Stocks and the dollar eased as rising risk of a US government shutdown pressured markets, ending gold’s record run — spot gold, up 45% this year on bets of Fed rate cuts and haven demand amid trade tensions and weakening confidence in US exceptionalism, slipped to $3808.65 at 11:26 am GMT after earlier hitting $3871.89 a fresh high and remains on track for its biggest annual gain since 1979.

Central bank buying and renewed Fed rate cuts have also bolstered gold, and analysts at Goldman Sachs and Deutsche Bank see further upside for the rally.

Monday meeting between top congressional leaders and Trump broke up without a short-term funding agreement, stoking shutdown fears that could delay economic reports and deprive investors of key data on the US economy.

A government shutdown would postpone Friday’s key employment figures, shifting attention to the Labor Department’s JOLTS report on August job openings due today at 10 am ET, and could complicate the Fed’s outlook after its rate cut earlier this month.

The U.S. JOLTS report, the first of several indicators ahead of Friday’s key September employment report that the Fed uses to time rate cuts, is expected to show about 7.18 million job openings in August. A prolonged government shutdown could blind the Fed to fresh economic data before its October 29 meeting.

Technical analysis perspective

Gold /US Dollar

Gold has exceeded the $3,800 target flagged on Sept. 5, 2025, reaching a fresh high of $3,871.78 today.

- Prices are trading within a rising-wedge–like pattern.

- That pattern is bearish if the wedge’s rising support at $3,770 is breached and then acts as resistance.

- For now, expect range-bound trading between $3,870 and $3,770.

- A decisive move above $3,870 would open the way for further gains.

Gold daily chart

GLD (SPDR Gold Trust) ETF

- GLD cleared the 340 target set on Sept. 5, reaching 352.83 yesterday.

- The ETF is trading inside a rising-wedge–like pattern.

- Near-term range: 354–344.

- A strong, sustained break below 344 would likely trigger a drop to 326.

- Conversely, a decisive break above 354 would signal further upside.

GLD daily chart:

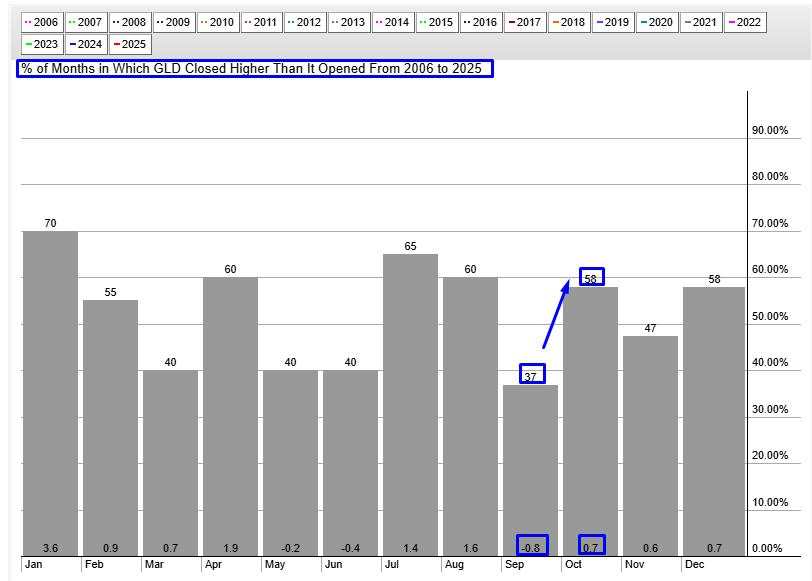

GLD seasonality

Since 2006, GLD has posted September decline of -0.8% in 37% of the years, while October has seen a rise of 0.70% in 58% of the years.

September seasonality failed to play this year!

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()