The Federal Reserve delivered exactly the rate cut everyone expected, but then Chair Jerome Powell threw a curveball that sent stocks tumbling, bond yields spiking, and the dollar surging. What a whiplash!

Here’s what happened at yesterday’s FOMC meeting, how markets reacted, and what it all implies for dollar direction from here.

The Expected Cut That Became Unexpected

The Decision: As widely expected, the Federal Reserve cut interest rates by 0.25%, bringing the benchmark federal funds rate down to a range of 3.75% to 4.00%. This marks the Fed’s second rate cut of 2025, following a similar quarter-point cut in September.

Why They Cut: The Fed’s statement pointed to slowing job gains and an unemployment rate that’s edged up to 4.3% through August, its highest level since 2021. In addition, the central bank emphasized that “downside risks to employment rose in recent months,” signaling they’re more worried about the job market than inflation right now.

The Twist: While inflation has ticked up to 3% in September, thanks partly to Trump’s tariffs on imports, the Fed decided supporting jobs was more urgent. The committee stated that “uncertainty about the economic outlook remains elevated” and noted concerns about both sides of its dual mandate.Not Unanimous: The vote was 10-2. Stephen Miran (a Trump appointee) wanted a bigger 50 basis point cut, while Kansas City Fed President Jeffrey Schmid wanted no cut at all. That split tells you a lot about how divided policymakers are right now.

Powell’s Bombshell: December Isn’t a “Done Deal”

Here’s where things got interesting. During the FOMC press conference, Powell immediately threw cold water on expectations for another cut in December.

“In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December,” Powell said. “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.”

“In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December,” Powell said. “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.”

The phrase “far from it” hit markets like a freight train.

Why the caution? The Fed has been flying partially blind thanks to the ongoing government shutdown, which has suspended nearly all official economic data releases since early October. Powell acknowledged that “if there is a very high level of uncertainty, then that could be an argument in favor of caution about moving.”

Before the shutdown, hiring had already slowed dramatically, averaging just 29,000 jobs per month over the previous three months. But without September and October jobs reports, the Fed is relying on private-sector data, consumer confidence surveys, and the “Beige Book” of anecdotal economic reports.

How Markets Reacted: A Wild Afternoon

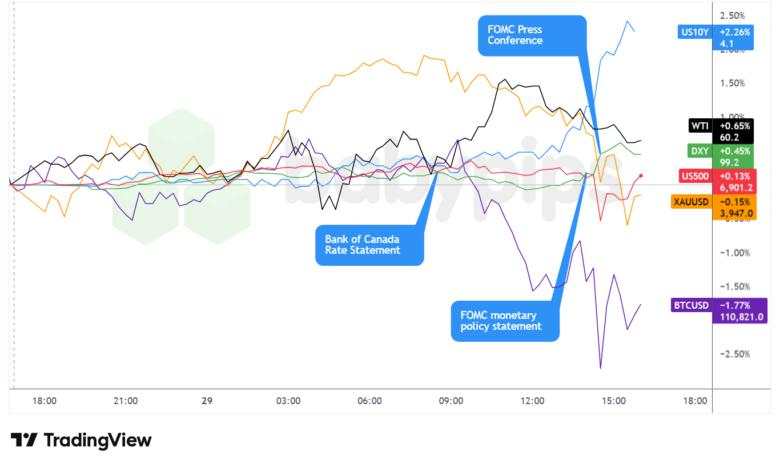

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Initial Response (2:00-2:30 PM): Everything looked calm and good. Stocks had hit record highs earlier in the day and held steady. Gold briefly touched $3,987 per ounce. The dollar was calm.

After Powell Spoke (2:30 PM onwards): Markets reversed quickly.

Stocks:

- The S&P 500 closed down 0.3 points (essentially flat at 6,890), erasing earlier gains

- Only the Nasdaq held on for a 0.6% gain to close at 23,958, boosted by tech stocks like Nvidia

Bond Yields (the big mover):

- The 10-year Treasury yield jumped 9.3 basis points to 4.076%, signaling that investors now expect fewer rate cuts

- The 2-year Treasury yield surged 10.2 basis points to 3.596%

- Bond prices fell as yields rose, with the benchmark 10-year climbing from 3.98% earlier to over 4.07% after Powell’s remarks.

