As expected, the Bank of Canada lowered interest rates by 25 basis points from 2.75% to 2.50% in their September decision while offering minimal forward guidance on next moves. This decision marked the first rate cut since March and brought the policy rate to its lowest level in over a year.

Governor Tiff Macklem emphasized that while the central bank provided no explicit forward guidance, the overall assessment suggests this likely won’t be the final cut of the cycle, with analysts pointing to December as the probable timing for another reduction.

Key Takeaways

- Rate cut delivered as expected: 25bp reduction brings overnight rate to 2.50%, with bank rate at 2.75% and deposit rate at 2.45%

- Labor market deterioration accelerating: Employment has declined for two consecutive months, pushing unemployment to 7.1% in August

- GDP contracted sharply: Second quarter GDP fell 1.6%, largely due to tariff impacts on exports which plummeted 27%

- Inflation pressures moderating: Core inflation measures around 3% but monthly momentum has dissipated; headline CPI at 1.9%

- Trade disruption spreading: Beyond initial tariffs on steel and aluminum, impacts now affecting auto, copper, softwood lumber, and agricultural sectors

- Business investment paused: Companies delaying capital expenditure amid elevated policy uncertainty

Link to Bank of Canada official statement (September 2025)

The central bank’s statement revealed three key shifts in the risk balance since July that justified the rate reduction.

First, Canada’s labor market has softened further, with job losses concentrated not only in trade-sensitive sectors but also reflecting weaker hiring intentions across the broader economy. Second, recent data suggest the upward pressures on underlying inflation have diminished. Third, the federal government’s recent decision to remove most retaliatory tariffs on US imports reduces upside risks to future inflation, providing additional room for monetary accommodation.

During the press conference, Macklem noted that uncertainty remains elevated with the upcoming review of the Canada-United States-Mexico Agreement (USMCA). He emphasized the central bank will continue to assess impacts of tariffs and uncertainty on economic activity and inflation, paying particular attention to how export developments spill over into business investment, employment, and household spending.

Link to BOC Press Conference (September 2025)

Market Reactions

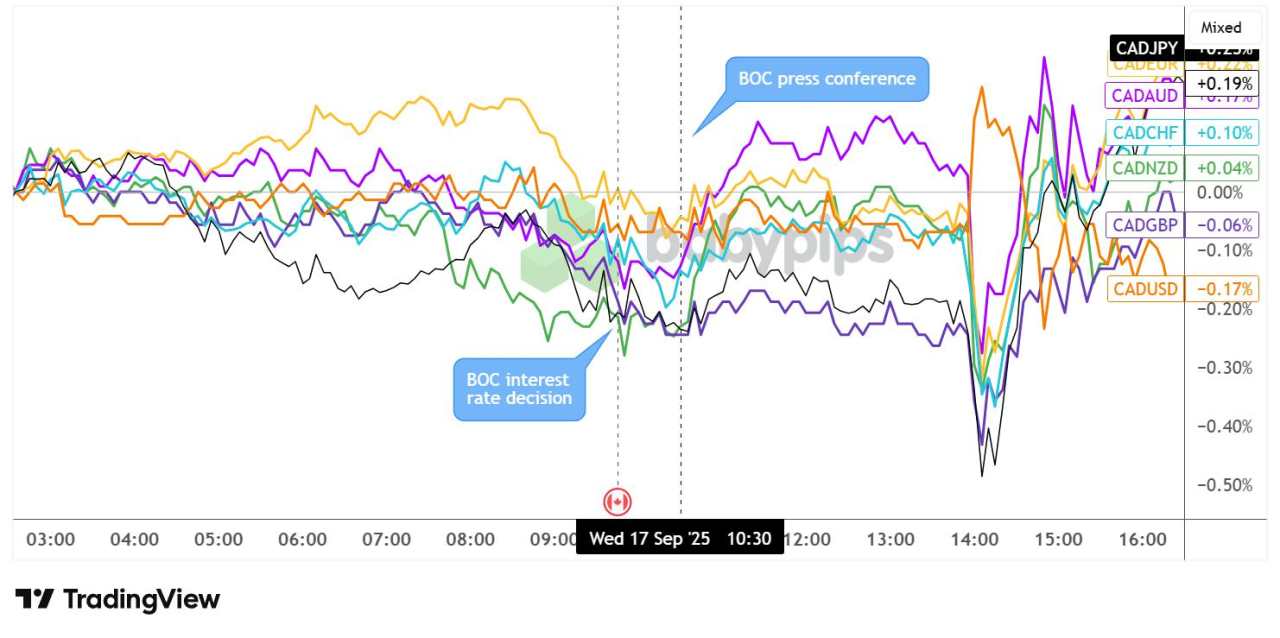

Canadian Dollar vs. Major Currencies: 5-min

Overlay of CAD vs. Major Currencies Chart by TradingView

The Canadian currency found a bit of relief during the press conference, as Governor Macklem refrained from giving outright clues on further easing for the remainder of the year. CAD staged a notable rebound versus commodity currency peers AUD (+0.18%) and NZD (+0.04%) after the presser while paring some losses against CHF (+0.10%) and JPY (+0.23%).

However, the Loonie underwent significant volatility as it tumbled then bounced around the time of the FOMC decision and press conference before closing mixed by session’s end.

Tải thất bại ()