Turkey's economy at a glance

During the July MPC meeting, the Central Bank of Turkey stated that future policy steps will be guided by economic data and evaluated on a meeting-by-meeting basis, emphasising a cautious and flexible approach. Taken together, these factors point to less aggressive easing this month than previously anticipated, in our view. Accordingly, we expect a 200bp cut from the CBT to 41%. We anticipate the bank bringing the policy rate to 37% in December.

The stronger-than-expected inflation data for August has reaffirmed the ongoing difficulties in achieving disinflation. We revised our inflation forecast for end-2025 to 30% from 29.5%. Based on the policy rate forecast, this implies a high real rate to continue in the near term.

The 2Q data reveals a clear acceleration in both annual and quarterly growth, defying earlier expectations of a slowdown in quarterly momentum. This suggests upside risks to Turkey’s 2025 growth outlook, especially amid ongoing monetary easing. However, this stronger-than-expected performance may prompt the central bank to adopt a more cautious approach to interest rate cuts. Given the resilience in domestic demand, we have raised our full-year GDP growth forecast for 2025 to 3.3%, up from the previous estimate of 2.7% and for 2006 to 4% from 3.5%.

In the press meeting accompanied by the inflation report release, Governor Fatih Karahan introduced year-end interim targets. He emphasised that these interim targets, which represent specific inflation levels that the CBT is committed to achieving in the short term as part of its broader disinflation strategy, will act as benchmarks for shaping the monetary policy trajectory. This adjustment to the framework reflects a stronger commitment by the CBT to respond decisively to developments that could cause inflation to diverge from its targets, in our view. In this sense, the new approach reinforces the credibility and precision of the CBT’s inflation targeting strategy.

On the FX side, the CBT considers the real appreciation of the Turkish lira a natural outcome of its tight monetary stance, which increases demand for the currency. While we may not observe consistent appreciation in the short term, i.e., on a month-to-month or quarterly basis, it is highly likely that the lira will experience cumulative real appreciation over a longer period, according to the bank.

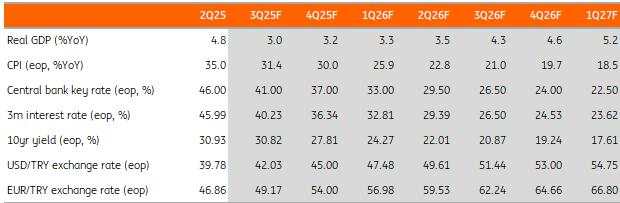

Quarterly forecasts

Source: Various sources, ING

FX and rates outlook

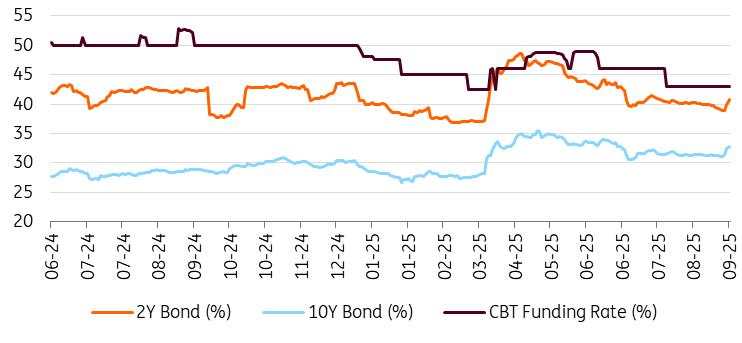

New political headlines in early September put pressure on TRY assets, where we saw a visible sell-off in Turkish government bonds (TURKGBs) and FX implied yields. On the other hand, the USD/TRY spot rate proved resilient, and the central bank clearly has this market fully under control. This confirms our previous preference to keep exposure in Turkey close to home, and we believe this strategy will continue to work in the coming months.

Despite the continuation of the CBT's cutting cycle, FX carry remains an attractive and popular market position. At the same time, higher-than-expected inflation in August and increased volatility suggest a more cautious approach to rate cuts by the central bank, which should prolong the attractiveness of carry in Turkey. Although we can expect the market to reduce risk ahead of 15 September, we believe that the central bank is sufficiently equipped to keep the spot market unchanged on its current trajectory, and TRY continues to offer an attractive carry relative to other EM currencies.

The rates market and FX implieds have adjusted their expectations closer to a 200bp CBT rate cut for the September meeting. However, for this year, the market remains on the dovish side compared to our forecast of 37% at the end of the year. Although bonds and rates may seem cheap after the September sell-off, we remain cautious and the coming weeks may bring a better entry level for new longs. On the supply side, according to our calculations, the Ministry of Finance covered approximately 77% of the planned issuance of TURKGBs, which should put the Ministry of Finance in a comfortable position, but budget execution indicates some additional slippage, which may lead to additional issuance.

