U.K. consumer price inflation fell to 3.6% year-on-year in October, down from 3.8% in September, marking the first decline since March.

The cooling inflation print came as energy price increases moderated significantly compared to last year, though persistent food price pressures and stubborn services inflation suggested the disinflation process remains uneven across sectors.

For traders, the numbers mostly reinforced expectations that the Bank of England (BOE) will deliver a pre-Christmas rate cut.

Key Takeaways

- Headline CPI dropped to 3.6% in October from 3.8% in September, matching both economist forecasts and BOE’s expectations

- Core inflation (excluding food, energy, alcohol, and tobacco) eased to 3.4% from 3.5%, continuing its gradual descent

- Services inflation fell to 4.5% from 4.7%, the lowest reading since December 2024 and below the BOE’s anticipated rise to 5.0%

- Food inflation accelerated to 4.9% from 4.5%, reversing September’s dip and adding upward pressure

- Energy price effects drove the decline, with gas prices rising just 2.1% annually versus 13.0% in September, following changes to the Ofgem energy price cap

- Markets now price approximately 80% odds of a BOE rate cut at the December 18 meeting, with the upcoming November 26 Budget seen as the final hurdle

Link to official ONS Consumer Price Inflation October 2025 Report

Market Reactions

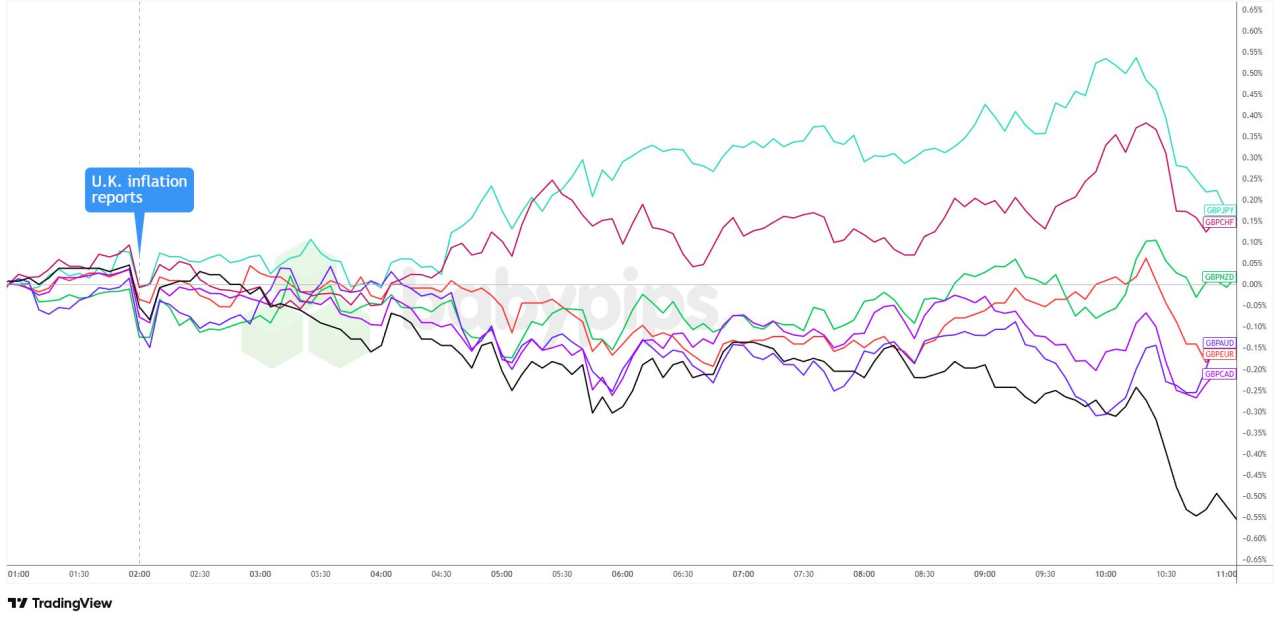

British pound vs. Major Currencies: 5-min

Overlay of GBP vs. Major Currencies Chart by TradingView

GBP saw more sustained bearish pressure in the hours that followed, likely as markets worked through the softer services inflation reading. That number is the one BOE hawks focus on the most.

Even so, the pound still pushed higher against JPY and CHF as improved dollar demand came through. That kind of resilience likely reflected the market’s awareness that the Autumn Budget on November 26 could still shape the BOE’s December decision, especially if Chancellor Rachel Reeves announces steps that affect energy bills or wider inflation trends.

The currency finished the day mixed, trading higher against NZD, JPY, and CHF but lower against the other majors. The measured tone suggests traders have mostly priced in a December rate cut and are now waiting to see the fiscal side of next week’s Budget.

The muted volatility also made sense given the mixed signals inside the report. The headline and services figures backed a dovish view, while the pickup in food inflation to 4.9% and ongoing wage concerns gave the hawks enough material to argue for caution once the December cut is out of the way.

Để lại tin nhắn của bạn ngay bây giờ