- Gold consolidates just under $3,650 as traders weigh Fed cut odds and CPI/PPI catalysts.

- Structural bids from central banks and geopolitical risk continue to underpin strength.

- H4 Fair Value Gaps ($3,616–$3,645) define the battleground; breakout above $3,650 opens $3,700, breakdown risks $3,570.

Gold sustains record-high bid as rate-cut odds surge

Gold’s latest leg higher came on the back of a decisively weak U.S. August jobs report and a quick repricing toward a September Fed rate cut. Spot gold printed fresh records near $3,600/oz and continues to hover just below that line as traders firm up odds of easing at the upcoming FOMC. Lower policy-rate expectations compress real yields and keep the dollar on the defensive—classic tailwinds for bullion.

Beyond the macro rates impulse, the structural bid is alive: central-bank buying (with fresh headlines pointing to continued PBoC additions in August) and elevated geopolitical risk have reinforced gold’s role as a portfolio hedge. That backdrop helped absorb profit-taking dips into the back half of last week.

What’s driving Gold right now

- Soft NFP seals the deal for September easing. August payrolls rose just 22k, and unemployment ticked up to 4.3%, pushing gold to new highs and cementing a 25 bp cut as the base case.

- Markets sit near records; yields ease. Risk assets’ resilience alongside falling yields reflects a market leaning into easier policy—a mix that historically supports gold.

- Central-bank demand & geopolitics. Reports of China’s PBoC adding to reserves and ongoing conflict risks keep strategic demand firm.

