Wondering what’s up with the risk rallies early this week? Equity indices soared to all-time highs on Monday while safe-haven gold tumbled and the lower-yielding dollar weakened.

Welcome to what happens when the world’s two largest economies step back from the brink of a full-blown trade war.

Read on to find out what happened between the U.S. and China over the weekend, why it matters, and how markets tend to respond when geopolitical tensions ease.

The Basics: What Happened in Malaysia

Unless you’ve been living under a rock, you probably know that the U.S. and China have been locked in escalating trade tensions since early this year, with tariffs reaching 145% on Chinese goods and 125% on US goods at their peak.

Things got particularly heated a few weeks back when China tightened export controls on rare earth minerals, which are critical materials used in everything from smartphones to electric vehicles to military equipment.

In retaliation, President Trump fired back with an additional 100% tariff on Chinese imports set to take effect November 1. Should this have been implemented, it would have been economically devastating for both nations.

But this weekend’s talks changed the trajectory. U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer met with Chinese Vice Premier He Lifeng and top negotiator Li Chenggang. And after what Li described as “very intense consultations,” both sides reached preliminary consensus on several key issues.

Here’s what they agreed to:

- Tariffs off the table: The threatened 100% tariff increase won’t happen on November 1

- Rare earth reprieve: China will delay its expanded export licensing regime on rare earth minerals by one year

- Soybean purchases: China will resume “substantial” purchases of U.S. soybeans after buying none since May 2025

- Trade truce extension: The current tariff pause will likely extend beyond its November 10 expiration

- TikTok deal: Details finalized for transferring TikTok’s US operations to American control

- Fentanyl cooperation: Initial agreements on combating the flow of fentanyl precursor chemicals

Trump and Chinese President Xi Jinping are scheduled to meet Thursday, October 30 in South Korea to finalize the details.

Why It Matters: Market Reactions Tell the Story

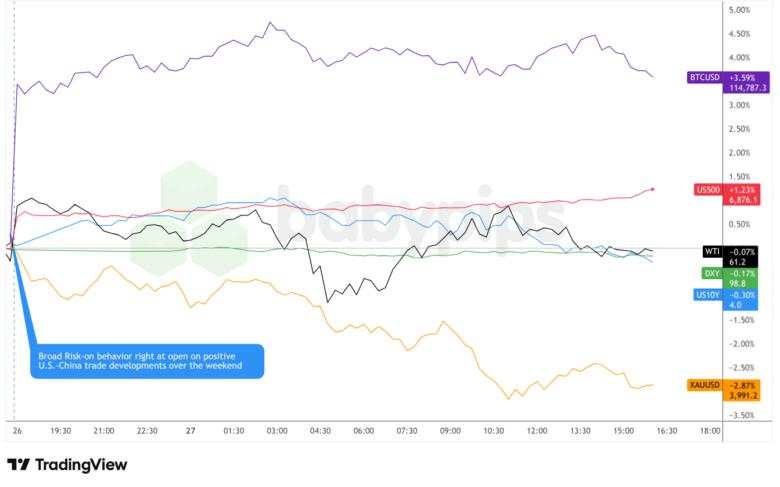

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

When heightened trade tensions ease, markets move quick. Here’s what happened on Monday, October 27:

Stocks surged: The S&P 500 climbed about 0.8-0.9% in early trading, pushing toward new all-time highs. The index has now rallied 83.8% since its October 2022 lows. Tech stocks, which are particularly sensitive to U.S.-China tensions, led the advance.

USD weakened. The US Dollar Index (DXY) hovered around 99.00, giving back earlier gains as “risk-on” sentiment took hold. The dollar has been under pressure all year, down nearly 9% year-to-date—its steepest decline in over three years. When traders feel optimistic about global growth, they typically sell dollars to buy riskier assets in other currencies.Gold plummeted. Spot gold fell as much as 3.2% below $4,000 per ounce, extending what Bloomberg called “the worst rout in over a decade.” After hitting a record high of $4,381 on October 20, gold has now dropped more than 5%. Why? Gold is a safe-haven asset. When geopolitical risks decline and stock markets rally, traders dump gold to chase higher returns elsewhere.

This pattern (stocks up, gold and dollar down) is textbook “risk-on” behavior. It signals that traders believe the biggest near-term threat to the global economy (a full-blown US-China trade war) is diminishing.

What These Moves Tell Us About Positioning

Markets are forward-looking machines. They don’t react to where things are—they react to where things are going. Monday’s price action reveals three things about how traders are positioning:

1. Risk appetite returned

Money flowed out of safe havens (gold, bonds) and into riskier assets (stocks, cryptocurrencies). Bitcoin rallied alongside equities. The VIX volatility index, which is often called the “fear gauge,” fell to multi-month lows. This tells us traders are betting on economic stability rather than turmoil.

2. The “sell America” trade is pausing

The dollar’s year-long weakness reflects concerns about US policy uncertainty and the economic impact of tariffs. But the dollar’s muted reaction on Monday suggests traders aren’t yet convinced this deal solves underlying structural issues. They’re waiting to see if Trump and Xi actually sign something concrete on Thursday.

3. Growth expectations are improving

When tariffs come down and trade flows increase, corporate profit margins improve and GDP growth typically accelerates. The stock market’s rally, especially in sectors sensitive to trade like technology and industrial companies, suggests traders are pricing in better earnings ahead.

The Bottom Line

The weekend’s U.S.-China breakthrough is undeniably positive for markets in the near term. Stocks are rallying, volatility is falling, and the risk of economic catastrophe from a full-blown trade war has diminished. For traders, this is a classic “risk-on” environment where equities and growth-sensitive assets outperform.

But keep perspective. This is a JUST a framework, not a final deal. Trump and Xi still need to meet Thursday in South Korea and agree on specifics.

But keep perspective. This is a JUST a framework, not a final deal. Trump and Xi still need to meet Thursday in South Korea and agree on specifics.

Besides, China hasn’t officially confirmed the meeting yet, although this is typical Beijing protocol. Also, the rare earth delay is just for one year, not permanent. Soybean purchases are “substantial” but not quantified. TikTok deal details remain vague.

Watch these key events:

- Thursday, October 30: Trump-Xi meeting at APEC summit in South Korea

- November 1: Original deadline for Trump’s 100% tariff threat (now averted)

- November 10: Current trade truce expiration (likely to be extended)

The market’s reaction on Monday tells us traders are relieved and optimistic. But seasoned investors know that frameworks can unravel, politics can interfere, and implementation always proves harder than negotiation.

This deal reduces tail risk (a.k.a. the chance of a worst-case scenario) but it doesn’t eliminate the fundamental strategic competition between the world’s two largest economies.

As always with major market-moving events: celebrate the wins, but manage the risks. The road from framework to implementation is never as smooth as traders hope on Monday morning.

-KẾT THÚC-