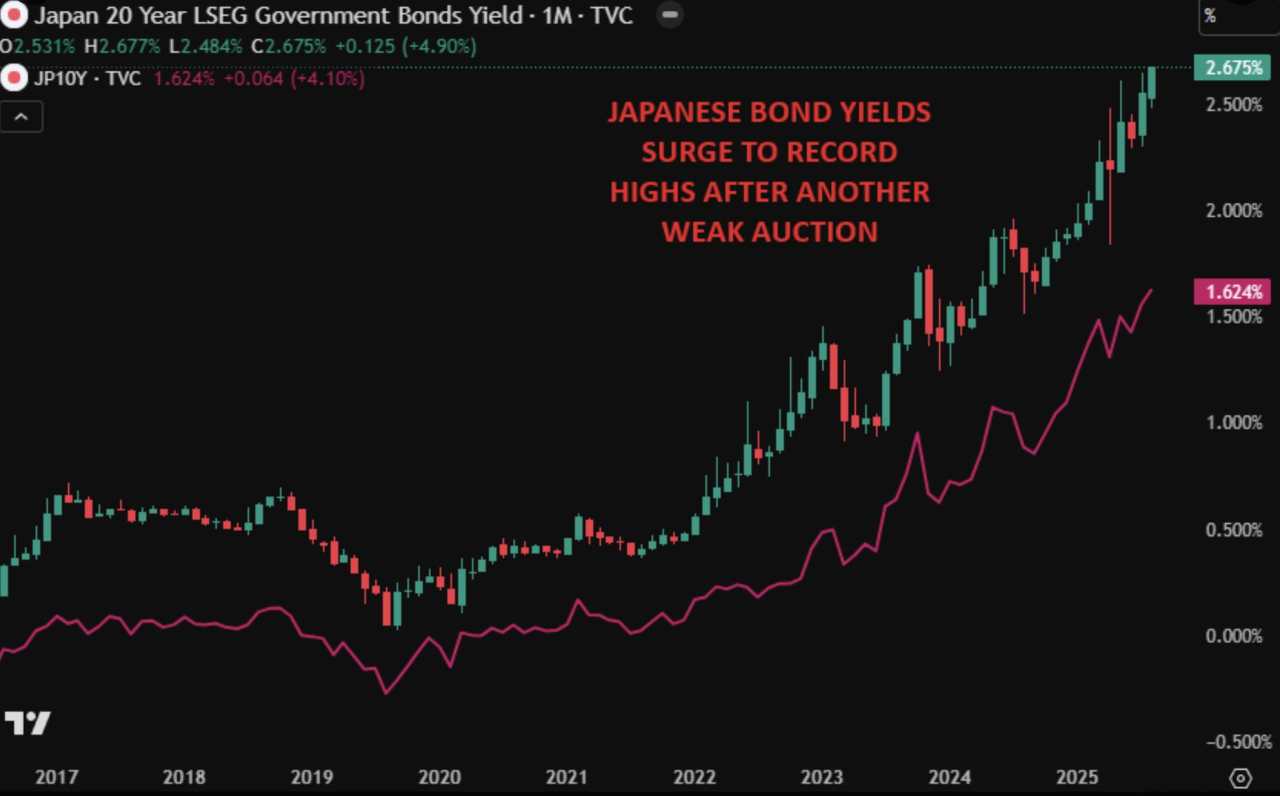

Bond auctions are showing signs of fatigue, with yields rising to attract buyers.

Source: Trading View, Kobeissi Letter

For currency markets, this creates a double burden on the dollar: rate cuts narrow its yield advantage, while ballooning debt raises questions about its safe-haven appeal.

Political friction adds to the pressure. President Trump has repeatedly attacked Powell and other Fed officials, most recently threatening to fire Governor Lisa Cook. Such interventions have stoked concerns about the Fed’s independence, adding credibility risks that further undermine dollar sentiment.