Local bond yields vs CBT funding rate

Source: CBT, Refinitiv, ING

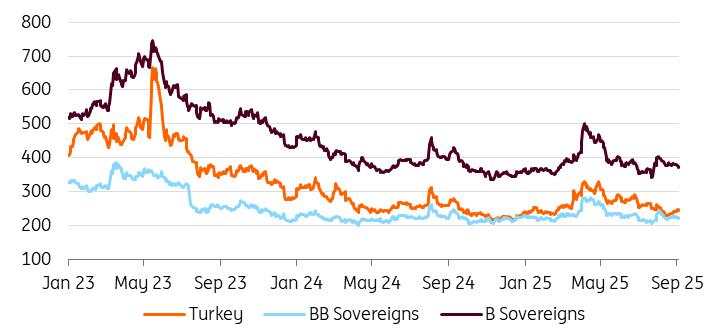

Sovereign credit views

Spreads in Turkey generally squeezed towards the BB average for much of the past month, before the latest bout of political headlines. We expect political noise could drive some further volatility in the USD bond space, with spread levels now still well off their YTD highs despite some weakness over the past week. More supply from the sovereign in the Eurobond market also seems likely, following a successful deal for the Turkey Wealth Fund last week.

US$ bond sub-index spreads vs USTs

Source: Refinitiv, ING

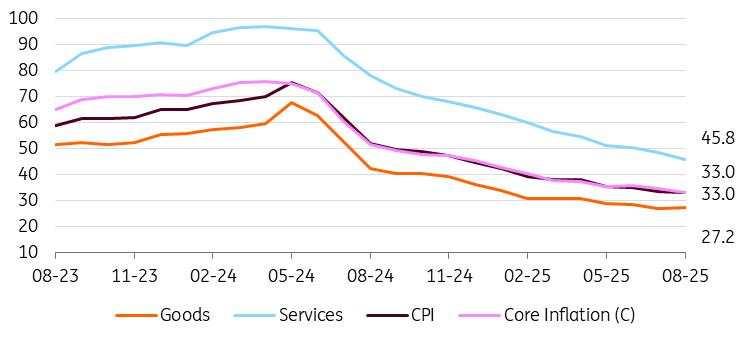

CPI higher than expected, but annual inflation slows

In August, the CPI inflation came in at 2.04% month-on-month, higher than the consensus estimate at 1.8% and our call at 1.5%. This was largely due to higher pricing pressures in food and transportation prices, while the decline in clothing remained below its long-term August average. However, the downtrend in the annual inflation rate continued with a decline to 32.95% from 33.52% a month ago.

While inflation rose by 2.47% in August 2024, the five-year average for August in the 2003-based index was just 3.0%. This suggests a favourable base effect, supporting the continued decline in annual inflation. Year-to-date inflation, on the other hand, reached 21.5% vs the CBT’s 25-29% forecast range for 2025, according to the latest inflation report. August data increases risks for end-of-year inflation remaining above the upper band.

Inflation outlook (YoY%)

Source: TurkStat, ING

Revision to the disinflation strategy

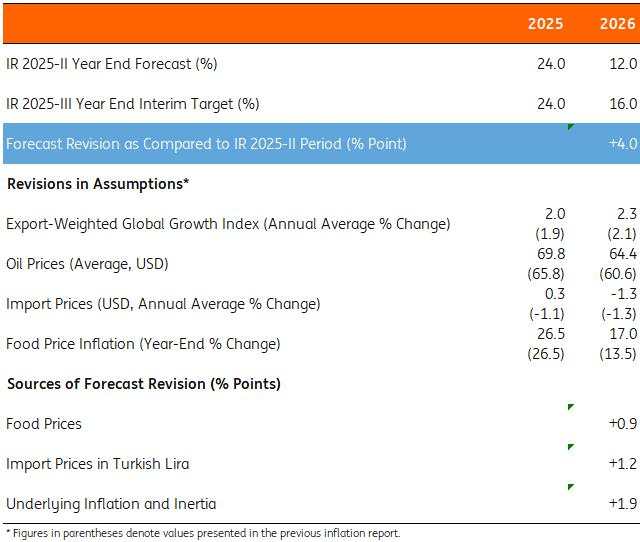

In mid-August, Governor Karahan held a press conference to present the central bank’s third Inflation Report of the year. During the event, the Bank announced a key change to its policy framework: the introduction of year-end interim targets. Unlike inflation forecasts, interim targets are fixed and will only be adjusted under exceptional circumstances.

