- ECB holds rates at 2.15%, signaling a “higher for longer” bias as inflation steadies above target.

- Fed rate cut odds surge, with markets pricing nearly 90% probability for easing at the September FOMC.

- EUR/USD technicals eye 1.1788 breakout, with U.S. CPI and ECB decision set to drive the next decisive move.

ECB rate decision: A pause with “higher for longer” bias

The European Central Bank (ECB) is pricing in a deposit rate unchanged at 2.15% this week, halting the easing cycle that had been underway since mid-2024. Inflation in the Eurozone ticked up to 2.1% in August, slightly above target, which reinforced policymakers’ decision to pause.

Officials signaled that while the economy remains resilient, risks tied to food prices, tariffs, and global supply disruptions still warrant caution. Investors now expect rates to remain stable into 2026, with only limited chances of further cuts.

This policy steadiness, set against lingering inflationary pressures, has lent near-term support to the euro.

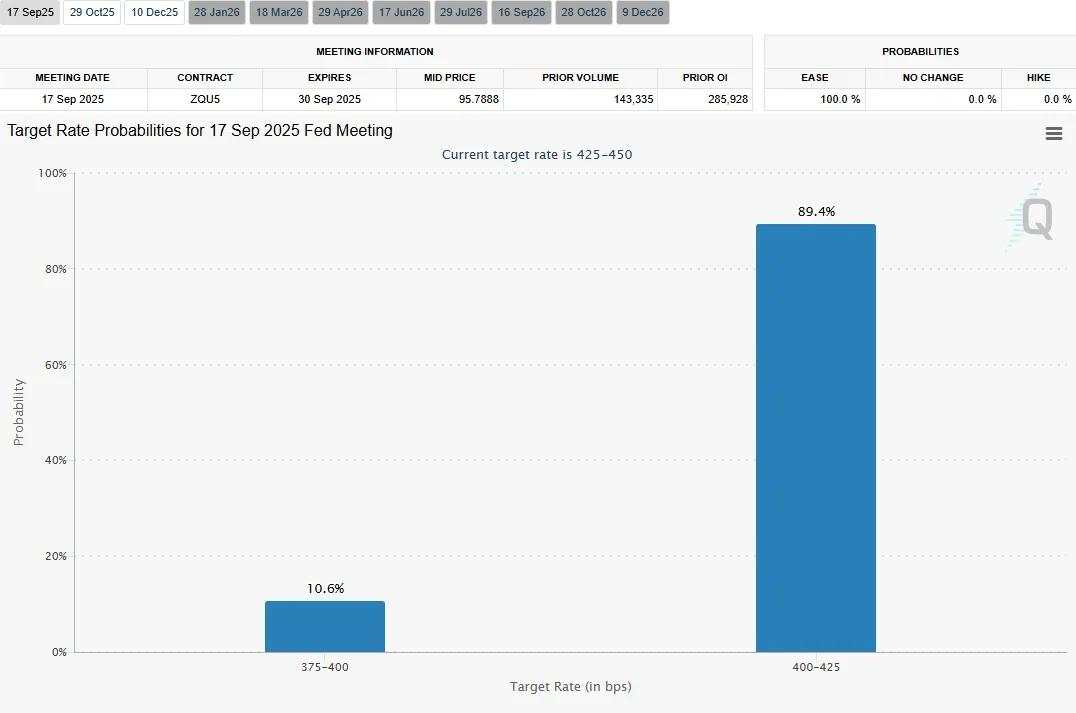

Fed rate forecast: Markets fully expect a September cut

The latest CME FedWatch data for the September 17, 2025 FOMC meeting shows an overwhelming 89.4% probability of a 25 bp cut, bringing the Fed funds target down to 400–425 bps. A smaller 10.6% chance remains for a deeper 50 bp cut to 375–400 bps. Markets assign zero probability to a hold or hike.

This dovish repricing is tied to the weak U.S. August jobs report and rising unemployment. With growth momentum fading, the Fed is expected to move toward accommodation to ease pressure on the labor market.