The U.S. Dollar:

- The dollar index (DXY) rose 0.45%, strengthening against major currencies

- The Greenback got a boost from Powell’s cautious comments about December easing

- EUR/USD and GBP/USD both retreated as the dollar gained

Gold:

- After an initial surge toward $3,987/oz earlier in the day, gold pulled back to the $3,950-4,010 range after the event

- The precious metal pared gains as Powell’s comments suggested “a potential slowdown in the pace of future easing”

What This Means for the U.S. Dollar

The Short-Term Boost: Powell’s hawkish surprise gave the dollar immediate strength. When markets price out rate cuts, it makes the dollar more attractive because higher interest rates draw foreign investment into U.S. assets.

The Bigger Picture Problem: The dollar still faces significant headwinds:

- The labor market is weakening. Even with limited data, unemployment has risen from 4.0% to 4.3% this year, and job creation has slowed dramatically.

- The Fed is still cutting. Despite Powell’s December doubts, the central bank reduced rates twice this year and is clearly in an easing cycle—not a tightening one.

- Economic uncertainty is high. The government shutdown, Trump’s tariff policies, geopolitical tensions, global trade developments (including the upcoming Trump-Xi summit) all create volatility.

What to Watch Over the Next Few Weeks

The next six weeks before the December 10 Fed meeting will be critical. Here’s your watchlist:

1. The Jobs Report (November 7?)

The September jobs report is still postponed due to the shutdown. If and when it’s released, it will be likely be game-changing. Before the blackout, job gains had collapsed to just 29,000 per month.

- Strong jobs data = Dollar strength, less chance of December cut

- Weak jobs data = Dollar weakness, higher chance of December cut

2. Inflation Data (When the Shutdown Ends)

The Consumer Price Index (CPI) for September was released late on October 24, showing inflation at 3% which was still well above the Fed’s 2% target. Once normal data releases resume:

- Watch for inflation trends

- Core inflation (excluding food and energy) will be especially important

- Any spike could make the Fed even more cautious about cutting

3. Trump-Xi Summit

What Actually Happened: President Trump and Chinese President Xi Jinping completed their highly anticipated meeting at Gimhae Air Base in Busan, South Korea. The 90-minute meeting, which Trump rated “12 out of 10,” produced several significant outcomes that exceeded market expectations.

Market Implications for the dollar:

- Mixed signals: The trade deal success creates risk-on sentiment which typically weakens the dollar as investors move into higher-risk assets

- However: The deals are only one-year agreements, maintaining uncertainty

- Near-term impact: The combination of Powell’s hawkish Fed comments and trade deal optimism creates cross-currents for the dollar

4. Government Shutdown Resolution

The shutdown has now lasted four weeks. When it ends:

- Expect a flood of delayed economic data

- Markets will likely reprice Fed expectations based on real numbers

- The dollar’s direction will depend heavily on what that data shows

5. Fed Speakers (The “Blackout” Ends Today)

Analysts have noted that the split among policymakers during the December FOMC meeting suggests that the resumption of the members’ speaking rounds could have stronger clues on where they lean when it comes to data outlook and potential policy changes.In short, watch out for speeches from Fed officials over the next few weeks, as any hints about December will likely move markets.

The Bottom Line

Yesterday’s Fed meeting was a textbook example of “buy the rumor, sell the news” but in reverse. Markets got exactly what they expected (a 25 basis point cut) but were shocked by what they didn’t expect (Powell’s pushback on December easing).

For the U.S. dollar, the picture is now more complex. Powell’s caution about future rate cuts provided short-term support, but the successful Trump-Xi summit introduces new dynamics. The trade deal creates risk-on sentiment that could pressure the dollar, though the temporary nature of the agreements maintains underlying uncertainty.

What’s next? All eyes turn to:

- The implementation of the Trump-Xi agreements and whether they hold

- The eventual resumption of economic data releases

- Fed speakers’ hints about December over the coming weeks

The Fed meets again December 10, and between now and then, we’ll either get clarity or more chaos.

In uncertain times like these, risk management becomes even more important. The Fed just showed us that even when outcomes are “certain,” the market reaction can surprise you. Trade accordingly.

Tải thất bại ()