Ueda’s hawkish tone and BoJ outlook

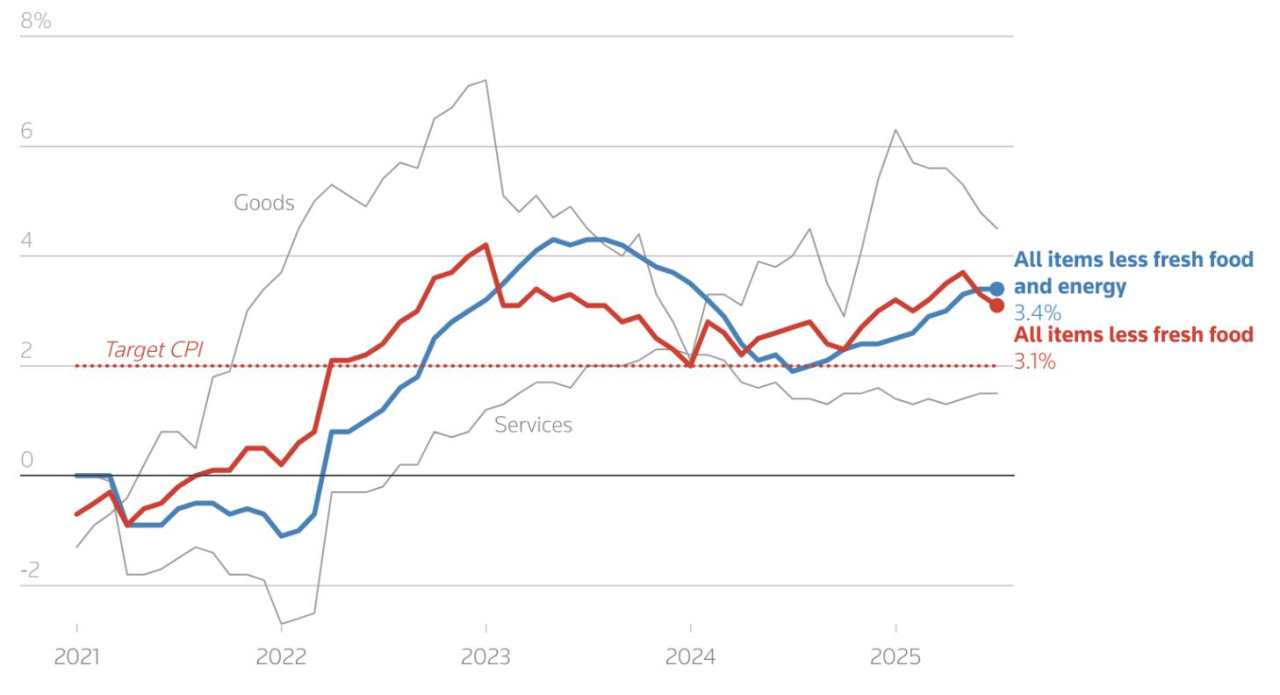

By contrast, BoJ Governor Ueda signalled that Japan’s wage growth is broadening from large firms to smaller businesses, and that a tight labour market is fuelling momentum. Combined with core CPI running at 3.1% year-on-year in July - above forecasts and still well above the BoJ’s 2% target - markets see a strong case for renewed tightening.

Source: LSEG Datastream

The probability of a BoJ hike by October is now close to 50%. If confirmed, it would mark the continuation of Japan’s exit from ultra-easy policy, a structural shift that has already pushed government bond yields to multi-year highs.

USD/JPY divergence in focus

The Fed’s dovish tilt and the BoJ’s hawkish stance sharpen the policy divergence shaping USD/JPY. If the Fed cuts in September and the BoJ follows with a hike in October, the yen could strengthen sharply, pulling USD/JPY back toward 140. On the other hand, if U.S. data proves strong enough to delay cuts - or if safe-haven flows rise due to fiscal or geopolitical stress - USD/JPY could push through 147.50 resistance and test the 150 level.

The next catalysts are clear: Friday’s PCE inflation print and next week’s payrolls report. Both will determine how quickly the Fed moves and whether the BoJ gains confidence to tighten.

