#NonfarmPayrolls#

4.38k Xem

1.41k Thảo luận

Nonfarm payrolls is the measure of the number of workers in the U.S. excluding farm workers and workers in a handful of other job classifications.

Gold crashes, WTI falling to support, US Nonfarm Payrolls deliver [Video]

Last week’s Non-Farm Payrolls and Unemployment Rate were much better than expected sending the USD stronger. Pay attention that price action stopped at key levels and we will look at these tomorrow. We spotted a Falling Wedge on USDJPY last week and the Non-Farm Payrolls broke this and price action

Gold supported prior to NFP

Gold made a small breakout yesterday, but it is supported prior to the NFP. We might see a move up before the NFP. The main even the Nonfarm Payrolls will determine the move in gold. However, we might expect a small move to the upside prior to the news. After the NFP, we could see the following scen

Technical vs. Fundamental, which is Better?

Written by@非一菜 click to check the original article Before I start, let’s have a little survey. How did you enter the foreign exchange market? Have you had any trading experience in other financial instruments before trading forex? No matter when or under what circumstance, I believe tha

All eyes on NFPs, and on EV supply-chain [Video]

It’s NFP Friday, and the market mood is not too bad when we think that the major news in the wire point that the rapidly spreading delta variant is about to threaten the economic recovery sooner rather than later. There are event cancellations, companies pushing back their plans to bring employees b

Weekly Fundamental US Dollar Forecast: Inflation Fears Linger; May US NFP Due Friday

Advertisement Fundamental Forecast for the US Dollar: NeutralThe ongoing erosion of US real yields, thanks to rising inflation expectations and stagnant US Treasury yields, proved to be a negative influence on US Dollar price action – like it was for much of 2020.For now, without a corresponding ris

NFP React: Huge NFP Miss sends Treasury yields on rollercoaster ride, Stocks rally, Dollar drops,

Investors were supposed to quickly look quickly beyond this nonfarm payroll report. The playbook for the next couple of months was to look for more robust employment reports and try to figure out what is the right balance of pricing pressures that will force Fed Chair Powell and company to begin tal

USD/CAD Outlook: Bears take a breather ahead of NFP/Canadian jobs report

Another USD selloff on Thursday dragged USD/CAD to the lowest level since September 2017. Sliding crude oil prices did little to undermine the loonie or stall the sharp intraday downfall. Investors look forward to the US/Canadian monthly jobs report for a fresh directional impetus. The USD/CAD pair

Market summary on May 6: The USD continued to weaken ahead of the NFP report!

Tradehay.com: 07/05/2021 - 03:52 The dollar has a bearish session when Fed officials all commented that it is not time to narrow QE and economic data shows the recovery of the economy. US stocks rallied, gold price surpassed hard resistance and USD / CAD rate continued to decline. The S&P 500 In

US NFP to rise by 1,300K in April – Goldman Sachs

Analysts at Goldman Sachs predict a strong US NFP report for April, with their expectations highlighted below. Key quotes “Estimate nonfarm payrolls rose 1,300k in April (m/m sa).” “Estimate a five-tenths decline in the unemployment rate to 5.5%, reflecting rapid job gains partially offset by an exp

Forex Weekly Outlook: BoE policy decision, US NFP loom big

The FOMC remained in dovish mode, despite promising US numbers. The UK economy is gradually reopening, but the eurozone is still hampered by a slow vaccine rollout. In April, German Inflation rose above the 2% level for the first time in two years. In the eurozone, CPI is expected to rise to 1.6% in

Week Ahead – BOE and RBA rate decisions in focus; US April NFP report could show over a million jobs created

Everyone on Wall Street is trying to figure out if the peak in Treasury yields will stick for a while now that the US is approaching peak growth. The best expansion since World War 2 is being accompanied with a Fed that remains committed to supporting the economy until a complete recovery. The playb

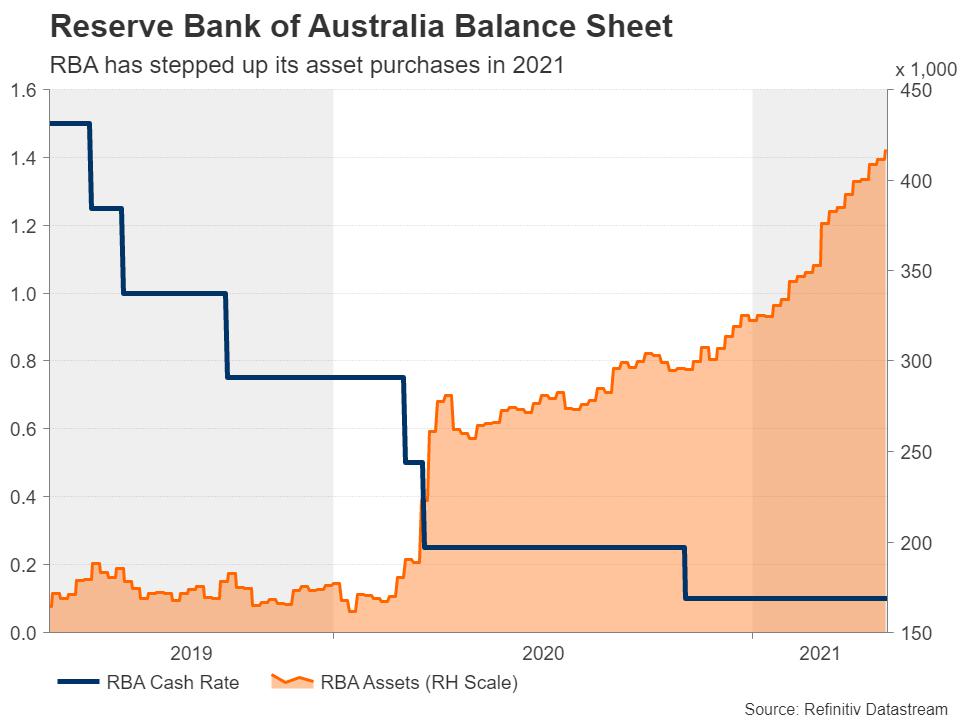

Week ahead: RBA to stand pat but BoE might taper, can a bumper NFP excite after dovish Fed? [Video]

The central bank theme will continue over the next seven days with policy meetings by the Reserve Bank of Australia and Bank of England. The RBA will probably maintain some caution after weak inflation figures but there is some speculation the BoE could start to taper its asset purchases as early as