Today marks a pivotal day in markets, the day when the Fed resumed its rate-cutting campaign after a year’s hiatus. The circumstances of the cuts to come are very different to last September however, with a Trump-sized contradiction in the Fed’s behaviour.

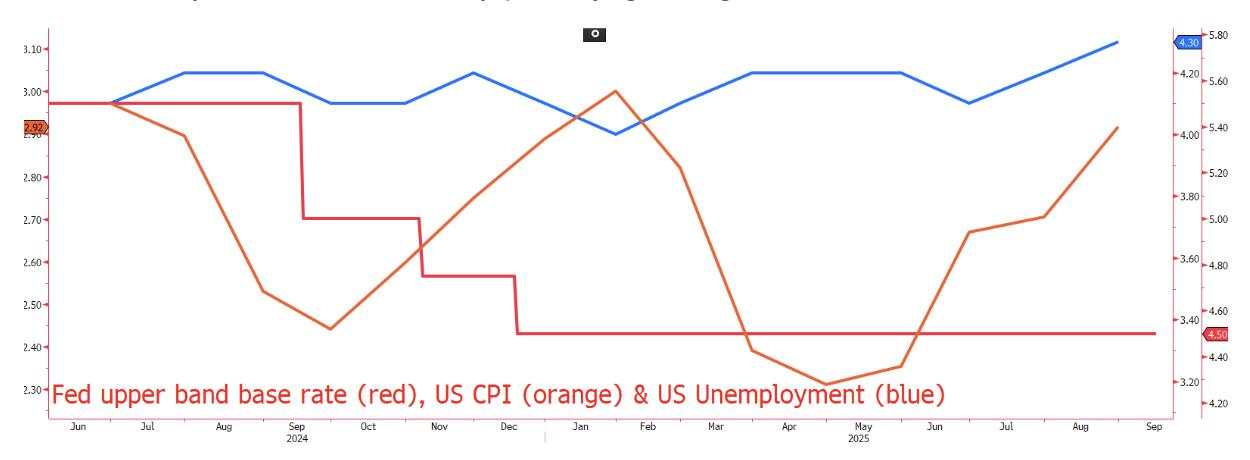

Last September, the Fed cut its base rate by 0.50%, at a time when CPI had fallen for the last 6 consecutive releases, unemployment had risen from 3.8% to 4.2% in 9 months and there was growing concern about US economic performance.

Now, the Fed looks set to cut by 0.25%, when CPI has risen the last 3 releases and is showing little sign of stopping, unemployment has risen a smaller 0.3% YTD and the economy remains reasonably punchy, growing 3.3% in Q2.

Understanding these factors, it is not immediately obvious that the Fed should be cutting rates, in fact, there would be a strong case for holding rates steady and waiting for the full impact of tariffs to materialise.

But instead, the market is almost totally positioned for a serious weakness in USD, with EURUSD options growingly supporting a move up to the €1.20 and Gold reaching all-time highs in anticipation of Powell announcing a fresh cutting campaign.

Furthermore, options pricing suggests at least 1 more cut to come from the Fed before the end of the year, in addition to the likely cut today, with a possible third given an even chance.

Why this sudden U-turn in opinion? I suspect the President plays a more significant role in this than people believe. Verbal attacks turned into aggressive career-ending politics when FOMC member Lisa Cook was accused of mortgage fraud and the President immediately called for her resignation.

Any institution would struggle to continue “business as normal” under this level of pressure. Combined with the fact that Powell’s term will end in May 2026, Fed members jostling for position to ingratiate themselves with the President by calling for lower rates all suggest a short- and long-term softer Dollar.

There is room for an upset, should Powell not suggest as many cuts as expected to come in the outlook, however, given his imminent replacement, the initial bullish Dollar reaction would pass quickly.

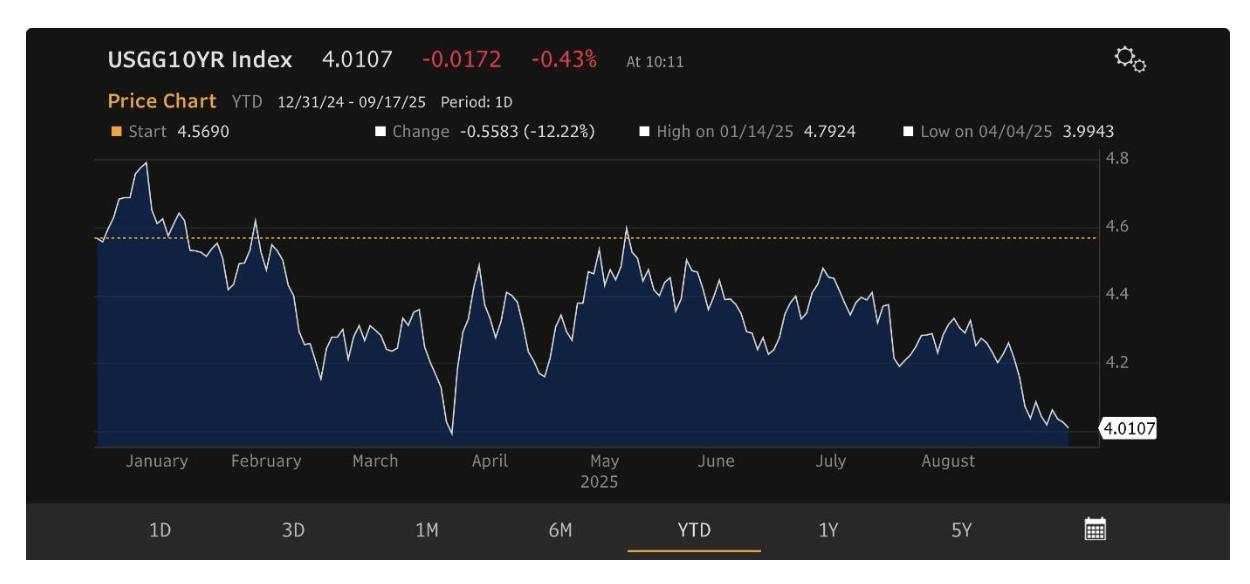

Moreover, these expectations of a lower Fed base rate are pulling down the yield on Treasuries across the curve. Much to the delight of the President and his Treasury Secretary Scott Bessent, no doubt. Bessent came out earlier in the year to state that lowering the yield on 10-year Treasuries in particular was a major aspect of his mandate, a critical aspect when you consider the ever-widening US deficit.

Lower T-yields are another motivator for the Dollar to weaken off further, simply adding to already existing expectations. With all of this in mind, EURUSD at €1.20 and GBPUSD pushing up close to $1.40 by year's end seems an increasingly likely proposition.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()