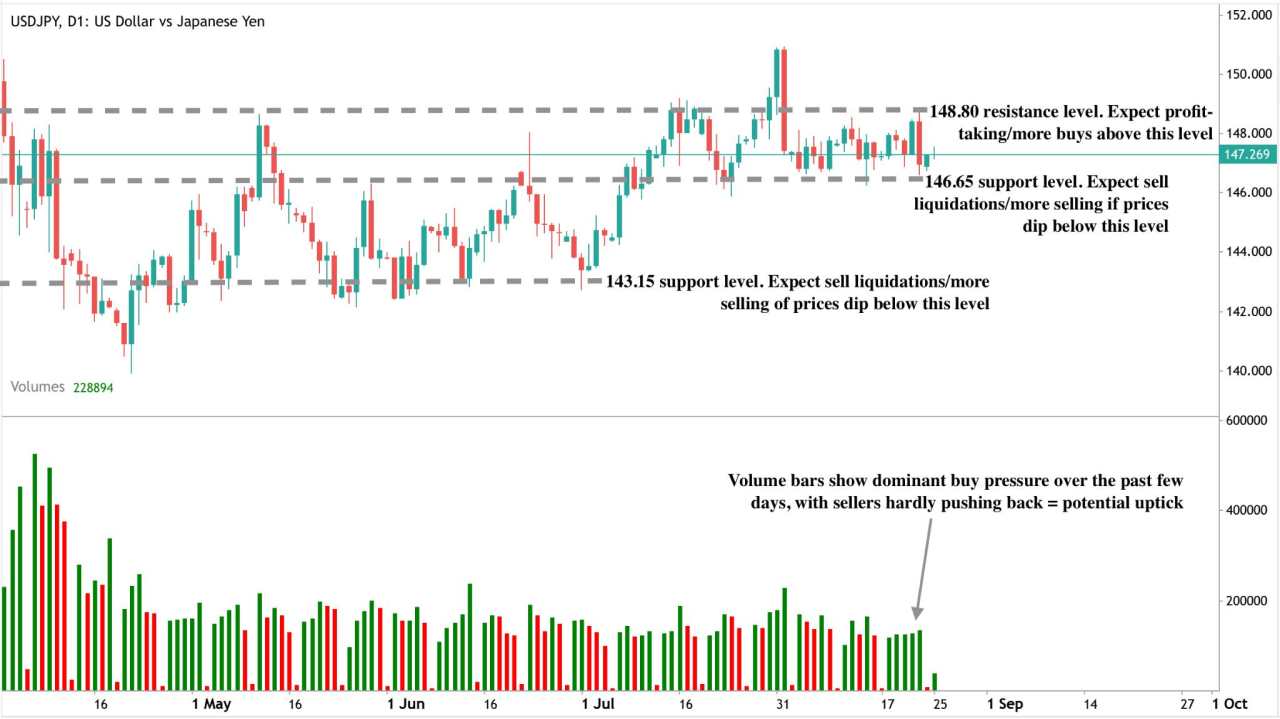

USD/JPY technical outlook

At the time of writing, the pair is trading close to a support level, hinting at a potential price uptick. The volume bars showing dominant buy pressure with little pushback from sellers add to the bullish narrative. Should a price uptick materialise, prices could find resistance at the $148.89 price level. Conversely, if we see a dip, prices could find support at the $146.65 and $143.15 support levels.

Source: Deriv MT5

Investment implications

For traders, USD/JPY positioning hinges on the sequencing of Fed cuts and BoJ hikes:

- Short-term: Tactical selling near 147.50–150 may appeal if U.S. data confirms September easing.

- Medium-term: Yen strength could build if the BoJ raises rates while the Fed cuts into year-end.

- Risks: U.S. fiscal instability and political pressure on the Fed could accelerate dollar weakness beyond policy divergence.

The balance of risk is tilting toward yen strength, but near-term volatility will remain high as central bank decisions come into focus.

Frequently asked questions

Why did Powell’s speech weaken the Dollar?

Because it reinforced expectations of a September rate cut, reducing U.S. yield appeal.

How much easing is priced in?

Markets see an 87% chance of a cut in September and 53 basis points of reductions by year-end.

Why is U.S. debt important for USD/JPY?

Exploding debt raises doubts about fiscal sustainability, making the dollar less attractive as a safe haven.

What supports BoJ hawkishness?

Sticky inflation above 2%, broadening wage growth, and persistent labour shortages.

What are the key levels for USD/JPY?

Upside resistance at 147.50–150, downside support near 146.65 and 140.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()