Markets opened the holiday-shortened week on a cautiously optimistic note, with technology stocks leading a rebound in equities as Federal Reserve officials signaled openness to further rate cuts, though trading volumes remained thin ahead of Thanksgiving.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- Over the Weekend: Renewed US pressure on Ukraine to accept concessions to Russia as Washington pushes revised peace framework

- Japanese markets closed for a holiday, reducing Asian session liquidity

- Swiss Non Farm Payrolls for September 30, 2025: 5.53M (5.54M forecast; 5.53M previous)

- Germany Ifo Business Climate for November 2025: 88.1 (88.0 forecast; 88.4 previous)

- Canada Manufacturing Sales Prel for October 2025: -1.1% m/m (-1.5% m/m forecast; 3.3% m/m previous)

- U.S. Dallas Fed Manufacturing Index for November 2025: -10.4 (-1.0 forecast; -5.0 previous)

- Due to concerns about the labor market, Federal Reserve Governor Waller said on Monday that he advocates for an interest rate cut in December

Broad Market Price Action:

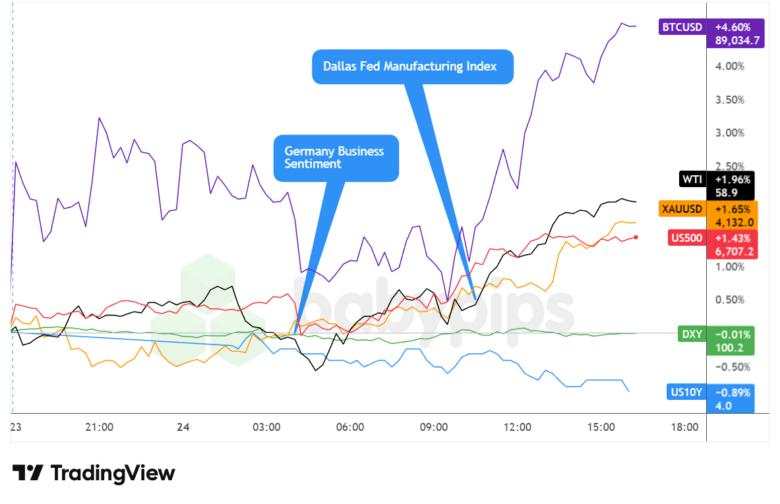

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Monday’s session reflected cautious optimism as markets digested dovish commentary from multiple Federal Reserve officials over the weekend and assessed ongoing geopolitical developments.

Gold advanced 1.65% to trade near $4,132 per ounce, building on its recent strength as investors weighed Fed rate cut expectations against geopolitical uncertainties. The precious metal traded in subdued ranges during the Asian session with Japanese markets closed, then found support during European hours, correlating with the release of weaker-than-expected German business sentiment data. Gold extended gains into the US afternoon session as Treasury yields declined and the dollar traded mixed.

WTI crude oil climbed 1.96% to close near $58.90, recovering from earlier pressure despite ongoing discussions about a potential Russia-Ukraine peace deal. Oil prices remain in a longer-term downtrend from expectations that a settlement could eventually unwind sanctions and release previously restricted Russian supply. However, new US sanctions on Rosneft and Lukoil that came into force Friday have left nearly 48 million barrels of Russian crude stranded at sea, creating a dynamic that could potentially support prices short-term if the situation persists.

Equity markets found firm footing after last week’s volatility, with the S&P 500 posting its best day in six weeks with a 1.5% advance to 6,707. Technology stocks propelled the rally, with the Nasdaq 100 surging more than 2%—its largest gain since May. The rebound followed supportive commentary from Fed officials Williams, Waller, and Daly indicating willingness to cut rates in December to protect the labor market. Markets entered the week in an oversold state following recent concerns about AI valuations and Fed policy uncertainty.

Treasury yields declined across the curve, with the 10-year yield falling to 4.03% from 4.062% at Friday’s close. The move lower likely reflected increased market expectations for a December rate cut, with money markets now pricing roughly 70% odds of easing next month. The 2-year yield ticked higher to around 3.526% from 3.513%.

Bitcoin popped higher at the open, pulled back, then reversed to close 4.6% higher near $89,035, demonstrating fresh resilience amid it’s current massive sell-off since hitting earlier 2025 highs above the $126,000 price level. There are no major Bitcoin-related news on the session, so this was arguably some short profit taking or dip buyers off of oversold levels.

