🌅 Morning Market Update | 9 October 2025 ☕

📈 U.S. index futures are trading flat today, while the dollar (USDIDX) slips 0.1%.

🇪🇺 Key events ahead include the ECB minutes (11:30 GMT), Jerome Powell’s speech (12:30 GMT), and U.S. wholesale trade data (16:00 GMT).

🧾 Before Wall Street opens (around 09:00 GMT), PepsiCo will report its Q3 earnings, kicking off the U.S. large-cap earnings season!

📊 The September FOMC minutes revealed a cautiously optimistic Fed: officials revised upward GDP growth forecasts for 2025–2028, signalling confidence that the economy can maintain momentum as monetary policy gradually eases.

💬 Almost all members supported a 25 bp rate cut in September, while a few preferred no change — and one argued for a deeper 50 bp cut. This highlights the Fed’s intent to balance growth support and inflation control.

💡 Inflation vigilance remains key: participants still see persistent price risks, but also growing downside risks to employment. The Fed may rely on tools like the standing repo facility to stabilise markets during quantitative tightening.

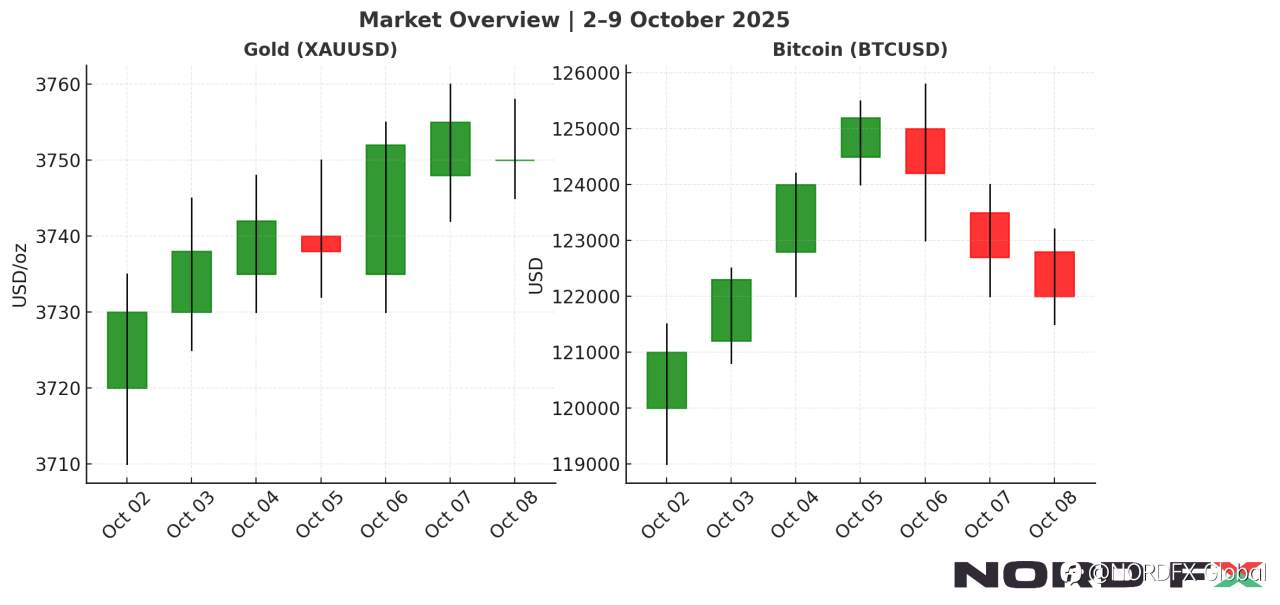

🥇 Precious metals stay near recent highs: gold -0.1%, silver +0.5%.

💻 Crypto faces pressure — Bitcoin hovers near $122,000, down from $125,000, while Ethereum slides nearly 2%.

🔥 Natural gas futures -1% ahead of the EIA storage report (14:30 GMT) — expectations point to a sharp jump from 53 bcf to 77 bcf.

🏛️ Meanwhile, Donald Trump said not all federal employees will receive back pay for the shutdown period, and the IRS confirmed 46% of staff will be furloughed during the closure.

🚀 Stay alert — today’s ECB and Fed remarks could set the tone for global markets!

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()