If you’re a beginner looking at prop firms today, you might be wondering:

- Will prop firms still be around in a few years?

- Are they just a fad, or will they evolve into something more sustainable?

- How might regulation, technology, and market trends change the game?

This lesson matters because your decision to engage with prop firms should also consider their long-term viability. Understanding where the industry is heading helps you:

- Set realistic expectations.

- Choose firms that are likely to survive.

- Plan your own path beyond prop firms.

How the Industry Has Changed: From Fast Money to Serious Business

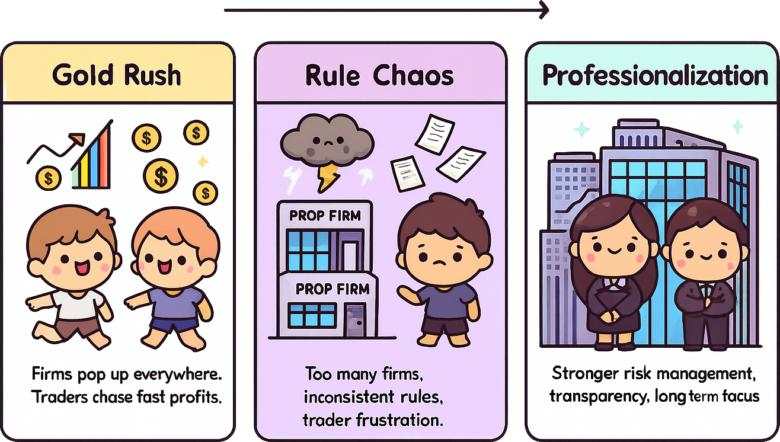

The proprietary trading firm industry has gone through dramatic changes in just a few years.

What started as a gold rush, with new companies popping up everywhere and traders flocking to easy opportunities, has transformed into a more mature, carefully managed business.

Understanding these three stages helps explain why some firms have failed, why rules keep changing, and where the industry is headed. Let’s break down each phase.

Stage 1: The Boom Years (2020–mid-2023)

It was easy to start a prop trading firm. Anyone with some technical knowledge could launch quickly using ready-made software by tech providers.

Companies advertised heavily, had relaxed rules, and offered limited-time deals that attracted huge numbers of traders.

The marketing focused on lifestyle and going viral on social media, not on the serious financial risks behind the scenes. The industry grew incredibly fast, but this growth wasn’t built to last.

Stage 2: Problems Emerge (late-2023–2024)

More firms entered the market, forcing everyone to lower prices and relax rules even further just to stay competitive.

At the same time, some traders found loopholes to exploit, using tricks like taking advantage of data delays, copying successful traders’ moves, or abusing referral programs. This made it much harder for firms to protect themselves financially, and payouts became unpredictable.

Firms realized that simply charging evaluation fees wasn’t enough to cover losses when things went wrong.

Stage 3: Getting Serious About Risk (2025 and Beyond)

The companies that survived are now rebuilding with a focus on financial stability.

They’re setting aside bigger cash reserves, verifying trader identities to prevent fraud, creating clear legal agreements, monitoring trader behavior more carefully, and using advanced systems to manage their overall financial exposure in real-time.

The goal: build sustainable, honest businesses that can reliably pay traders without relying on gimmicky promotions.

The Current Problems in the Industry

The prop firm industry experienced explosive growth but faced a major shakeout over the last two years. Here are the main challenges:

Oversaturation and Mass Closures

- Between 80-100 prop firms shut down in 2024 alone, representing about 13-14% of all firms.

- Hundreds of firms had popped up in just a few years, but many lacked capital or sustainable business models.

- Competition drove unrealistic promises (“90% split! Million-dollar scaling!”).

- By the end of 2024, only 71 out of 82 tracked firms remained operational (86.6% survival rate).

The MetaQuotes Crisis (2024)

The biggest industry shock came in February 2024 when MetaQuotes, the company behind MetaTrader platforms, restricted support for prop firms:

- Many firms lost access to MT4/MT5 platforms overnight.

- Firms scrambled to migrate to alternative platforms (cTrader, TradeLocker, DXTrade, MatchTrader).

- MetaTrader’s market share among prop firms dropped from 48% to 24% within 9 months.

- Notable casualties included SurgeTrader, True Forex Funds, and MyForexFunds.