At the press conference, Governor Karahan confirmed that the CBT has retained its 24% inflation forecast for the end of 2025 as the interim target for that year. For subsequent years, the interim targets are set at 16% for 2026 (which is 4ppt higher than the Bank’s previous estimate) and 9% for 2027. In terms of projections, the CBT expects inflation to range between 25% and 29% by the end of 2025. For 2026, inflation is forecast to decline to a range of 13% to 19%. The upward revision for the 2026 forecast is attributed to three key factors: i) food prices, contributing an increase of 0.9ppt, ii) import prices in TRY terms, adding 1.2ppt, and iii) underlying inflation, accounting for a rise of 1.9ppt.

Details of inflation report

Source: CBT, ING

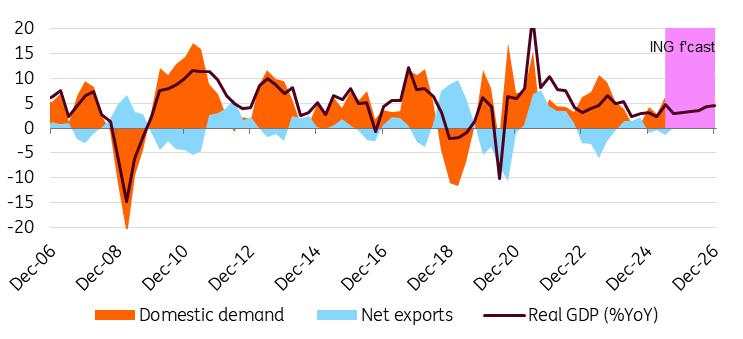

Resilient domestic demand drives growth in 2Q

In the second quarter of 2025, Turkey’s Gross Domestic Product (GDP) grew by 4.8% year-on-year - surpassing both the market consensus of 4.1% and our forecast of 3.8%. This marks a notable acceleration compared to previous quarters, partially supported by a favourable base effect. However, the growth was primarily driven by robust private consumption and increased investment activity. As a result, GDP growth for the first half of the year reached 3.3%.

After seasonal adjustments, 2Q25 GDP corresponds to a quarter-on-quarter (QoQ) growth rate of 1.6% - the highest quarterly increase in the past two years. This unexpected momentum, despite tighter financial conditions following political developments in March, is attributed to i) a positive shift in investment contributions ii) inventory accumulation, which exceeds drags from private consumption, government spending, and net exports.

Real GDP (%YoY) and contributions (ppt)

Source: TurkStat, ING

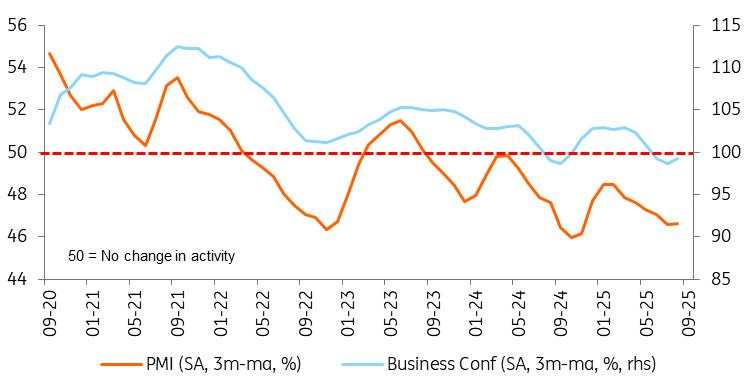

PMI slightly recovered in August, but still below 50

The manufacturing sector PMI recovered in August to 47.3 from 45.9 a month ago, though it remained in contractionary territory, which has been the case since April 2024. This implies continuing pressures on the manufacturing sector in the third quarter amid tight financial conditions in recent months. Accordingly, firms continued to scale back employment and purchasing activity. However, some positivity in output and new orders suggests the strain may be easing. The data also shows that the rate of input cost inflation rose slightly, though output prices moved at the slowest pace year-to-date.

Findings in the sectoral PMIs, on the other hand, released by the Istanbul Chamber of Industry, are in line with what the manufacturing PMI data suggested in August, as all 10 sectors, with the exception of basic metals, have remained below the 50 threshold, while half of them recorded a deterioration in PMIs in comparison to a month ago.