- Implication: ECB holding steady vs. Fed cutting widens relative policy divergence, a dynamic that favors euro upside.

- Caveat: Markets have already priced in cuts—meaning EUR/USD may see “buy the rumor, sell the news” dynamics if Powell fails to hint at deeper easing.

Impact on EUR/USD

- Bullish Euro factors: ECB pause + resilient inflation = reduced odds of further cuts. Fed leaning dovish = weaker dollar.

- Dollar vulnerability: Lower U.S. yields diminish the greenback’s attractiveness, opening the door for EUR/USD to climb toward 1.18–1.20.

- Short-term risk: If the Fed only delivers a 25 bp cut without dovish guidance, EUR/USD could briefly correct lower on profit-taking.

Previous forecast vs. price action confirmation

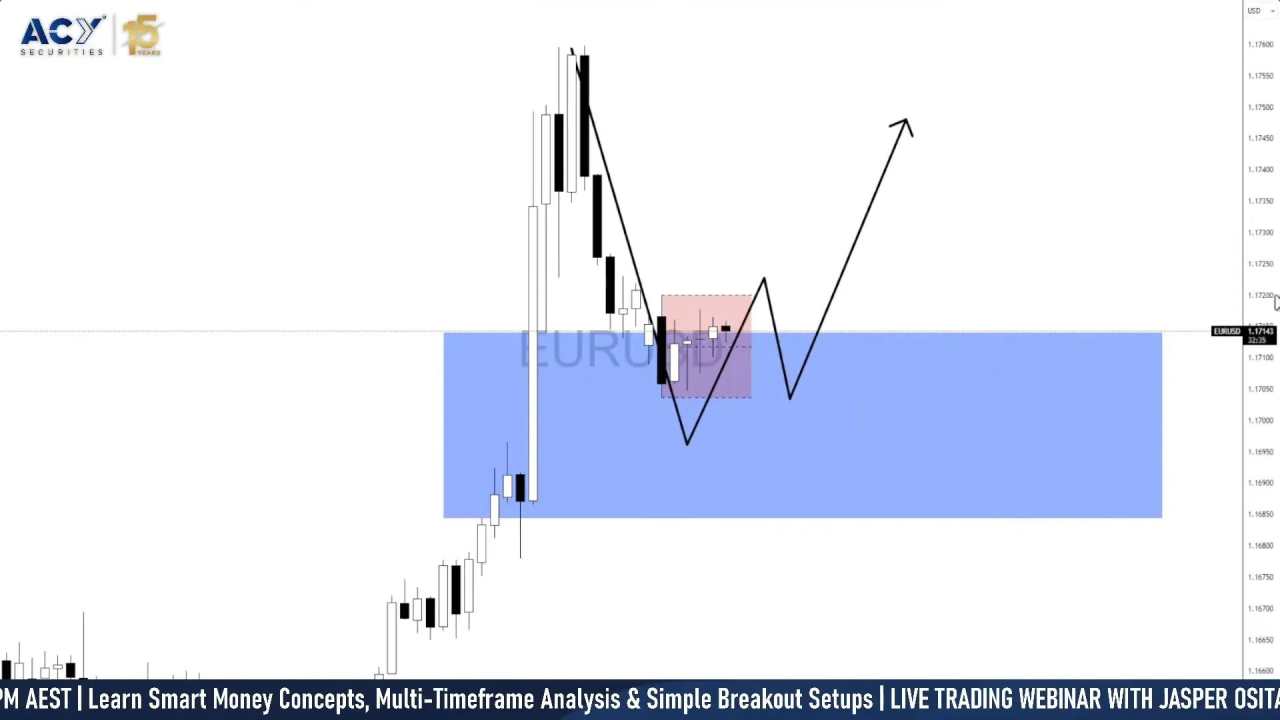

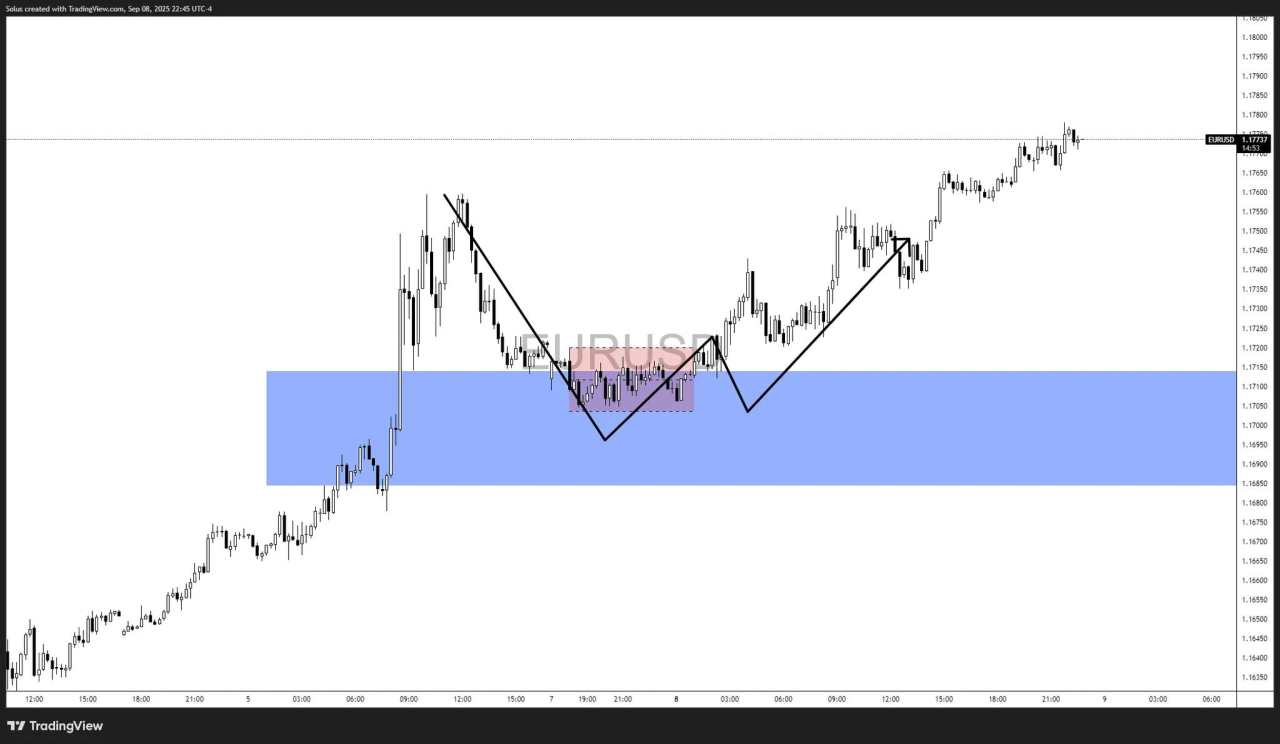

On Monday, we highlighted the blue demand zone (around 1.16844–1.17141) as the critical area for a potential bullish reversal. The forecast anticipated that if EUR/USD respected this demand zone, price could build a base and push higher toward the 1.1760–1.1780 region.

During the London session yesterday, that bullish scenario played out nicely as mentioned in the webinar. Price dipped into the highlighted demand zone, swept short-term liquidity, and then reclaimed structure with a strong impulsive leg to the upside. The rebound confirmed the demand zone’s significance, with buyers stepping in aggressively. This confirmation came from an M15 range breakout.

- Initial retest: EUR/USD tested the 1.1700 handle, rejecting lower levels and leaving behind a Fair Value Gap (FVG) within the zone.

- London session move: Bullish order flow took over, breaking through minor structure highs and setting the tone for intraday momentum.

- Follow-through: Price extended toward 1.1770, fulfilling the forecast’s upside target and validating the bullish roadmap.

This sequence underscores the importance of mapping key demand zones and combining them with liquidity concepts. What was initially outlined as a “potential bullish path” in the forecast has now transitioned into a confirmed move, providing traders with both validation of analysis and fresh opportunities for scaling into positions.