Trust Erosion

- Traders are increasingly skeptical after seeing firms collapse or withhold payouts.

- Pass Rate Reality: Of the 14% who pass challenges, only about 45% achieve actual payouts (7% of all traders).

- Bad actors continue to damage the reputation of the entire industry.

Liquidity Crunches

- If too many traders request payouts at once, firms without strong financial backing can’t keep up.

- Several firms in 2024 closed due to liquidity issues within weeks or months of launching.

- This creates instability and sudden collapses.

Lack of Regulation

- With minimal oversight, firms can shut down overnight without accountability.

- But change is coming: Nearly 70% of traders now support regulation (PipFarm survey, January 2025).

- European regulators (ESMA, Italian Consob, Belgian FSMA) are actively investigating the industry.

- CFTC in the US is also increasing scrutiny.

Potential Future #1: Industry Consolidation

This is already happening.

Current Reality:

- 80-100 small firms closed in 2024.

- Many firms were absorbed or acquired by larger players.

- Established firms with proven track records are gaining market share.

- Traditional regulated brokers (IC Markets, Eightcap, OANDA) are entering the space.

What This Means:

- Traders are gravitating toward firms with years of proven payouts.

- Only well-capitalized, professionally-run firms will survive.

- The “Wild West” era is ending.

Potential Future #2: Regulation

Controversy exists around regulation: Prop firms are legal in many places but often unregulated, leading to debates on whether they resemble Ponzi schemes (payouts funded by losers’ fees) or genuine talent scouts.

Regulation is no longer “potential” since it’s actively happening.

Current Regulatory Status:

Here’s the reailty: Most prop firms aren’t regulated like real financial companies. They give you demo or simulated accounts (fake money), not real accounts. Since you’re trading with fake money during challenges, governments treat them like video game companies, not financial institutions. That’s why they can operate without strict financial oversight…for now.

Current Regulatory Developments:

Europe:

- ESMA (European Securities and Markets Authority) conducted preliminary reviews of prop firms.

- Italian regulator Consob warned investors about prop trading “video games“.

- Belgian FSMA raised concerns about courses designed to make traders fail repeatedly.

- Spanish CNMV issued similar warnings.

United States:

- CFTC shut down MyForexFunds in 2023 for fraudulent practices.

- SEC expanded definitions of “dealers,” affecting some prop operations.

- Increasing pressure on firms to classify as either gaming platforms or financial services.

Likely Future Regulations:

Consumer Protection Rules:

- Firms may be required to disclose pass rates.

- Mandatory disclosure of business models (demo vs. live trading).

- Clear payout ratios and fee structures.

Financial Oversight:

- Firms holding trader fees may need licenses or audits.

- Separation of payout funds from operating capital.

- Minimum capitalization requirements.

Advertising Restrictions:

- Limits on “get rich quick” marketing.

- Required risk disclosures.

- Appropriateness tests are conducted before allowing traders to participate.

Trader Rights:

- Clear rules against withholding payouts without a valid cause.

- Standardized challenge rules.

- Transparent dispute resolution processes.

Industry Self-Regulation:

- The Prop Association (TPA) was formed in 2025 to establish industry standards.

- Goal: Transparency, accountability, and ethical operations.

👉 For traders, regulation could mean fewer scams and more protection, possibly higher fees, and stricter entry requirements.

Potential Future #3: Hybrid Models

Some firms are already experimenting with hybrid models:

Education + Funding

- Firms require traders to complete training before funding.

- Ensures traders have baseline skills.

Why mandatory education isn’t standard? Prop firms profit from challenge fees even when traders fail. Requiring education before challenges would reduce revenue by creating barriers to entry. The business model depends on volume: with 90-95% of traders failing, firms earn more by offering educational “support” while keeping the challenge pipeline flowing.

Brokerage Integration

Traditional regulated brokers are entering the prop space, with funded accounts tied directly to their infrastructure.

- IC Markets launched ICFunded in March 2024, offering $5,000-$500,000 accounts with challenge fees from $29.75 to $2,498.

- OANDA launched OANDA Prop Trader in January 2024 with $10,000-$500,000 accounts and up to 90% profit splits.

- Axi launched Axi Select, Hantec Markets launched Hantec Trader, and ATFX announced prop trading expansion in October 2024.

