When tensions flare in the Middle East, traders hold their breath. When a ceasefire breaks through, markets exhale.

So it’s no surprise when the Gaza War ceasefire between Israel and Hamas ended two years of tragic conflict, it sent immediate ripples across global markets, most notably in oil & gold prices.

Let’s quickly break it all down into simple terms, and see what it may mean for the markets in the short-term.

What Just Happened?

Israel and Hamas have signed a ceasefire agreement after two years of conflict that rattled energy markets and drove geopolitical risk higher.

Israel and Hamas have signed a ceasefire agreement after two years of conflict that rattled energy markets and drove geopolitical risk higher.

The deal includes a halt to fighting, partial withdrawal of Israeli forces from Gaza, and a hostage-prisoner exchange that sets the stage for a longer process to rebuild Gaza without Hamas control.

More importantly, it sparks hopes for more lasting stability in the region.

How Did Markets React?

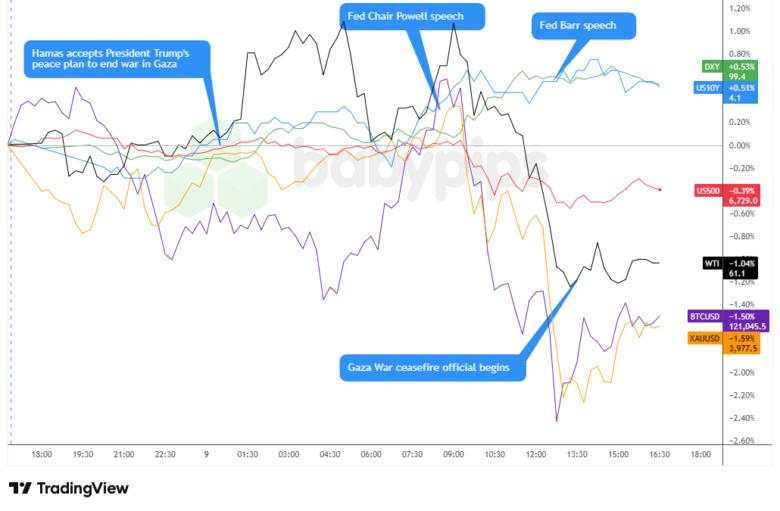

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

- Oil prices dipped as the news eased worries about supply shocks and broader regional escalation. A durable ceasefire could also clear the way for new negotiations with Iran, potentially increasing global crude supply – another factor that might keep oil prices under pressure.

- Middle Eastern equity markets gained, with indexes in Dubai, Abu Dhabi, and Saudi Arabia up, likely reflecting investors rotating into riskier assets and regional stocks.

- Gold saw a notable decline. The shiny metal rocketed 50% this year on war woes, smashing through $4,000/oz yesterday before today’s pullback. The ceasefire buzz likely contributed heavily to the trim in prices, now holding around that $4,000/oz psychological level.. Silver followed suit, easing from records.

- Bitcoin has arguably been a benefactor to rises in geopolitical tensions as it has been recently viewed as a hard asset (i.e., “digital gold”). And with these positive developments, BTC moved lower in tandem with gold as the Gaza ceasefire story developed, briefly breaking below $120K before rebounding to the $121K area.

- The U.S. dollar saw net positive moves during the developments of this story on Thursday, and given that there have been no positive reports on the status of the U.S. government shutdown, it’s likely the Gaza War ceasefire may have been the driver for the Greenback bounce.

Potential Implications Going Forward

Middle Eastern equities, particularly in the Gulf, may continue to bounce on hopes that peace will allow fiscal surpluses and sovereign wealth capital to be redeployed into domestic growth. Sectors expected to benefit include construction, infrastructure, financial services, logistics, and consumer stocks as the focus shifts to rebuilding and growth.

Global risk appetite typically improves when tensions fade, potentially supporting riskier assets and a move away from safe havens such as U.S. Treasury bonds, but regional political issues (e.g., U.S. government shutdown, Japanese leadership change, etc.) may limit any potential gains in other country equities from improved risk appetite.

Gold: A short-term pullback from recent highs near $4,000/oz is a probable scenario as safe-haven flows reverse amid lower geopolitical tensions, but inflation concerns and government instability themes may limit downside moves there as well.

Bitcoin: BTC is kind of in a weird place now where its role can quickly switch between “digital gold” and a risk asset. If the ceasefire transitions into sustained peace, the weight of this geopolitical driver may fade and traders may focus more on institutional flows and crypto currency adoption. Of course, if the situation quickly reverses back into war, BTC could flip back into “digital gold” and draw in safe haven flows.

In currencies, these developments will likely continue to support the Greenback, but the U.S. Government shutdown and Fed interest rate expectations will likely have more weight overall. Locally, if the Gaza ceasefire holds, the Israeli shekel and other local currencies may strengthen as investors return capital to the region and risk aversion ebbs.

Big Risks to Watch

Despite the initial optimism, markets know better than to celebrate too early. The ceasefire’s durability remains the biggest question, as past truces have fallen apart quickly, and political divisions in Israel could still derail the deal.

Uncertainty over Gaza’s future governance and whether Hamas will disarm also clouds the outlook.

If peace holds, risk premiums across energy, transport, and financial markets could keep fading, but if violence returns, so will defensive trades.

Quick Tips for Forex Traders

- Stay tuned to the story, an watch for volatility in regional currencies and those tied to energy export/import activity for fresh short-term opportunities.

- Stay alert for central bank signals about local rates, especially in the Gulf, Israel, and neighboring economies if you’re looking to go more exotic and Middle East currencies.

- Monitor shifts in oil-linked currencies like CAD, NOK, and RUB as the risk premium in crude adjusts.

The ceasefire offers genuine relief from geopolitical risk premiums, but traders should maintain flexible positions, as the fragility of peace could quickly reverse current market sentiment.

Để lại tin nhắn của bạn ngay bây giờ