Price action follow-through: From forecast to $3,650 test

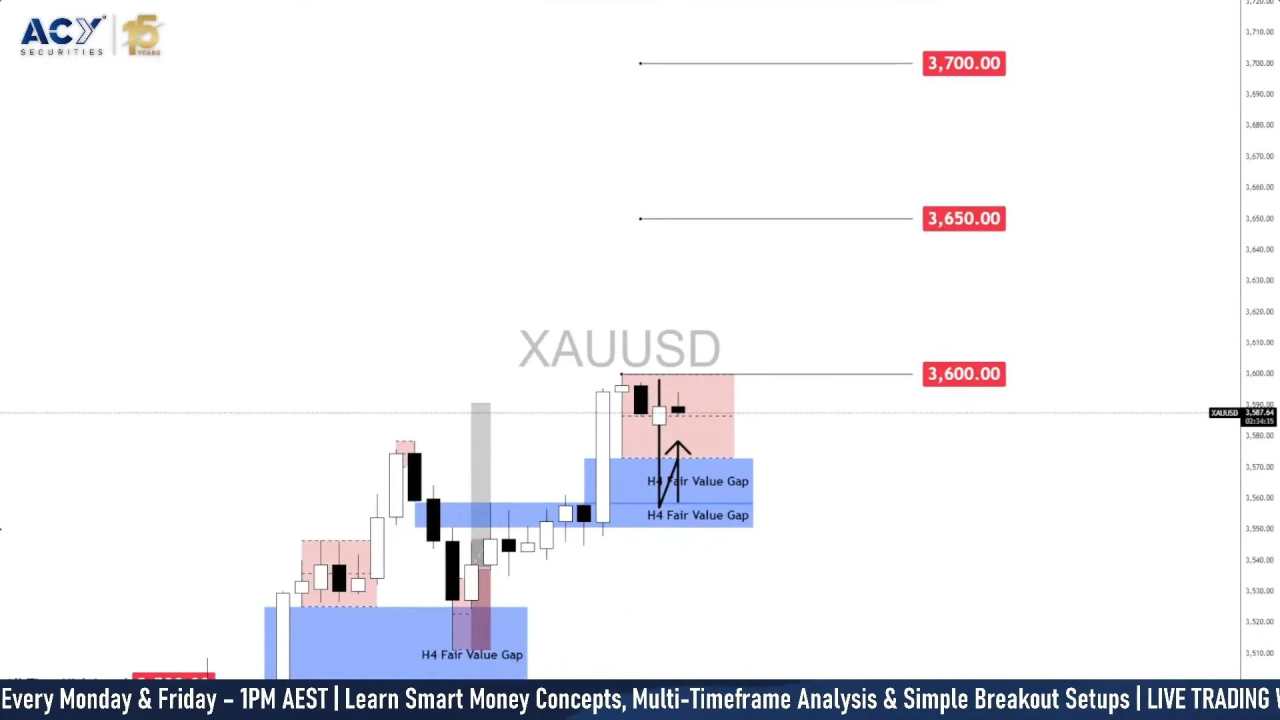

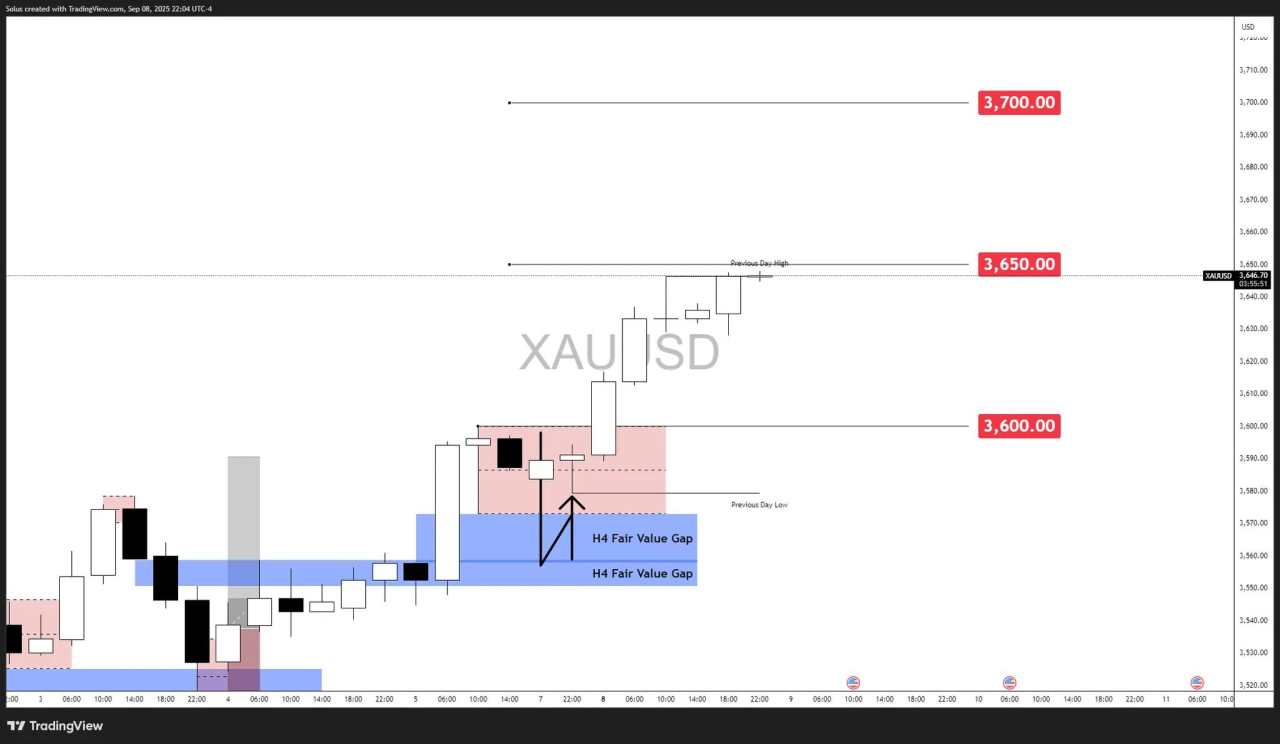

In Monday’s outlook, we highlighted gold’s ability to reclaim layered H4 Fair Value Gaps as a structural foundation for further upside. That forecast has since materialized: buyers defended the $3,550–$3,560 shelf, and momentum carried price into a clean breakout sequence.

The move extended into the $3,640–$3,650 zone, aligning with our projected bullish continuation path. Each retest of intraday imbalances attracted fresh demand, confirming market conviction that dips remain buying opportunities. The current structure shows price consolidating just under $3,650 - the next pivotal resistance before $3,700 comes into view.