While IC Markets and OANDA are regulated brokers, their prop trading divisions operate through offshore entities without direct prop firm regulation. IC Markets operates its prop division separately from its main regulated entities, while OANDA operates through the British Virgin Islands under its Global Markets division.

Broker-backed firms offer more stability and transparency, but understand the regulatory structure. You’re still trading simulated capital through offshore entities. The broker’s reputation provides credibility, not regulatory protection.

Subscription Models

Some prop firms now offer monthly “seat fees” for access to capital, rather than one-time challenge payments.

How Subscriptions Work:

Instead of paying $500-$2,000 for ONE challenge attempt, you pay $49-$360 monthly for unlimited retries during that billing cycle.

The Process:

- Choose your account size ($10,000-$300,000 range)

- Pay first month’s fee (auto-renews unless you cancel)

- Start your evaluation immediately

- If you fail, automatically retry with a fresh account

- Stop paying once you get funded

Why This Creates More Predictable Revenue for Firms:

- Subscription models provide consistent income streams for prop firms, regardless of market conditions or trader performance.

- A firm with 5,000 subscribers at $150/month generates $750,000 in predictable monthly revenue, plus reset fees, activation fees, and profit splits from successful traders.

Why It’s a Lower Barrier to Entry for Traders:

Let’s compare the costs:

- Traditional: Pay $500 → fail → pay $500 again → fail → spent $1,000 with no funding

- Subscription: Month 1 ($99) → retry Month 2 ($99) → retry Month 3 ($99) → pass Month 4 ($99) → Total: $396 for four attempts

The psychology matters to “just $49 to try” creates less pressure than “I paid $500 and can’t afford to fail.”

Real Examples with Pricing:

Topstep:

- $50K account: $49/month

- $100K account: $99/month

- $150K account: $149/month

Bulenox charges $115-$535 monthly during evaluation (based on account size). Once funded, monthly fees end, though you’ll then pay data feed fees (~$130/month) and commissions.

BluSky Trading, Apex Trader Funding, My Funded Futures, Take Profit Trader, and Elite Trader Funding all use this model.

Industry Adoption:

- 80-90% of futures prop firms now use subscription models (industry standard), while 30-40% of forex firms have adopted this approach, with traditional one-time fees still dominating forex/crypto prop trading.

Subscription models reduce upfront risk and allow gradual learning. Just remember to manually cancel to avoid ongoing charges. Subscriptions auto-renew, and firms typically offer no refunds once a billing cycle starts.

Instant Funding Models

Some firms now offer immediate funding without challenges with higher fees, but faster access to capital.

How Instant Funding Works:

- You eliminate evaluation phases entirely.

- Select your account size, pay a one-time fee (typically 3-10x higher than equivalent challenges), and receive login credentials within hours to start trading immediately.

The Complete Process:

- Choose from $625-$200,000 account tiers

- Pay one-time fee ($44-$5,000 depending on size)

- Receive credentials the same day

- Begin trading immediately. No profit targets, minimum days, or evaluation phases

- Request payouts bi-weekly or weekly

A $10,000 challenge typically costs $80-150, while instant funding costs $400-450, roughly 3-5x more expensive. You’re paying a premium to skip 4-12 weeks of evaluation.

Why Instant Funding is Popular Among Experienced Traders:

Time is money for proven traders. Someone with a profitable strategy validated over 6-12 months sees little value in spending another 4-12 weeks proving themselves through artificial challenge requirements.

If you’re still learning technical analysis basics or consistently blow demo accounts, instant funding’s higher costs and lack of evaluation structure make it a poor choice.This model suits traders with 6-12 months of consistent live trading, proven drawdown management, and documented profitable strategies.

Will These Hybrids Become the Standard?

The short answer: Some already are, others are emerging.

- Education + Funding: NOT standard as a mandatory prerequisite. Challenge-based evaluations remain dominant (90%+ of firms), with education offered as optional support rather than a required gateway.

- Brokerage Integration: IC Markets, OANDA, Axi, Hantec Markets, and ATFX confirm that regulated brokers view prop trading as a strategic opportunity. Expect more major broker launches in the future.

- Subscription Models: Established standard in futures (80-90% adoption), growing in forex/crypto (30-40% adoption). This is mature rather than emerging, particularly for US-based futures trading.

- Instant Funding: Rapidly becoming standard. Expect more firms to offer this. Dozens of recent launches confirm this transition from novelty to mainstream expectation.

