📊 Morning Market Update – 08.10.2025 🌅

U.S. index futures are trading flat ⚖️, with investors showing caution after the AI-fuelled rally and mixed Oracle results. All eyes are on today’s FOMC minutes 🏦, which could offer clues on future policy moves. The EU50 edges up +0.15%.

🌏 In Asia-Pacific, markets remain quiet due to holidays in China 🇨🇳 and South Korea 🇰🇷. Tech stocks drag regional indices lower after Oracle’s weak margins (Baidu –4% in premarket). Optimism from Sanae Takaichi’s victory in Japan’s LDP leadership race is fading, leaving major indices in the red:

📉 HK.cash, CHN.cash –1.4%, JP225 –0.45%, AU200.cash –0.2%.

🏦 The Reserve Bank of New Zealand surprised markets with a 50 bps rate cut to 2.5% (vs –25 bps expected). The decision was unanimous, and further easing remains on the table. The NZD becomes today’s weakest G10 currency.

🇯🇵 Japan’s current account surplus beats forecasts, rising to ¥3.776 trillion (expected ¥3.55T).

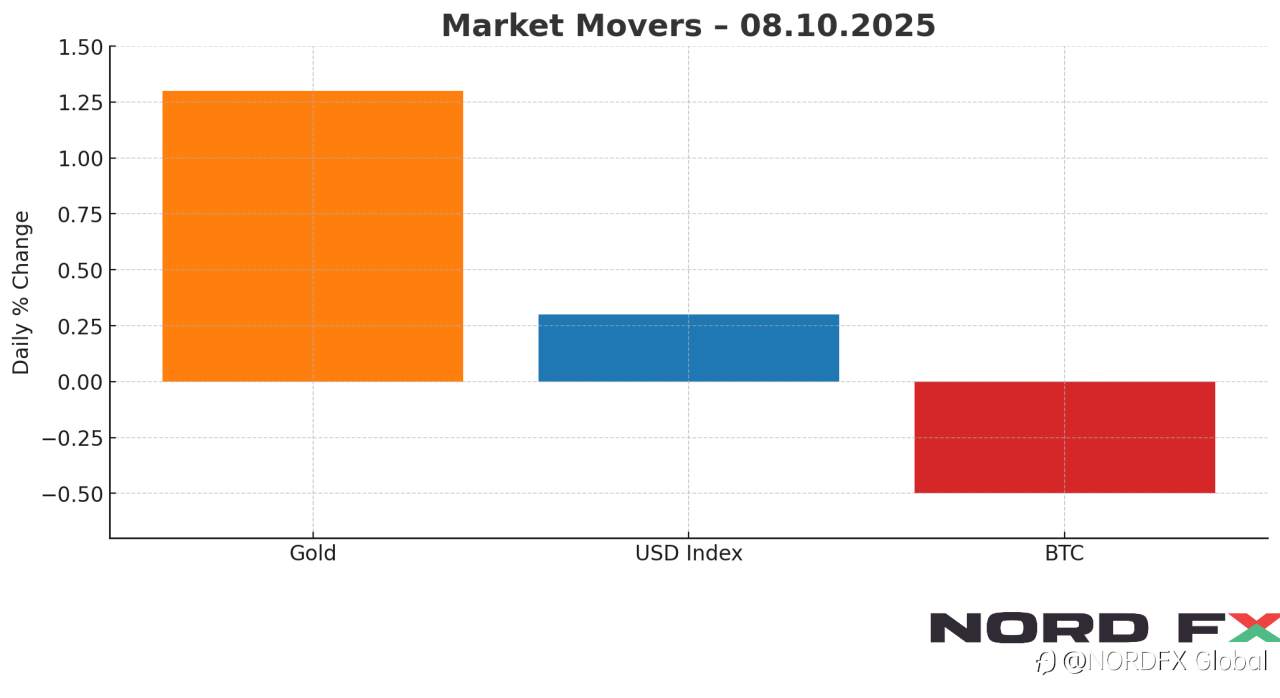

💱 Forex: The NZDUSD drops –1%, while EURNZD gains +0.65%. The USD Index strengthens for a third session (+0.3% to 98.63), its highest since August. The EURUSD falls to 1.1616, while the GBP, CHF, and JPY each lose around –0.3%.

🥇 Gold breaks above $4,000/oz for the first time ever (+1.3%) amid the ongoing U.S. government shutdown 🇺🇸. Silver jumps +2.3% to $48.90, with platinum and palladium also up +2.2%.

🛢️ Oil extends gains slightly (+0.3%), while natural gas slips –0.9%.

💥 Crypto markets stay under pressure: Bitcoin –0.5% to $121,620, Ethereum –1.3% to $4,432, Solana –1.9%, Dogecoin –1.8%, Polygon –1.6%.

📈 Stay tuned and trade global trends with confidence at NordFX 🚀

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()