🌅 Morning Update | 29.10.2025

📈 Wall Street futures extend their rise ahead of key Big Tech earnings (Microsoft, Alphabet, Meta) and the Federal Reserve’s decision, where markets expect a 25 bp rate cut.

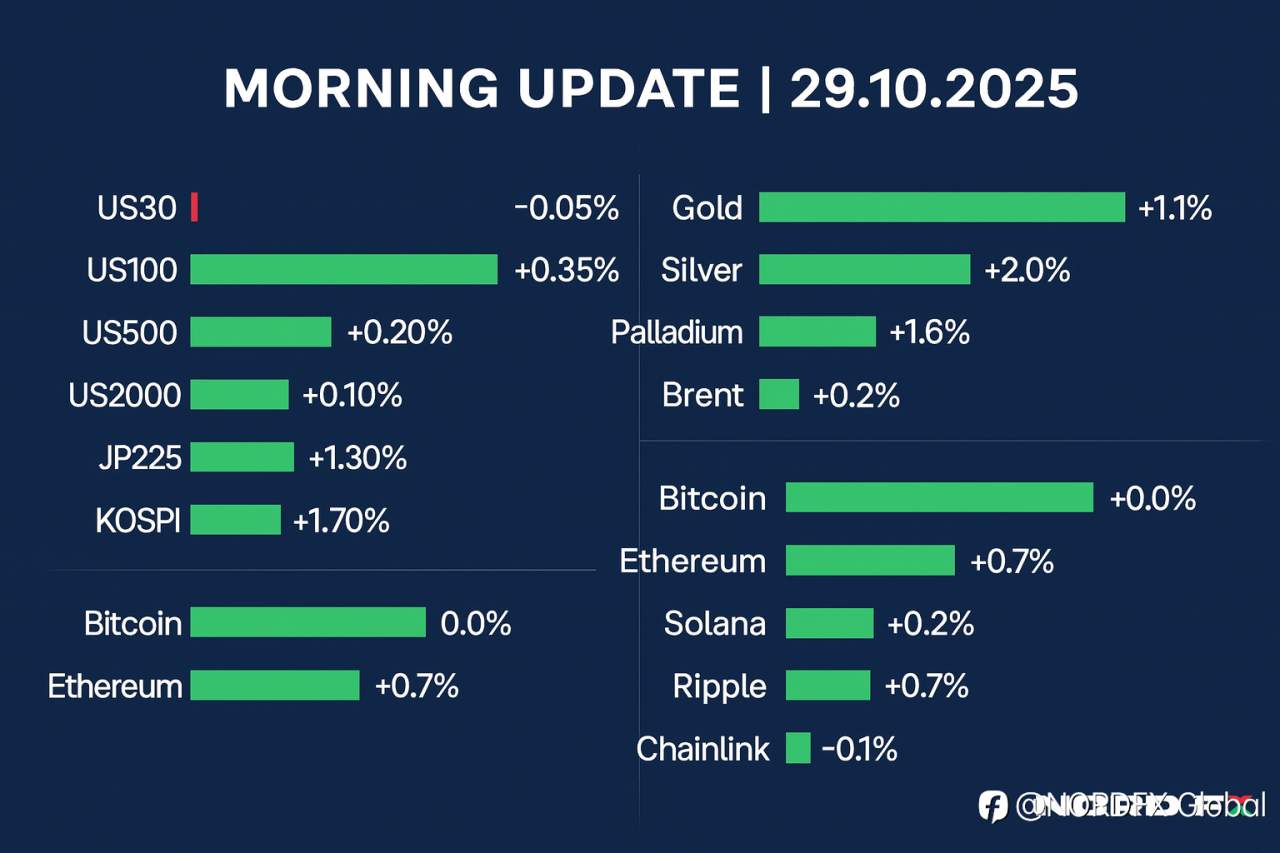

🟢 US100 is up for the sixth day (+0.35%), US500 gains +0.2%, and US2000 adds +0.1%, while US30 and EU50 hover slightly below the line.

💬 U.S. Treasury Secretary S. Bessent said that “leaving room for the Bank of Japan will be key to anchoring inflation expectations,” following PM Takaichi’s calls for closer BOJ–government coordination.

🌏 In Asia, sentiment is mixed. Australia’s AU200 fell nearly 1% after a hotter-than-expected CPI, while Japan (JP225 +1.3%) and Korea (KOSPI +1.7%) rallied on AI-driven tech optimism, supported by record profits from SK Hynix ($7.9 billion operating profit).

🇦🇺 Australia’s inflation surprised to the upside in Q3:

📊 CPI +1.3% q/q (vs 1.1%) and +3.2% y/y (vs 3.0%), led by housing, recreation, and transport.

Electricity prices soared 9% after tariff reviews and delayed rebates.

💵 The AUD strengthens across G10 (AUDUSD +0.4%), while the GBP weakens for a second session (GBPUSD –0.2%) after disappointing retail data. EURUSD trades at 1.163 (–0.2%).

🥇 Gold rebounds +1.1% to $3,980, silver +2% to $47.84, while platinum +1% and palladium +1.6% also edge higher.

🛢 Brent +0.2%, WTI +0.3%, and natural gas +0.6% recover modestly after recent declines.

💹 Crypto market is calm: Bitcoin flat ≈ $ 4,030, Ethereum +0.7%, Solana +0.2%, Ripple +0.7%, Chainlink –0.1%.

✨ Markets await today’s U.S. data and the Fed’s statement — stay tuned with NordFX for instant updates!

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()