These hybrid models represent genuine innovation in how traders access funding, offering unprecedented choice in fee structures, evaluation approaches, and institutional backing.

As the industry matures, look for firms to offer multiple pathways: traditional challenges, subscriptions, and instant funding, allowing traders to choose based on their experience level, budget, and timeline.

More options exist than ever, but the core challenge remains unchanged: only 5-10% pass challenges, and just 7% of funded traders receive payouts. The average successful trader earns $7,000. Choose the model matching your situation, but focus primarily on developing the trading skills that actually determine success.

Potential Future #4: Technology Evolution

Technology is rapidly advancing…

AI-Powered Risk Management

Over 40% of prop firms now use AI or machine learning.

Traditional prop firms relied on humans manually reviewing thousands of trader accounts for rule violations. AI systems now automate this process in real-time:

Pattern Detection:

- AI algorithms analyze trading behavior across hundreds of data points-trade frequency, position sizing, holding times, win/loss patterns, and correlation with market events.

Example: If a trader suddenly increases position size by 300% after consecutive losses (classic revenge trading), AI flags this immediately rather than catching it days later during manual review.

Dynamic Drawdown Adjustments:

- Instead of fixed 10% maximum drawdown limits for all traders, AI can adjust limits based on individual performance history, volatility of traded instruments, and market conditions.

Example: A trader with 6 months of consistent 2% monthly returns trading EUR/USD might get a 12% drawdown limit during normal conditions, while someone trading volatile cryptocurrency pairs with erratic performance might be restricted to 6%.

Automated Rule Enforcement: When traders violate rules (exceeding position limits, trading restricted instruments, holding overnight when prohibited), AI systems can:

- Automatically close positions that violate size limits.

- Lock accounts that break drawdown rules.

- Send real-time warnings before violations occur.

- Generate detailed violation reports for review.

Fraud Detection: AI systems learn from historical data and adapt to changing market conditions, continuously optimizing detection strategies. This catches sophisticated cheating methods:

- Account farming: Creating multiple fake accounts to pass challenges artificially.

- Latency arbitrage: Exploiting price feed delays.

- Trade copying violations: Mirroring trades from external sources when prohibited.

- Bot manipulation: Using unauthorized automated trading systems.

Real Firms Using AI:

- AI Prop: Partnered with TradeBot365 to give traders unrestricted access to AI-powered bots even during evaluation stages. Their bots use adaptive machine learning to respond to market changes in real-time.

- FPFX Tech: Provides automated risk tools, identification of toxic behavior, real-time analytics, and hedging strategies for over 140 prop firms managing 1.8 million traders.

- Swiset AI: Offers machine learning-based tools for predictive analytics that detect market patterns and generate trading signals, plus strategy automation that enables trade execution without human intervention.

AI risk management means faster, more consistent enforcement of rules. You’ll get instant feedback if you’re approaching limits, and the firm can identify and remove cheaters more effectively, which creates fairer competition. However, AI also means less flexibility. There’s no “talking your way out” of violations.

Platform Diversification

In February 2024, MetaQuotes (the company behind MetaTrader 4 and MetaTrader 5) effectively cracked down on prop firms using their platforms.

This single event led to over 80 prop trading firms shutting down in 2024.

Why MetaQuotes Did This:

MetaQuotes faced mounting pressure regarding prop firms:

- US regulators pressured MetaQuotes to block US clients, threatening removal from app stores if they didn’t comply

- Prop firms were using “demo” accounts (which don’t generate fees for MetaQuotes) rather than “live” accounts

- Questionable operational standards at some firms created reputational risk

- Grey-labeling arrangements (where brokers let prop firms use their MetaTrader licenses) meant MetaQuotes had little oversight

The Immediate Fallout:

- Blackbull Markets was forced to immediately shut down Funding Pips as a client, with executives stating they were “in breach of our grey label license ability to offer this for prop firms”.

- Purple Trading terminated services to Funded Engineer, AquaFunded, Goat Funded Trader, The Funded Trader, and others. Major firms like The5ers and FTMO suspended onboarding US traders.

Following the MetaQuotes crisis, the industry has diversified:

- While MetaTrader 5 still holds the largest market share, alternative platforms like cTrader, DXtrade, MatchTrader, and TradeLocker have seized the opportunity, reshaping a once-monopolized space.

