Over the last 10 years, September has been the worst month for Fixed Income bonds and so knowing the poor state of the UK fiscal situation, seeing UK Gilts reach 27 year highs was like watching a car crash in slow motion. A car crash, where the Ambulance screams around the corner, only for Rachel Reeves to step out.

Not a pretty picture and a disaster for the Labour Government, just as they saddle up for only their second Autumn budget. Long dated (10yr+) UK Government debt has been crushed by both a global trend and the unique issues the UK faces.

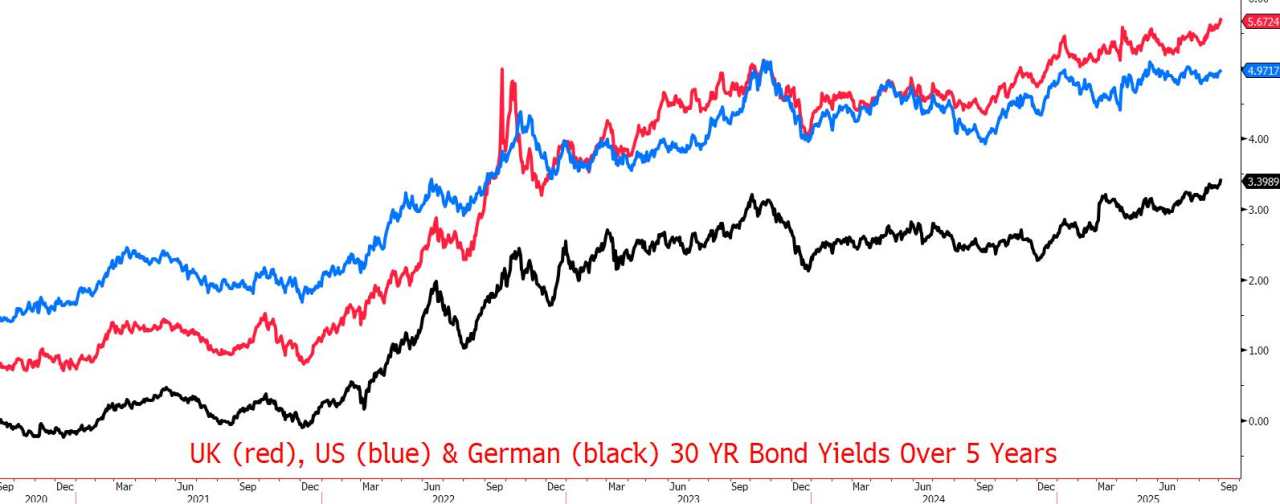

As seen above, everyone’s debt has been becoming more expensive, especially at the long end of the curve (debt dated 10yr+), but the UK does stick out at the top.

Why? Well, the UK’s budget deficit has been widening since the end of the pandemic, as successive Governments fail to address the major issues, especially in regard to spending.

That means, as a creditor, your debtor is spending more and more money and is now indicating in its upcoming budget that it’s going to be spending even more, all the while part funding this with growth sapping tax raises, straddled on an already spluttering economy.

All of these reasons to avoid lending to the UK then combine with the global trend away from long dated debt, after all, you wouldn’t fix your mortgage for 30yrs given current rates, so why would you fix your debt at such volatile rates.

So as Pension funds, Traders, Banks, etc, fade away from long dated Gov. debt, the yield increases in an attempt to attract capital. This then leads to the Government having to lower its prices for debt at future auctions and so have to issue more debt as a result.

All of this leads to higher financing costs that only get worse with time, leading us to our sorry state today.

The natural suggestion would be to cut the high levels of Government spending that has led to this situation, only the Labour back bench blocked this in July when their own Government attempted to shift some of the 2.8 million people of working-age on long term sickness.

Any such cuts seem unlikely, instead, the Chancellor has chosen to align herself with a Labour MP named Thorston Bell, a man who recommended lowering the VAT threshold from £85,000 to a level where “almost no business owner would consider the option of deliberately staying below that level of turnover” during his time at left leaning thinktank “The Resolution Foundation”.

Given businesses have already been hit with the double damage of a rise in employers National Insurance contributions and a rise in the minimum wage, such an idea will hopefully be swatted away, lest small businesses continue their path to extinction in the UK. Although in saying that, it seems the chancellor plans to raise £50bln in taxes this budget, meaning something heavy with have change.

All of this leaves the Pound in a tight spot, with the higher yields being at such a level that they dissuade the holding of GBP for investment purposes. Moreover, the longer term outlook worsens once we consider the likely upcoming tax hikes sapping the economy of liquidity just when it needs it. Moreover, should the Government go ahead with its initial plan to lower the VAT threshold, it will likely have a crippling effect on the SME ecosystem in the UK, further damaging the attractiveness of the UK for investment.

Inflation is also a persistent concern, currently sitting at 3.8% and likely expanding to 4%, double the BoE’s target, in September. This keeps the BoE hawkish, keeping its base rate at 4% for longer, although I think the bullish GBP effect this has is already waning as the damage of higher rates on the economy becomes ever more apparent.

Overall, it’s tough to see bright skies anywhere in GBP’s future and I would anticipate GBP to be the bottom performer of the G-10 currencies in September.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()