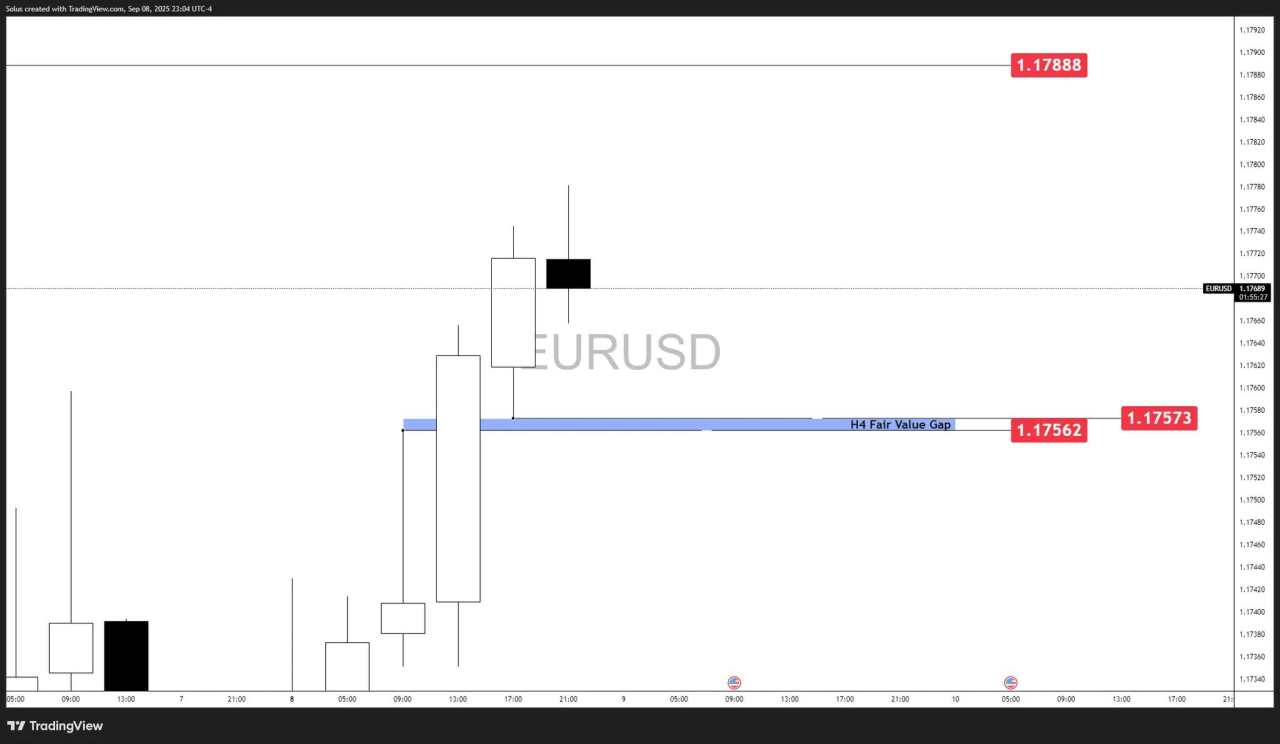

Technical outlook: EUR/USD near key levels

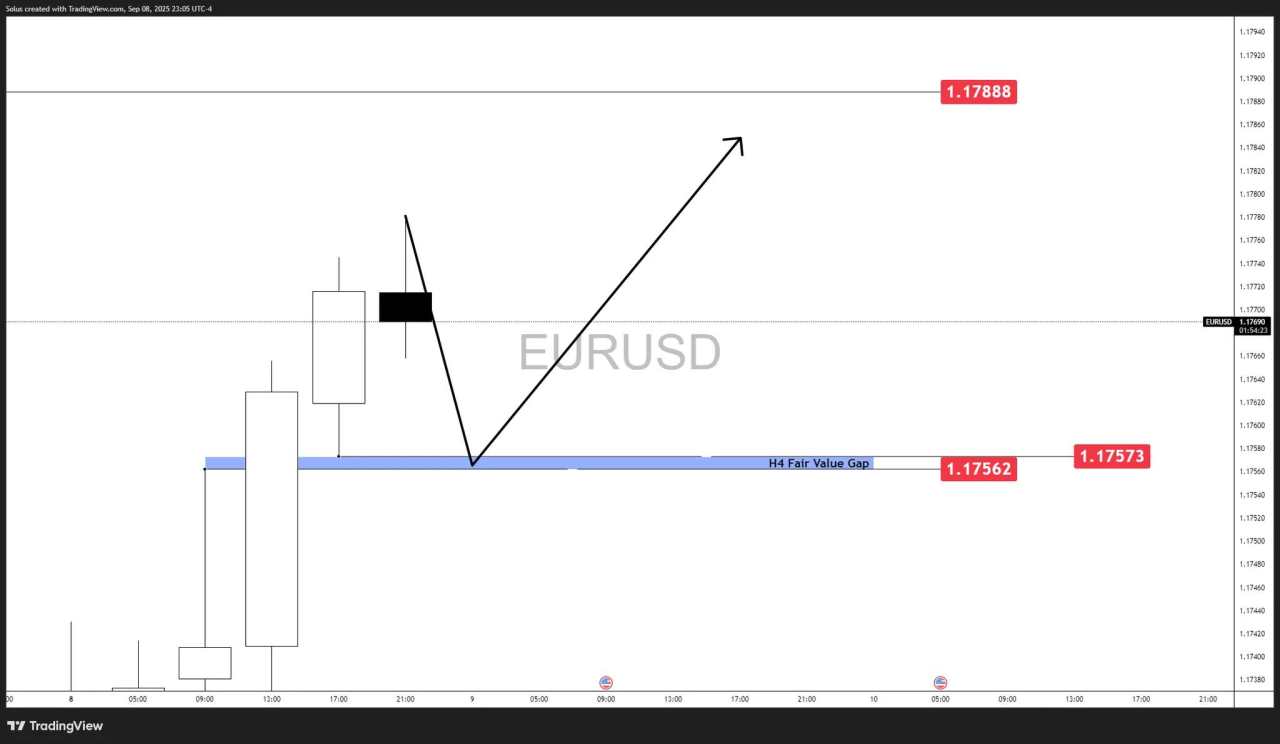

EUR/USD has extended higher into the 1.1788 region, stalling just under a major H4 supply zone. The recent London session push validated the bullish forecast from last week, but now price faces an inflection point. The H4 Fair Value Gap (1.1756–1.1757) will be critical in shaping the next move.

Price action shows early rejection from the highs, suggesting potential for a corrective dip. However, as long as the pair holds above the demand/FVG zone, the bullish structure remains intact.

Bullish scenario

If EUR/USD respects the H4 Fair Value Gap (1.1756–1.1757) and buyers step in to defend the zone, the market structure would shift into a higher-low formation. Such a move would signal that the bullish order flow remains intact, paving the way for continuation higher. A decisive break above the 1.1788 intraday high would serve as confirmation, opening the path toward higher objectives.

- Controlled pullback into the H4 Fair Value Gap (1.1756–1.1757) holds firm.

- Buyers defend the zone, creating higher-low structure.

- Break above 1.1788 confirms bullish continuation.

Targets: 1.1820, 1.1850, and extended upside toward 1.1880 if momentum accelerates.

Catalyst: dovish Fed tone, weaker U.S. CPI, or ECB hawkish reinforcement.