What “Platform Diversification” Means for Beginners:

Before 2024, most prop firms offered only MetaTrader 4/5. Today’s firms typically offer multiple platforms:

cTrader:

- Modern interface with advanced charting.

- Popular in Europe and among algorithmic traders.

DXtrade:

- Web-based platform requiring no downloads.

- Good for traders who switch between devices.

TradeLocker:

- Newer platform gaining rapid adoption.

- Clean, intuitive interface for beginners.

MatchTrader:

- Offers an all-in-one white label solution with trading infrastructure, trader management, and backend analytics, helping prop firms launch faster and manage everything under one roof.

- Low-latency infrastructure with a fully optimized mobile platform.

NinjaTrader:

- Dominant in US futures trading.

- Professional-grade for active traders.

Why Multiple Platforms Matter:

- Reduced dependency risk: Firms no longer face an existential crisis if one platform provider changes policies.

- Trader choice: You can use the platform you’re comfortable with rather than learning a new one.

- Geographic flexibility: Different platforms work better in different regions due to regulations.

- Specialized tools: Futures traders prefer NinjaTrader, algo traders prefer cTrader, and beginners prefer DXtrade.

When choosing a prop firm, check which platforms they offer.

If you’re already experienced with MetaTrader, find firms still offering it. If you’re starting fresh, platforms like DXtrade and TradeLocker are known for more beginner-friendly interfaces.

Smarter Dashboards

Today’s prop firm dashboards go far beyond just showing your account balance.

Real-Time Performance Analytics:

Dashboards must provide real-time trade tracking showing open positions, pending orders, executed trades, and exposure across all accounts instantly, helping firms make quick decisions and prevent risky trades from going unnoticed.

What you see:

- Live P&L updating every second.

- Win rate percentages by session (Asian, European, US market hours).

- Average risk-to-reward ratios.

- Drawdown progression charts.

- Comparison to other traders (anonymized).

- Time spent in winning vs losing positions.

Personalized Coaching Based on Trading Behavior:

- Dashboards provide traders with comprehensive views of their trading performance, enabling them to identify strengths, weaknesses, and areas for improvement through accurate trading metrics, including profit and loss, risk-adjusted returns, and various performance indicators.

Examples of personalized insights:

- “You’re profitable on Tuesday mornings but lose money on Friday afternoons. Consider reducing position size at week’s end.”

- “Your win rate drops 15% when you trade within 30 minutes of news releases.”

- “You’re exiting winning trades 40% faster than losing trades. Work on letting profits run.”

- “Your best performance comes from trades held 2-4 hours, your worst from trades under 15 minutes.”

Advanced Risk Metrics and Warnings:

Ideal dashboards offer built-in risk tools including maximum position size limits, daily loss limits with automatic trade blocking, real-time drawdown calculators, and exposure monitoring across correlated pairs.

Mobile App Integration:

Modern platforms provide mobile apps allowing you to monitor positions and execute trades on the go with mobile-optimized interfaces. Mobile dashboard capabilities include:

- Push notifications for rule violations are approaching.

- Quick position closing during emergencies.

- Daily summary reports are provided each morning.

- Challenge progress tracking.

- Instant payout requests.

- KYC document uploads directly from phone.

Real Examples:

- FPFX Tech’s trader dashboard allows monitoring performance metrics, purchasing new challenges, uploading KYC documentation, signing trader agreements, registering as affiliates, joining trading contests, accessing education resources, and requesting withdrawals.

- Atlas Funded’s proprietary mobile app and dashboard complement TradingView’s interface, enabling real-time performance tracking and account management with dedicated account managers and educational resources.

Modern dashboards are like having a trading coach watching over your shoulder 24/7. They help you identify patterns you’d never notice on your own and prevent costly mistakes before they happen.

Tech Provider Dominance

Technology providers like FPFX Tech, Axcera, and Prop FinTech are now essential infrastructure powering dozens or even hundreds of firms from behind the scenes.

Most prop firms don’t build their technology from scratch. They license comprehensive “white-label” solutions from specialized tech providers who power the entire operation.

A white-label solution means a ready-made software platform built by a specialized provider that other firms can customize with their own logo, branding, and user interface. The key benefit is speed and cost efficiency: a company can launch a fully functional business using proven technology without having to develop or maintain it internally.