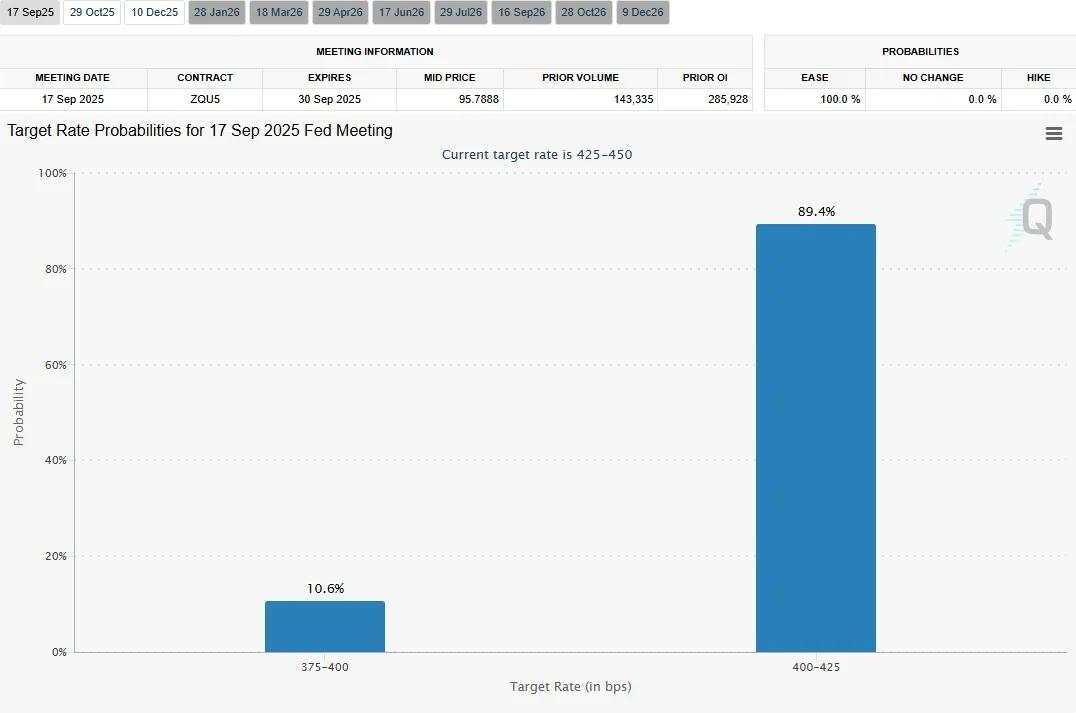

CME FedWatch: 89% probability of September cut

The CME FedWatch Tool now prices an 89% probability of a 25 bp Fed rate cut at the September 17 meeting, with a smaller 10% chance of a 50 bp move.

This overwhelmingly dovish repricing is critical for gold. A confirmed rate cut would:

- Lower U.S. real yields, directly reducing the opportunity cost of holding gold.

- Weaken the U.S. dollar, reinforcing gold’s inverse correlation.

- Strengthen haven demand, as easing signals the Fed’s recognition of slowing growth.

Together, these dynamics create a macro backdrop where gold’s floor remains supported, even if technicals temporarily stretch into overbought territory. Traders will watch whether CPI/PPI confirm the Fed’s dovish path—cool inflation could propel gold beyond $3,650 toward the $3,700 target zone.

Overall narrative: Why the bid can persist

Rate expectations are the beating heart of this move. With FedWatch showing nearly 90% odds of easing, gold has a clear policy-driven tailwind. Pair that with central-bank accumulation and risk-hedging flows, and dips have struggled to develop follow-through. If CPI/PPI confirm a cooling trend, the path of least resistance remains higher into the Fed meeting.