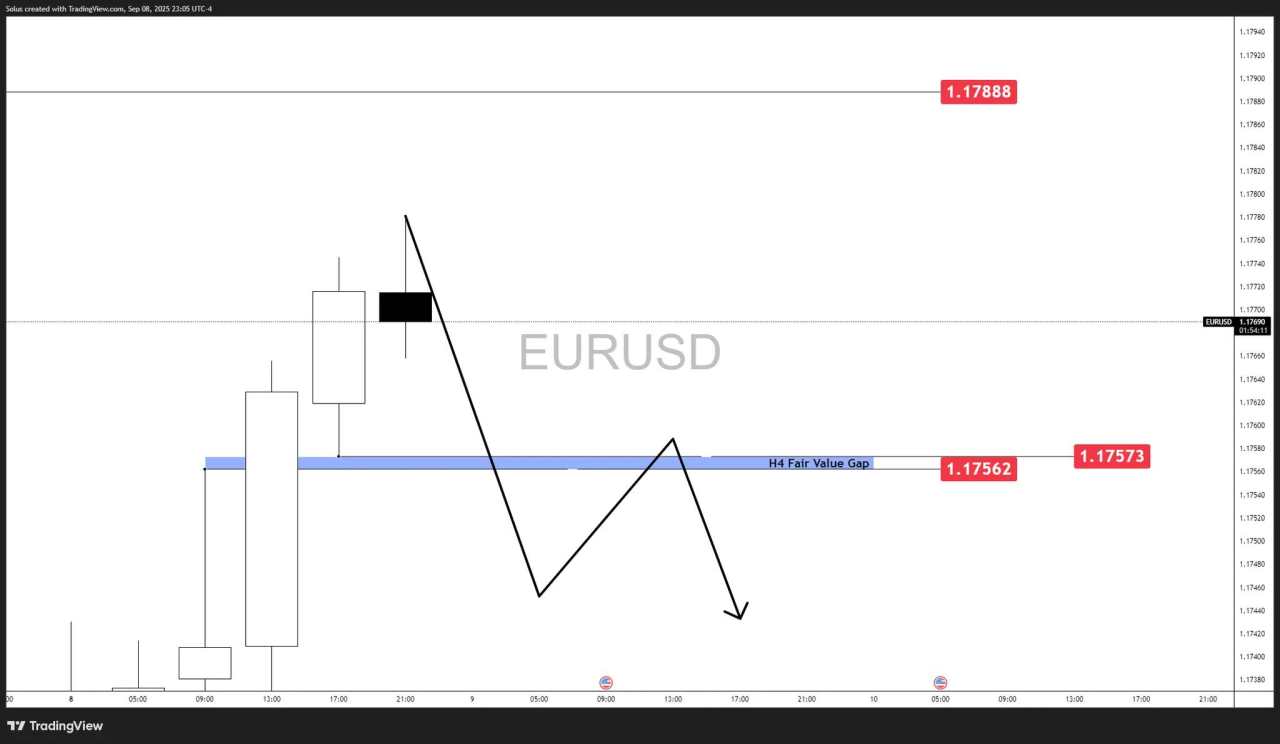

Bearish scenario

If the pair fails to hold the H4 Fair Value Gap and breaks decisively below 1.1750, bearish pressure could intensify. This would shift intraday sentiment toward distribution, opening the door for a deeper correction back into prior demand levels. The move would likely represent a shakeout before bulls attempt to regain control, but the downside risks must be respected.

- Price fails to hold the H4 Fair Value Gap and breaks below 1.1750.

- Intraday bearish momentum deepens.

Targets: 1.1720 as the first support, followed by 1.1685 (prior demand zone).

Catalyst: stronger-than-expected U.S. CPI, or ECB signaling a dovish shift despite steady rates.

Final thoughts

EUR/USD has honored the bullish roadmap, rallying into the 1.1780s after rebounding from demand. The pair is now at a make-or-break point, with both bulls and bears watching the H4 Fair Value Gap as the short-term battleground.

This week’s two key events will ultimately decide the next leg:

- U.S. CPI (Wednesday): A hot inflation print could revive USD strength and drag EUR/USD lower.

- ECB Rate Decision (Thursday): The ECB’s pause has been priced in, but the tone of the statement will matter - hawkish language supports the euro, dovish hints open downside risks.

Until then, EUR/USD is likely to remain choppy near the 1.1750–1.1788 zone, awaiting a decisive breakout.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()