The U.S. economy saw an uptick in its August CPI figure from 2.7% year-on-year to 2.9% as expected while the core version of the report also came in line with consensus, according to data released by the Bureau of Labor Statistics.

On a monthly basis, the headline CPI rose 0.4% in August 2025, marking the largest monthly increase since January. The reading exceeded economist expectations of 0.3% and highlighted persistent price pressures across multiple sectors.

Key Takeaways

- Headline CPI: Rose 0.4% month-over-month, up from 0.2% in July; annual rate climbed to 2.9% from 2.7%

- Core CPI: Increased 0.3% monthly, matching July’s pace; yearly rate ticked higher to 3.1% from previous 2.8%

- Shelter dominance: Housing costs rose 0.4% and accounted for the largest contribution to the monthly increase

- Food prices surge: Food index jumped 0.5% after remaining flat in July, with grocery prices climbing 0.6%

- Energy gains: Energy costs advanced 0.7% following a 1.1% decline in July, driven by 1.9% gasoline price increase

- Service sector strength: Core services excluding housing continued upward momentum with broad-based increases

Link to official U.S. Consumer Price Index (August 2025)

While previous months showed limited tariff pass-through to consumer prices, August’s report suggests trade-related price pressures may be gaining traction.Several import-sensitive categories including apparel, used vehicles, and household furnishings showed meaningful increases, though analysts note these effects remain contained compared to earlier projections.

The shelter component, representing over one-third of the core CPI basket, continues to drive inflation momentum. Owners’ equivalent rent climbed 0.4% monthly, while primary residence rent increased 0.3%. However, recent data from real-time rent trackers suggests this pressure may moderate in coming quarters.

Market Reactions

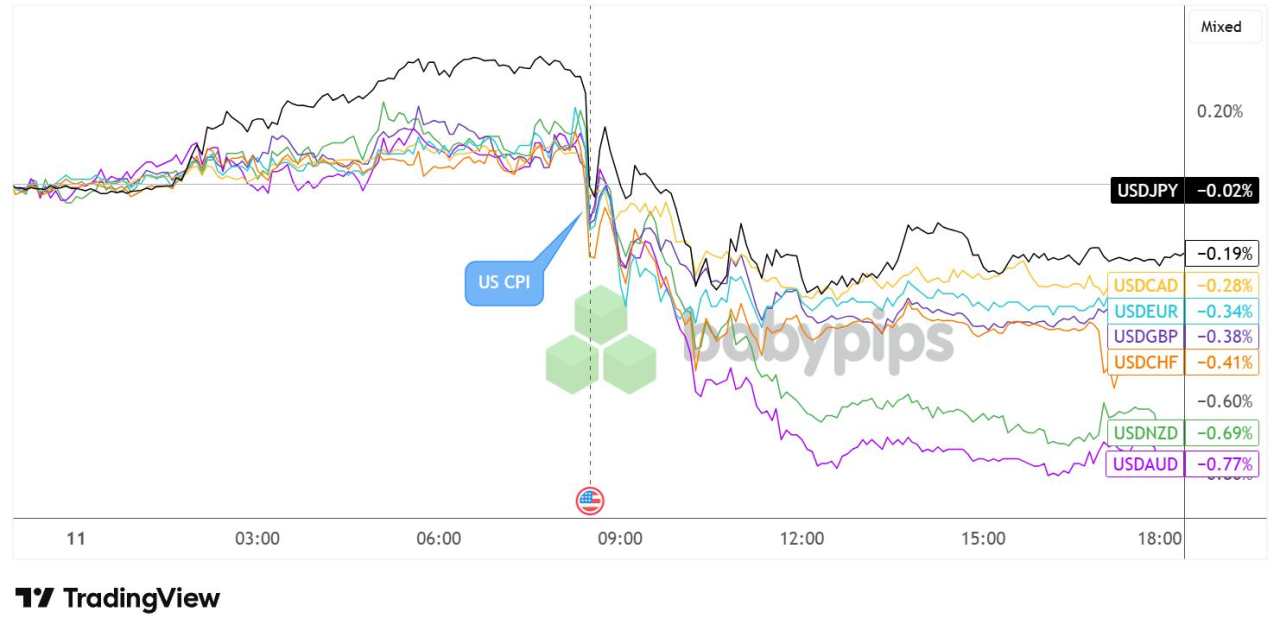

United States Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

USD sustained its decline in the hours that followed, chalking up its steepest losses to commodity currencies AUD (-0.69%) and NZD (-0.77%). The dollar also stayed in the red against the European currencies until the end of the New York session while limiting losses against JPY (-0.19%) and CAD (-0.28%).

Tải thất bại ()