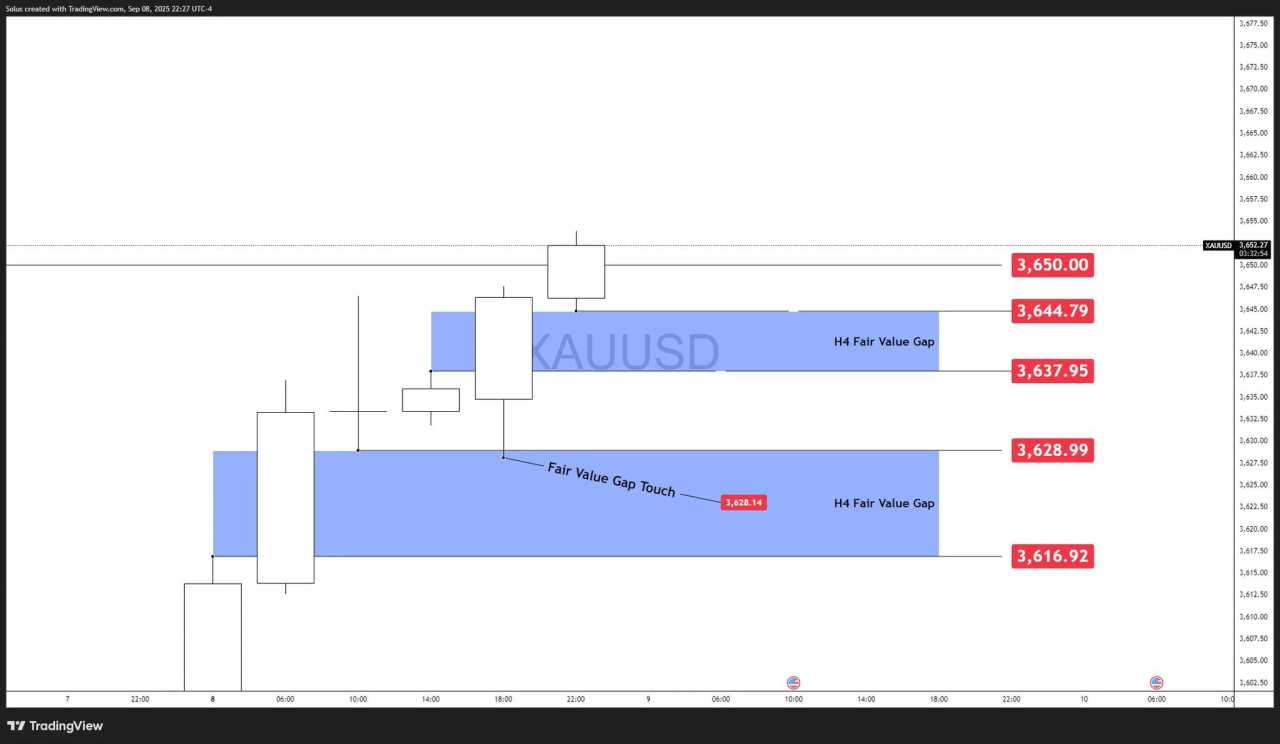

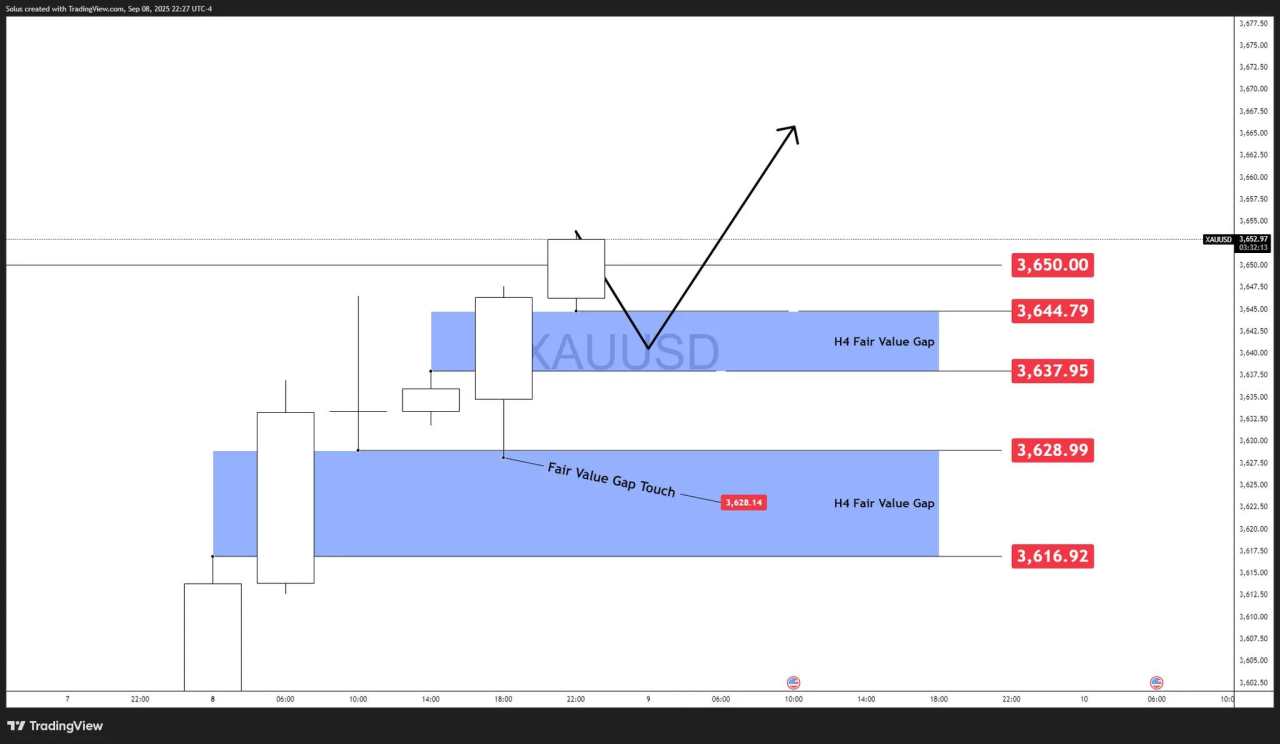

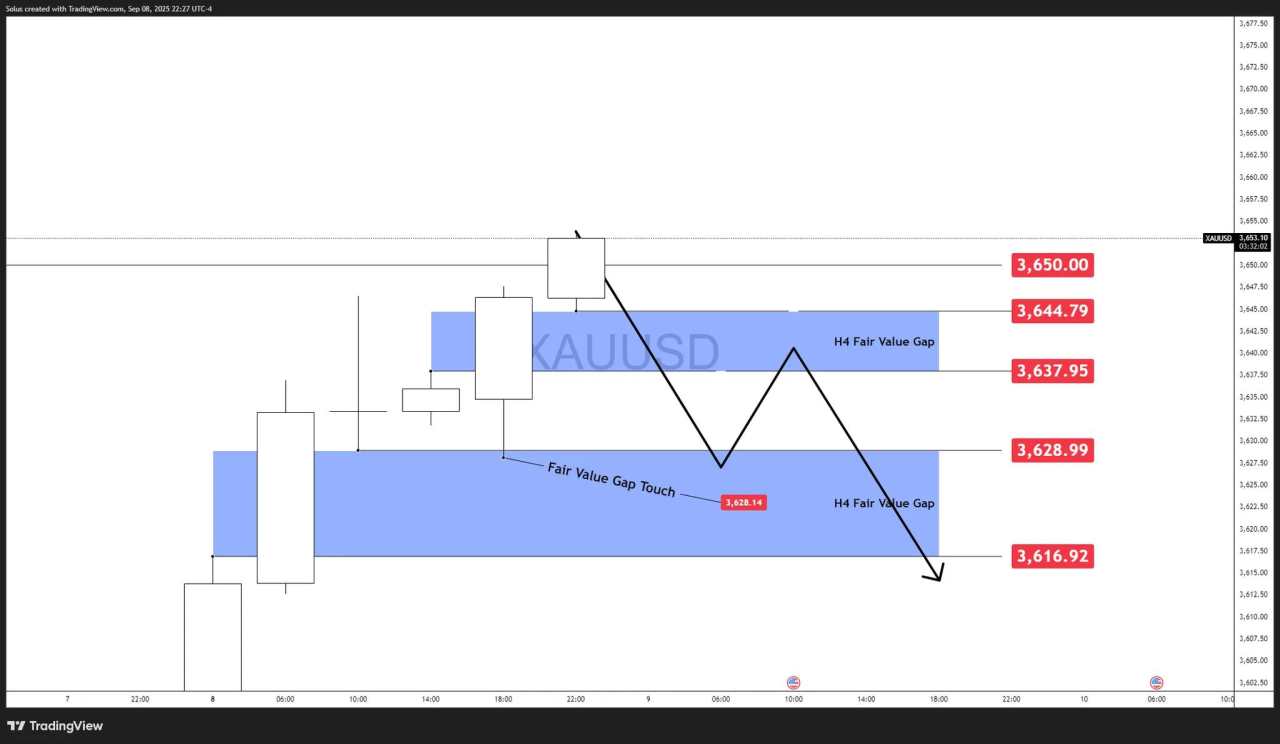

Technical outlook: XAU/USD still hot

Gold’s is consolidating beneath the $3,650 resistance, with multiple H4 Fair Value Gaps (FVGs) forming below current levels.

Prior to this move, the FVG at $3,630 - $3,616 served as a point-of-interest for bounce to the upside.

These FVGs between $3,616 - $3,645 are pivotal zones where buyers may attempt to step back in if price retraces. The reaction at these imbalances will dictate whether gold clears $3,650 for continuation or fades back into deeper retracement.

Bullish scenario: Reclaim above $3,650

The bullish case hinges on whether buyers can hold the FVGs and reclaim $3,650 with conviction.

- Price dips into the $3,628–$3,638 FVG zone and finds strong buyer response.

- A breakout and daily close above $3,650 confirms momentum continuation.

- Upside targets: $3,670 first, then $3,700 psychological resistance.

Bearish scenario: Rejection and breakdown through FVGs

Alternatively, a sustained rejection under $3,650 combined with a hot CPI or stronger USD could trigger a deeper pullback.

- Failure to reclaim $3,650 opens the path to revisit the FVGs.

- A clean breakdown through the $3,628–$3,616 FVG cluster signals bearish intent.

- Downside targets: $3,600, followed by $3,580–$3,570 where structural supports align.

Final note: Wait for confirmation

While both bullish and bearish paths are clear on the chart, gold is sitting at a pivotal juncture. With CPI/PPI ahead and Fed cut odds already priced, chasing moves without confirmation risks being trapped in volatility. Traders should wait for a confirmed breakout above $3,650 or a decisive breakdown through the $3,628–$3,616 zone before committing to directional trades.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()