FX Market Behavior: U.S. Dollar vs. Majors:

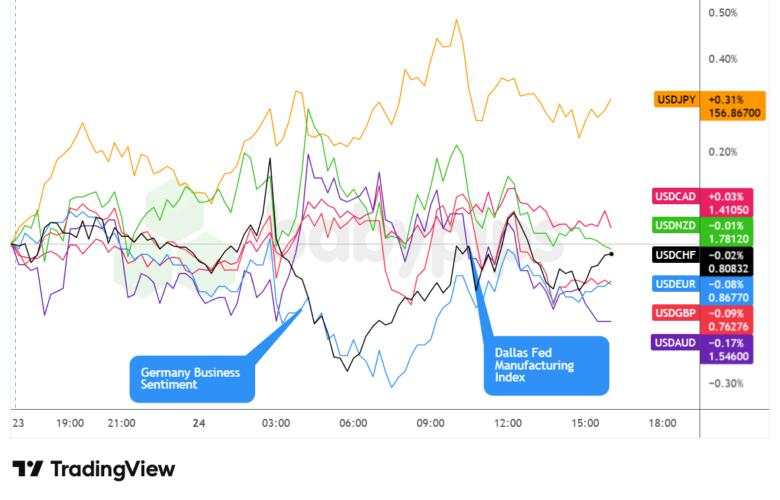

Overlay of USD vs. Majors Forex Chart by TradingView

The US dollar traded in narrow ranges on Monday, closing mixed against major currencies in a session marked by thin liquidity due to Japanese markets being closed and traders positioning cautiously ahead of a data-heavy Tuesday and the Thanksgiving holiday later in the week.

During the Asian session, the dollar edged slightly higher before pulling back in subdued trading conditions. With Japanese markets shut for a holiday, liquidity was noticeably reduced. Major currency pairs traded in tight ranges as traders lacked fresh catalysts, with the session taking on an arguably bearish lean for the greenback heading into the London open.

The London session brought choppy, mixed trading as European data crossed the wires. Germany’s Ifo business climate index fell to 88.1 in November from 88.4 previously, coming in slightly below the 88.5 forecast. The Ifo current conditions component beat expectations at 85.6 versus 85.1 forecast, but the expectations component disappointed at 90.6 against 91.1 expected. The weaker German sentiment data initially weighed on the euro, but the dollar’s response remained muted as traders maintained a slightly bearish lean against most major currencies through the morning hours.

The US session saw the dollar gain traction after the open, with the DXY index pushing higher as equities rallied and rate cut expectations were tempered by the market’s improving risk appetite. However, the greenback pulled back ahead of the London close as profit-taking emerged. The Dallas Fed Manufacturing Index for November came in at -10.4, significantly weaker than the -1.0 forecast and down from -5.0 previously, marking the sector’s continued contraction. Despite this soft data, the dollar maintained resilience against most pairs.

At the Monday close, the dollar traded mixed across the board, with the DXY index essentially flat at 100.189. The greenback showed strength against the yen & some commodity currencies but gave ground to the Aussie, pound and euro.

Upcoming Potential Catalysts on the Economic Calendar

- Germany GDP Growth Rate Final for September 30, 2025 at 7:00 am GMT

- U.K. CBI Distributive Trades for November 2025 at 11:00 am GMT

- ADP U.S. Employment Change Weekly for November 8, 2025 at 1:15 pm GMT

- Canada Wholesale Sales Prel for October 2025 at 1:30 pm GMT

- U.S. Retail Sales for September 2025 at 1:30 pm GMT

- U.S. PPI for September 2025 at 1:30 pm GMT

- U.S. House Price Index for September 2025 at 2:00 pm GMT

- U.S. S&P/Case-Shiller Home Price for September 2025 at 2:00 pm GMT

- U.S. Business & Retail Inventories for August 2025 at 3:00 pm GMT

- CB U.S. Consumer Confidence for November 2025 at 3:00 pm GMT

- Richmond Fed Manufacturing Index for November 2025 at 3:00 pm GMT

- U.S. Pending Home Sales for October 2025 at 3:00 pm GMT

- Dallas Fed Services Index for November 2025 at 3:30 pm GMT

- U.S. Money Supply for October 2025 at 6:00 pm GMT

- API U.S. Crude Oil Stock Change for November 21, 2025 at 9:30 pm GMT

Tuesday brings a critical flood of delayed US economic data following the government shutdown, with retail sales and the Producer Price Index for September headlining the releases. These backward-looking figures will provide insight into economic conditions from over two months ago, though traders will scrutinize them for clues about underlying trends. The ADP weekly jobs data will also draw attention as markets assess labor market conditions ahead of the Fed’s December meeting. Any significant deviations from expectations could drive volatility across asset classes as traders adjust rate cut probabilities.

Beyond the data calendar, markets will remain sensitive to any developments on the geopolitical front, particularly regarding Ukraine-Russia peace negotiations and potential shifts in US trade policy toward China. Reports that the Trump administration is considering allowing Nvidia H200 chip sales to China have already impacted semiconductor stocks and could signal broader changes in the trade relationship. Oil markets will continue monitoring both peace deal prospects and the impact of new sanctions that have stranded Russian crude supplies.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!

Để lại tin nhắn của bạn ngay bây giờ