Australia’s monthly inflation accelerated to 3.0% year-over-year in August, hitting the top of the RBA‘s target band and marking the highest reading in 13 months.

The result came in slightly above economists’ expectations of 2.9% and represented a notable acceleration from July’s 2.8% pace.

Key Takeaways from Australia’s August CPI Report

- Headline inflation hit 3.0%, reaching the upper limit of the RBA’s 2-3% target band for the first time since July 2024

- Core inflation measures diverged – trimmed mean eased to 2.6% (from 2.7%), but CPI excluding volatile items jumped to 3.4% (from 3.2%)

- Housing and electricity drove gains – housing costs rose 4.5% annually, with electricity surging 24.6% as government rebates expired

- Rental growth continued to moderate – annual rent inflation slowed to 3.7%, the weakest pace since November 2022

Link to Australia’s Consumer Price Index (August 2025)

The sharp jump in electricity prices dominated the inflation narrative. Annual electricity costs surged 24.6%, primarily because households in Queensland, Western Australia, and Tasmania had exhausted their state government rebates that were available a year ago.

The Australian Bureau of Statistics (ABS) noted that, excluding these rebate effects, underlying electricity prices rose a more modest 5.9%.

Traders pared their Reserve Bank of Australia (RBA) rate cut expectations following the release, with the probability of a September 30 move dropping to near zero. November cut pricing also softened from around 70% to 60% as traders pushed back the timeline for potential easing.

The mixed nature of the report – hot headline but cooling core figures – leaves the RBA in a position to maintain its wait-and-see approach, with the return to 3.0% inflation reducing any urgency for immediate rate cuts.

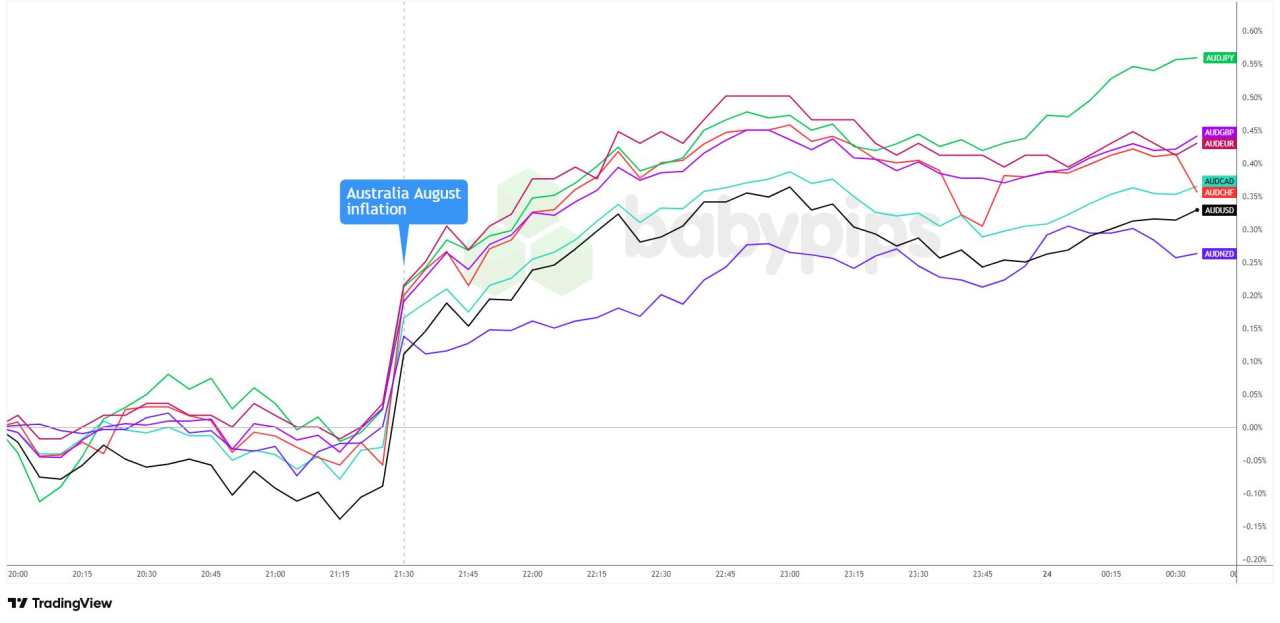

Market Reaction

Australian Dollar vs. Major Currencies: 5-min

Overlay of AUD vs. Major Currencies Chart by TradingView

While the trimmed mean actually cooled and the electricity surge was largely technical, traders appeared to focus more on the headline beat and the fact that inflation returned to the top of the RBA’s target band.

The currency’s resilience suggested markets were reassessing the likelihood of near-term RBA action, with the 3.0% headline print potentially giving the central bank cover to maintain its current stance.

The Aussie is still hanging out near its intraday highs against the majors as London gets ready to open.

Tải thất bại ()