PMI and business confidence

Source: ICI, CBT, ING

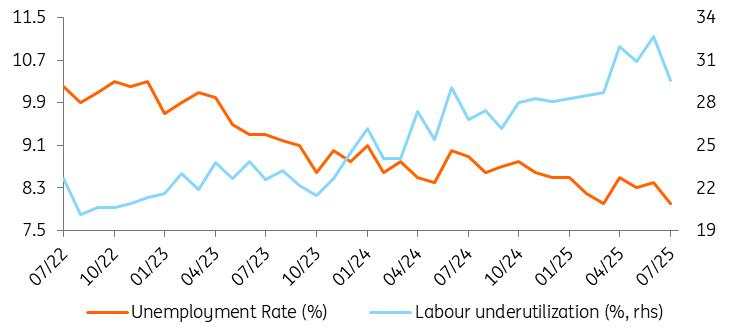

Continuing challenges in employment creation

In July, seasonally adjusted employment recorded a mere 0.1% increase, standing at 32.6mn. The data implies that employment generation has been stagnant since early 2024. The labour force participation rate showed a decline to 53.3%, the lowest in the last five months, while the unemployment rate, which has been in a range of 8.0-8.6% in the last nine months, touched the lower bound of this zone. This is the lowest level in the current labour market statistics, starting in 2005. On the other hand, the seasonally adjusted average weekly actual working hours rose by 1.0 compared to the previous month, standing at 44.4 hours.

One of the broader unemployment indicators, the underutilisation rate - which combines time-related underemployment, potential labour force, and the unemployed - maintained an uptrend in recent months and reached 32.7%, the historic peak in June. In July, it moderated to 29.6%, though the elevated level, along with challenges in the creation of new employment, indicates strains in the labour market, despite headline unemployment remaining quite low, in single digits.

Labour market outlook

Source: TurkStat, ING

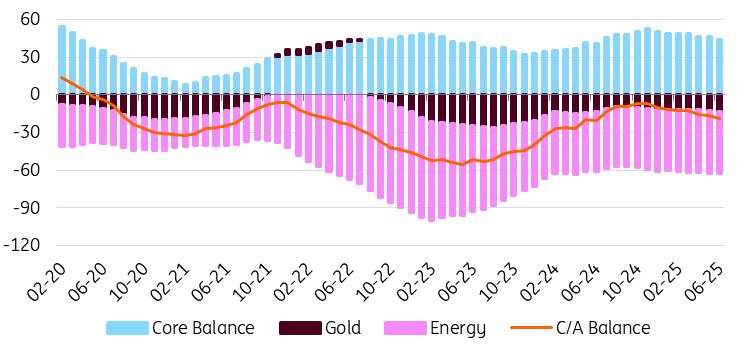

Widening in the June current account

In June, Turkey recorded a current account deficit of US$2bn vs a US$0.8bn surplus in the same month of 2024. A comparison with the last year reveals i) core trade turning to a wider deficit from a balanced figure, ii) a higher net gold trade deficit and iii) deterioration in the primary income balance. Based on our assessment, the persistent weakness in domestic demand is likely to help contain the current account deficit this year, keeping it around 1.3% of GDP, while early indicators for July and August hint at an improving current account on a 12-month rolling basis.

On the capital account side, we saw outflows in June by US$2.7bn. This was mainly driven by local banks’ increasing assets abroad, while we saw the continuation of a relatively higher rollover rate for the banking sector. With a modest net inflow from errors and omissions of US$0.6bn, and considering the current account deficit, official reserves depleted by US$4.1bn.

Current account (12M rolling, US$bn)

Source: CBT, TurkStat, ING

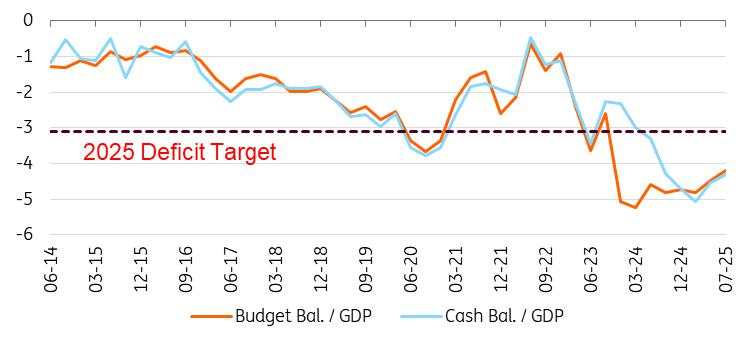

Improvement in July budget performance

The budget results for July indicate an improvement in the fiscal balance compared to the same month last year. This positive development is attributed to strong tax collection and the relative restraint in non-interest expenditures. In July, the total budget deficit amounted to TRY23.9bn, significantly lower than the TRY96.8bn deficit recorded in July of the previous year. As a result, while the budget deficit for the first seven months of the year has exceeded TRY1tn, the cumulative deficit over the past 12 months has decreased to TRY2.3tn - equivalent to 4.2% of GDP. In the most recent Medium-Term Program (MTP), the projected budget deficit for 2025 was announced as TRY1.93tn, corresponding to 3.1% of GDP.

