The US government shutdown may mean that we do not get the usual start of the month NFP report for September, however, there are other labour market data reports that will be released, including today’s ADP private sector payrolls report.

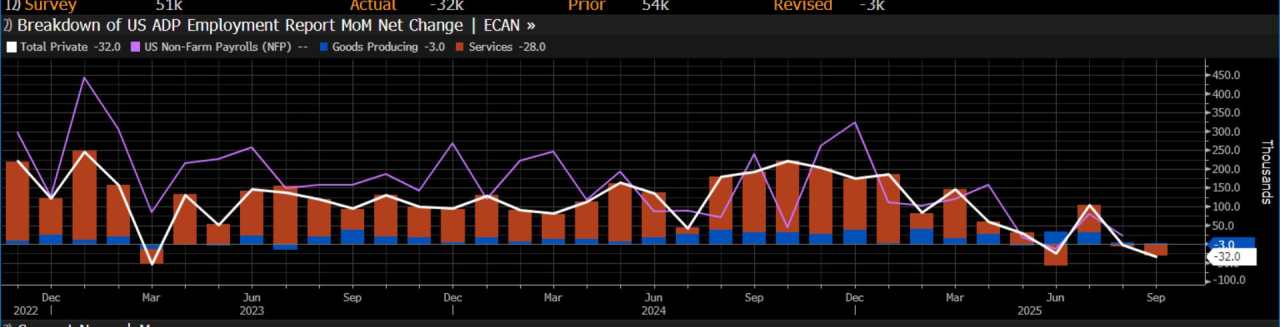

This reported a decline of 32k jobs in the private sector last month, worse than the increase of 51k expected. The losses were concentrate in the services sector, which shed 28k jobs last month. The goods producing sector also reported job losses, but a far milder decline of 3k.

This is another sign that the US labour market is losing steam. This one is worrying, it is the third time in four months that the private sector has shed jobs, which comes after a boom in service sector jobs growth post Covid.

If the service sector is going into reverse when it comes to hiring, then the labour market picture in the US could deteriorate sharply from here.

As you can see in the chart below, there is a clear deterioration in private sector jobs growth. Combined with the hundreds of thousands of federal government workers who will now be on furlough, and thus will be considered temporarily unemployed, the unemployment rate could rise significantly in the coming months. This ADP report does not bode well for NFP, however, we have no idea when we will get the next NFP report, due to the shutdown.

The immediate market impact from this news is a recalibration of interest rate cut expectations from the Federal Reserve. The Fed Fund Futures market now expects more than a 100% chance of a rate cut later this month. There is also a small chance of a 50bp cut being priced in. There are 4.3 cuts priced in between now and October 2026, this compares to 3.9 cuts priced in by the market on Tuesday. Thus, the weakness in the ADP report is triggering a dovish reassessment of where investors see US interest rates in the coming year.

US Treasury yields are falling sharply after the ADP report, and this is weighing on the dollar, which has made fresh lows of the day. US stocks are expected to open lower, as the government shutdown weighs on sentiment. However, there is now another risk to contend with: a rapidly slowing labour market alongside the shutdown, which could keep sentiment subdued for the coming days.

ADP employment report, broken down by month

Source: XTB and Bloomberg

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()