U.K. inflation held steady at 3.8% y/y in September, unexpectedly coming in below the 4.0% forecast by economists and the Bank of England (BOE).

The largest downward contributions came from food and non-alcoholic beverages, where inflation fell to 4.5% from 5.1% in August, marking the first slowdown since March. Recreation and culture prices also helped ease pressure, while transport costs provided upward support due to fuel prices and volatile air travel.

The September inflation data marked a positive surprise that could put a November interest rate cut back in play, though markets remain cautious about aggressive easing expectations.

Key Takeaways

- Headline CPI remained at 3.8% year-on-year in September, below the 4.0% consensus forecast

- Core inflation (excluding food, energy, alcohol, and tobacco) eased to 3.5% from 3.6%

- Services inflation held steady at 4.7%, below the BOE’s expectation of a rise to 5.0%

- Food inflation slowed to 4.5% from 5.1%, the first decline since March

- Markets now price in about a 75% chance of a BOE rate cut by year-end, up from 46% before the data release

Link to the U.K. Office of National Statistics September CPI Report

Market Reactions

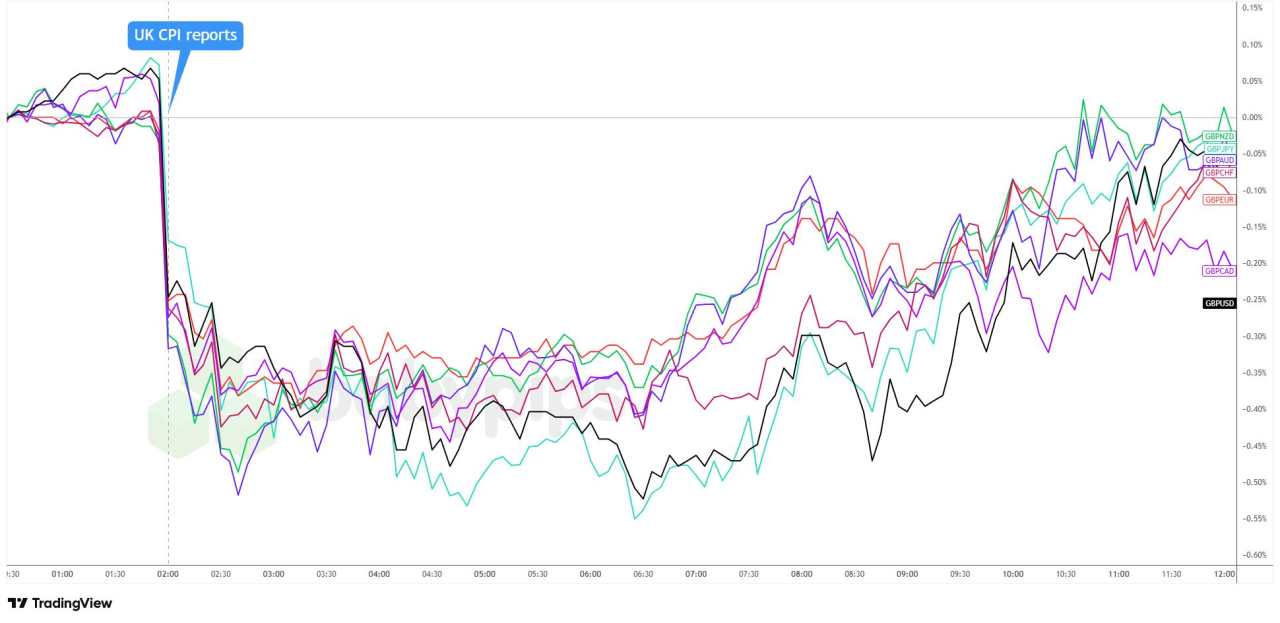

British pound vs. Major Currencies: 5-min

Overlay of GBP vs. Major Currencies Chart by TradingView

The British pound, which had been moving mostly sideways ahead of the U.K. CPI report, immediately weakened across the board following the lower-than-expected inflation print. Sterling saw the heaviest losses against the Japanese yen and comdolls like the Australian and New Zealand dollars in the first hour of the release.

The pound ranged near its intraday lows until just before the U.S. session when GBP demand picked up, possibly in reaction to broad U.S. dollar weakness. Later, talks of the government possibly implementing emergency measures to boost housebuilding in London likely gave the pound another lift.

GBP maintained a bullish lean until the London session close, and capped the day broadly lower against the major currencies despite the early U.S. session boost.

Để lại tin nhắn của bạn ngay bây giờ