In a statement regarding the budget, Minister of Treasury and Finance Mehmet Şimşek noted that, on the revenue side, they anticipate a "downward deviation" due to inflation accounting and the slowdown in economic growth. However, he emphasised that no deviation is expected on the expenditure side.

Budget performance

Source: Ministry of Treasury and Finance, ING

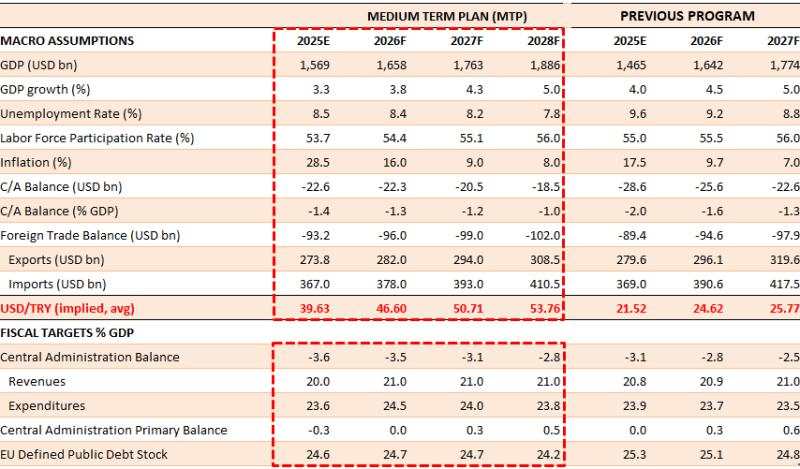

Turkey reinforces price stability with lower growth targets

Turkey's Vice President Cevdet Yılmaz convened a press conference with Finance Minister Mehmet Şimşek and Central Bank Governor Karahan to present the details of the Medium-Term Plan (MTP) for 2026-28. The plan outlined the government’s macroeconomic projections and set forth its principal policy and reform agenda.

The plan revised GDP growth forecasts downward by 0.7ppt for each year from 2025 to 2027. Nonetheless, the government expects growth to accelerate from 3.3% in 2025 to 5% by 2028. The official projection of 3.3% for this year is more optimistic than the 2.9% consensus in the latest Market Participants Survey, while the 2026 forecast is broadly in line with the market’s 3.7% expectation. Still, the growth trajectory outlined in the MTP remains below Turkey’s long-term average, signalling that policymakers are prioritising disinflation over rapid expansion.

On inflation, the MTP projects a year-end rate of 28.5% for 2025 – down from 33% in the previous plan and within the central bank’s forecast range of 27-29%. For 2026 and 2027, inflation estimates have been revised upward compared to the previous plan and aligned with the Bank’s interim targets.

In terms of fiscal policy, the MTP forecasts a central government budget deficit of 3.6% of GDP for 2025, up from 3.1% in the earlier plan. The plan anticipates gradual improvement, with the deficit narrowing to 2.8% of GDP by 2028 - still higher than previously projected in last year’s MTP. While the government signals fiscal discipline by keeping the deficit (excluding earthquake-related spending) near the Maastricht threshold of 3.0%, a notable increase in primary spending and interest payments is expected next year. This rise, however, is projected to be offset by stronger revenue generation. Policymakers have emphasised that fiscal policy will support disinflation, suggesting reduced reliance on inflationary measures such as administered price hikes and tax increases. Still, the combination of subdued public investment - capital expenditures and transfers are set to decline by 0.2% to 2.4% of GDP - and relatively strong current spending may not bode well for long-term growth prospects.

Externally, the government projects a current account deficit of 1.4% of GDP in 2025, with a gradual decline to 1.0% by 2028. However, the growth path envisioned in the plan raises questions about the feasibility of achieving this external adjustment.

Overall, Vice President Yılmaz acknowledged the short-term trade-off between inflation and growth, reiterating the government’s commitment to curbing inflation without triggering a recession. While the new MTP offers more realistic projections than its predecessor, attaining the goals of external adjustment and disinflation remains a challenge, in our view.

Details of the new economic programme

Source: Official Gazette, ING

Read the original analysis: Turkey: Downsizing rate cuts?

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()