Major Tech Providers:

- FPFX Tech: Built exclusively for prop trading, FPFX Tech revolutionized the industry by automating workflows, eliminating manual processes, and reducing the need for additional headcount.

- Axcera: Offers custom automation and risk tools tailored for prop firms, with demand reflecting the need for technology that can instantly enforce trading rules, manage drawdowns, and automate payouts.

- YourPropFirm: Provides proprietary technology and industry expertise to streamline prop trading firm launches, with partnerships covering everything from concept to launch.

- Match-TraderL Increasingly popular as firms switch from MetaTrader due to transparent pricing, lower ongoing costs, and features tailored for prop trading, including automated drawdown tracking, challenge progress monitoring, and payout management.

- Prop FinTech: Multiple references across industry reports as an essential infrastructure provider, though specific feature details vary.

What This Means for Beginners

Pick Firms with Staying Power

✅ Choose firms that survived 2024:

- Look for firms operating for 2+ years with a consistent payout history.

- Check for regulated broker partnerships.

- Avoid brand-new firms with no track record.

- Verify they survived the MetaQuotes crisis.

✅ Warning signs to avoid:

- Firms offering unrealistic splits (95%+).

- No verifiable payout proof.

- Changing rules frequently.

- Poor communication or support.

Understand the Real Numbers

- Only 7% of all traders who start challenges receive payouts.

- The average payout is only 4% of the plan size.

- Set realistic expectations based on these statistics.

Expect Rule Tightening

- As regulation and competition increase, expect stricter but clearer rules.

- More transparency requirements.

- Potentially higher fees but better protection.

- Industry is moving toward professionalization.

Use Prop Firms as a Stepping Stone

- Don’t plan your entire trading career around them.

- Use them to build skills and initial capital.

- Prepare for independence with your own trading account.

Stay Flexible

- The industry will look very different in 3-5 years.

- Platforms, rules, and business models are evolving rapidly.

- Be ready to adapt to new requirements.

The retail prop industry is consolidating. Over the next few years, only the strongest will survive, and the industry will become more stable and regulated.

How to Future-Proof Your Prop Firm Journey

Here’s how you can future-proof your prop firm journey:

Stay Informed

Follow industry developments:

- Join trader communities and forums.

- Watch for regulatory announcements.

- Monitor which firms are closing or being acquired.

- Pay attention to platform changes.

Focus on Transferable Skills

These skills matter whether with prop firms or personal capital:

- Risk management: Position sizing, stop losses, portfolio management.

- Trading psychology: Discipline, emotional control, consistency

- Strategy development: Backtesting, optimization, adaptation.

- Market analysis: Technical, fundamental, sentiment, and positioning analysis.

Avoid Over-Reliance

- Don’t depend solely on prop firms for income.

- Build your own savings and trading accounts alongside.

- Diversify income sources.

- Keep a backup plan if your prop firm closes.

Think Long-Term

- Use prop firms for 1-3 years as stepping stones.

- Aim for independence by building your own trading capital.

- Learn everything you can during the funded period.

- Prepare for a future where you trade your own money.

Verify Everything

- Always check TrustPilot and independent reviews.

- Ask for proof of payouts before committing.

- Be skeptical of too-good-to-be-true offers.

Key Takeaways

- The prop firm industry faces challenges: oversaturation, trust issues, liquidity crunches, and a lack of regulation.

- The future likely includes:

- Consolidation (fewer, stronger firms).

- Regulation (more oversight, clearer rules).

- Hybrid models (education, broker integration).

- Technology evolution (AI risk management).

- For beginners, the smart approach is to:

- Pick stable firms.

- Expect changes in rules and models.

The prop firm industry is maturing rapidly. The “easy money” era is over.

What remains will be more professional, regulated, and sustainable, but also more selective. Success requires treating prop trading as serious skill development, not a get-rich-quick scheme.

The traders who understand this reality and prepare accordingly will be the ones who succeed, regardless of how the industry evolves.

Now you’ve seen both the present challenges and the possible futures of prop firms.

But how do you, as a beginner trader, put all this knowledge together into a coherent plan?

In the final lesson, we’ll recap everything from Lessons 1–9 and build a complete roadmap: from first demo trades to long-term trading independence.

Để lại tin nhắn của bạn ngay bây giờ