🌅 Morning Market Update | 13 October 2025 ☕

📈 U.S. index futures are rebounding during the Asian session on hopes of easing tensions between the United States and China. Despite the partial weekend de-escalation, geopolitical uncertainty continues to support safe-haven assets.

🇺🇸 On Monday, October 13, U.S. stock markets will trade as usual, while the bond market will remain closed due to Columbus Day.

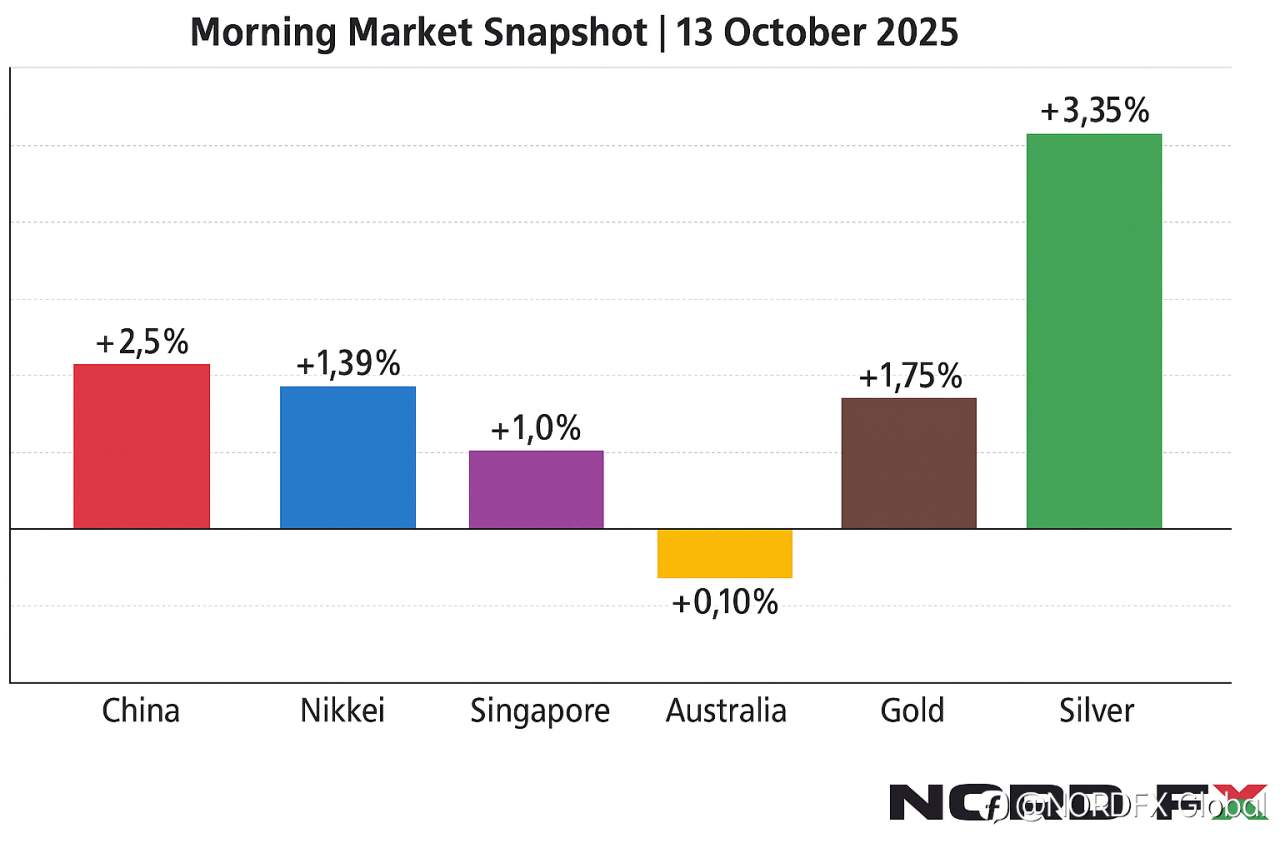

🌏 Asia-Pacific markets are trading firmly higher:

🇨🇳 China +2.5–3.0%

🇯🇵 Japan’s Nikkei +1.39%

🇸🇬 Singapore +1.0%

🇦🇺 Australia +0.10%

🥇 Gold climbs +1.75% to $4,075/oz, while silver surges +3.35% to $51.65/oz.

🗣️ After threatening 100% tariffs on all Chinese imports last Friday, Donald Trump softened his tone over the weekend — part of broader negotiation efforts. According to Goldman Sachs, markets are now expecting a “managed confrontation” rather than a full-scale escalation.

📊 China’s trade data show strength:

• Exports +8.3% YoY (best in 6 months)

• Imports +7.4% YoY (best in 17 months)

• Trade surplus: $90.5B (slightly below forecast)

At the same time, rare-earth exports fell 31% m/m to their lowest since February, while the U.S. plans to buy up to $1 billion of critical minerals to reduce reliance on China.

💡 Markets are waking up in a cautiously optimistic mood — with traders watching whether calm will last through the week.

📊 Stay tuned with NordFX for daily updates and fresh trading insights! 🚀

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()