The Federal Reserve’s September 16-17 meeting minutes revealed a central bank increasingly concerned about labor market weakness, with most officials supporting further rate cuts this year despite lingering inflation worries.

Remember, the Fed cut rates by 25 basis points to 4.00-4.25%, though newly-appointed Governor Stephen Miran preferred a more aggressive half-point reduction.

The minutes revealed officials navigating between competing mandates. Participants noted that “if policy were eased too much or too soon and inflation continued to be elevated, then longer-term inflation expectations could become unanchored.”

Conversely, “if policy rates were kept too high for too long, then unemployment could rise unnecessarily, and the economy could slow sharply.”

So, while a majority still emphasized upside risks to inflation, most participants observed that downside risks to employment had increased since the last meeting.

This marks a subtle but important shift from earlier meetings where inflation dominated the discussion.

Key Takeaways

- Most Fed officials judged it would likely be appropriate to ease policy further over the remainder of 2025

- The 10-9 split in favor of two more cuts this year showed how divided policymakers remain on the pace of easing

- Downside risks to employment had increased, while upside risks to inflation had either diminished or not increased

- Stephen Miran dissented in favor of a larger 50bp cut, marking the lone vote against the 25bp reduction

- Some officials noted financial conditions suggested policy may not be particularly restrictive, warranting caution

Link to official FOMC Meeting Minutes (September 2025)

Notably, the committee was narrowly split 10-9 on whether to implement two more cuts versus one or fewer by year-end, highlighting the lack of consensus on the appropriate pace of easing.

Several participants cautioned that financial conditions suggested monetary policy may not be as restrictive as previously thought.

On the labor market, officials assessed that recent readings “did not show a sharp deterioration in labor market conditions,” though they acknowledged job gains had slowed, and the unemployment rate had edged up to 4.3%.

Market Reaction:

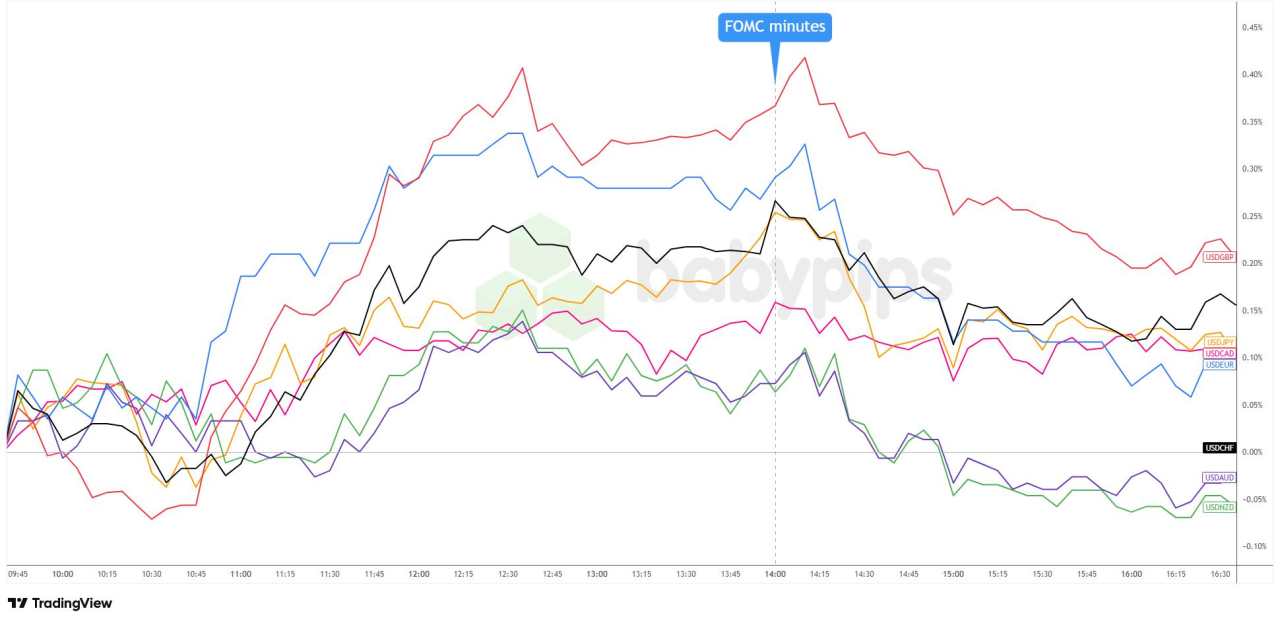

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar ticked higher around the time of the report’s release, but soon turned lower and maintained a bearish lean for about an hour.

The measured reaction suggested markets had already positioned for a dovish tilt following the September meeting’s 25bp cut. The lack of dramatic swings indicated traders found little surprising in the minutes’ confirmation that most officials favor continued easing.The dollar’s weakness persisted through the session but remained contained, reflecting ongoing uncertainty about the Fed’s path forward. With the government shutdown disrupting key economic data releases, markets appeared hesitant to make large directional bets ahead of the October 28-29 FOMC meeting.

The dollar spent the rest of the U.S. trading session in more subdued ranges before capping the day positively, except against the Australian dollar.

Tải thất bại ()