As expected, the Federal Reserve delivered its first rate cut of 2025, lowering rates by 25 basis points as concerns about a weakening labor market finally outweighed inflation worries.

Here are the top points you missed from the event:

The Fed Cut Rates by 25bps, Ending Its Pause

The FOMC lowered the federal funds rate to 4.00%-4.25%, marking the first cut since December 2024. After holding rates steady for five consecutive meetings this year, Powell cited a “shift in the balance of risks” toward employment concerns.

The Fed’s statement notably removed its description of the labor market as “solid,” signaling growing concern about job market deterioration. Powell explicitly stated “I can no longer say that” about the labor market being strong, acknowledging that recent data revisions showing job growth averaging just 29,000 over the three months ending in August gave the Fed a “very different picture” of employment risks.

Link to official FOMC Statement (September 2025)

Stephen Miran’s Lone Dissent Made Headlines

Trump’s newly appointed Fed Governor Stephen Miran, sworn in just before the meeting, was the sole dissenter favoring a larger 50bp cut. His participation drew significant attention, given his unusual arrangement – remaining on unpaid leave from his White House position rather than resigning.

Powell emphasized that “there wasn’t widespread support at all for a 50-basis-point cut today,” effectively shrugging off Miran’s more aggressive stance. Miran’s dot plot projection showing rates should fall to 2.875% by year-end stood out “like a sore thumb” according to analysts, positioned far below any other committee member’s forecast.

The Dot Plot Signals Two More Cuts This Year (Maybe)

Fed projections showed a narrow 9-7 majority expecting two additional quarter-point cuts in 2025, likely at the October and December meetings. However, the division was stark – seven officials see no further cuts needed this year, while Miran’s dot plot entry suggested rates should drop to around 2.9% by year-end, far below any other member’s projection.

Powell stressed the Fed is now in a “meeting-by-meeting situation” with no guaranteed path forward, noting that “there’s no risk-free path” given the unusual combination of tariff-driven inflation and labor market weakness. The median projection sees rates settling around 3.4% by the end of 2026, suggesting a gradual easing cycle ahead.

Fed Projects Inflation Won’t Hit 2% Target Until 2027, Sees Modest Growth Ahead

The inflation projections painted a sobering picture: PCE inflation is expected to remain at 3.0% through 2025 (unchanged from June), only gradually declining to 2.6% in 2026 and finally reaching the 2% target by 2027. Core inflation projections were even more concerning, with the Fed seeing it at 3.1% for 2025, suggesting persistent underlying price pressures that won’t fully abate for years.On the growth front, the Fed nudged up its 2025 GDP projection slightly to 1.6% from 1.4% in June, then saw growth settle around 1.8-1.9% in subsequent years – modest but not recessionary.

The unemployment rate is projected to rise to 4.5% by year-end 2025 and remain elevated at 4.4% through 2026 before gradually declining, reflecting expectations that labor market weakness will persist even with rate cuts.

Link to FOMC’s Economic and Dot Plot Projections (September 2025)

Powell Walked a Tightrope Between Inflation and Employment

The Fed Chair characterized the decision as a “risk management cut,” acknowledging the unusual situation of simultaneous inflation pressures from tariffs and labor market weakness. Powell noted that hiring has fallen below the break-even rate needed to maintain stable unemployment, with the “marked slowing in both supply of and demand for workers” being particularly concerning.

Despite inflation running at 2.9% – well above the Fed’s 2% target – Powell suggested tariff effects might be temporary, stating “the case for there being a persistent inflation outbreak is less.” He also highlighted concerning labor market details, including rising minority unemployment and younger workers being “more susceptible to economic cycles.”

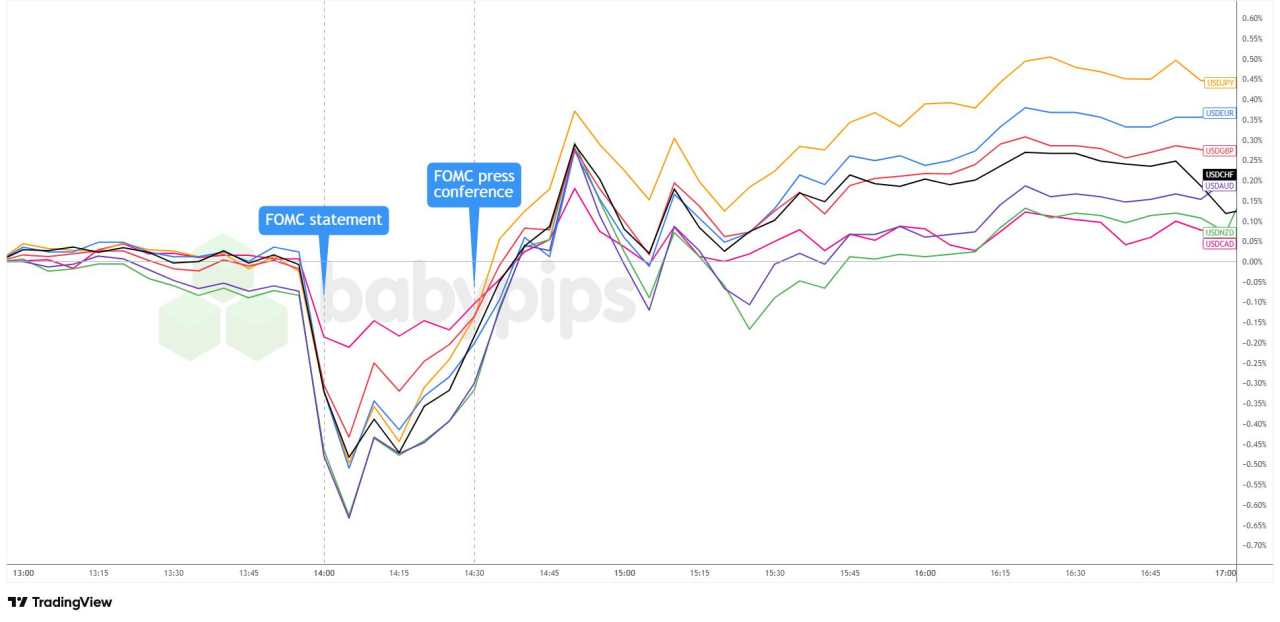

U.S. Dollar Showed Initial Strength Before Reversing During Powell’s Press Conference

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

However, Powell’s press conference triggered significant volatility and ultimately reversed these gains. His characterization of the cut as merely “risk management” rather than the start of an aggressive easing cycle likely disappointed dovish expectations. Two hours after the statement, the dollar had recouped most of its losses.

The mixed reaction likely reflected market confusion about the Fed’s true intentions. See, while the dot plot suggested more cuts ahead, Powell’s cautious tone and the divided committee painted a less certain picture. The divided committee, political pressures from the White House, and conflicting signals between fighting inflation versus supporting employment left traders struggling to position for what comes next.

The dollar soon steadied near its U.S. session highs and ended the day broadly higher against the major currencies.

Tải thất bại ()