#USD/JPYhits10-monthhigh#

794 Xem

59 Thảo luận

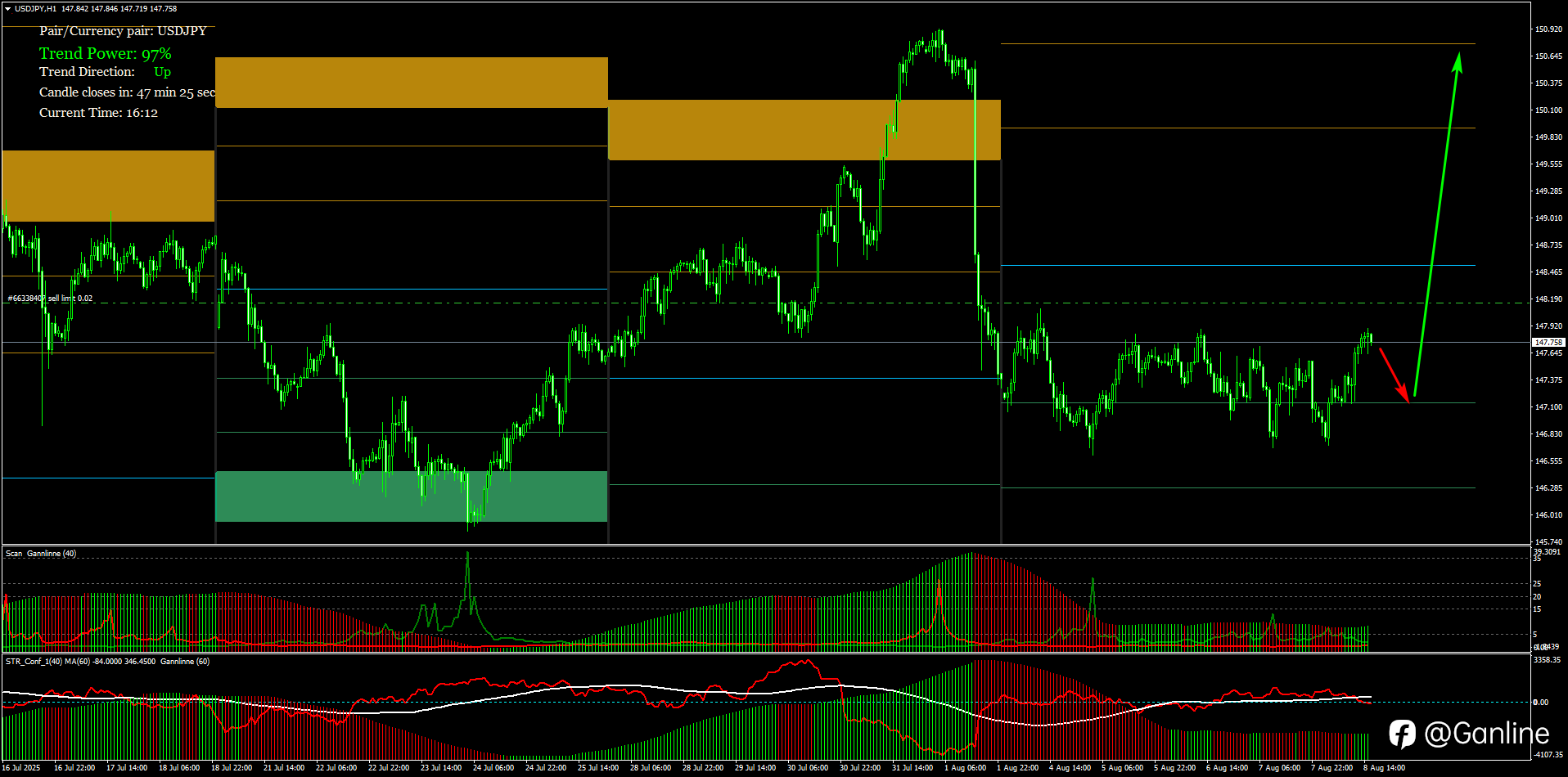

The Bank of Japan stated that it did not rule out the forced easing again and the strengthening of the US dollar, which caused USD / JPY to reach a new high of 112.22 in nearly 10 months. However, the exchange rate has now fallen, trading around 112. Excuse me, is it time to go short?

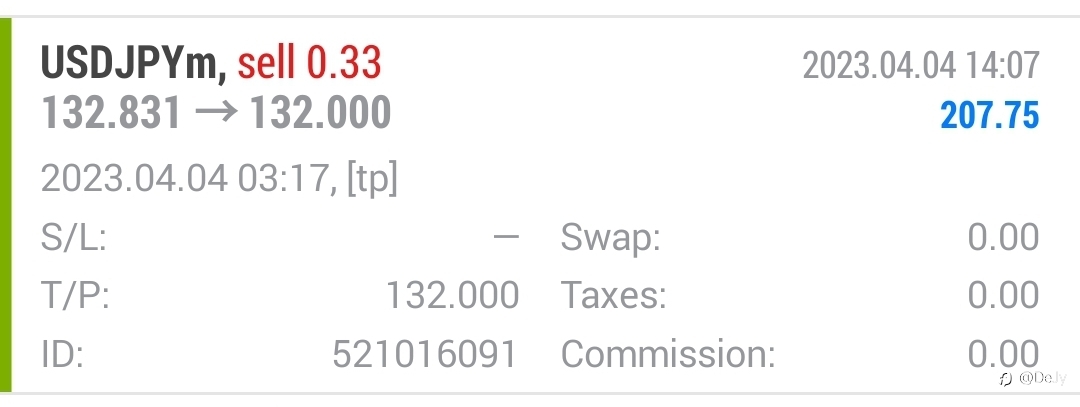

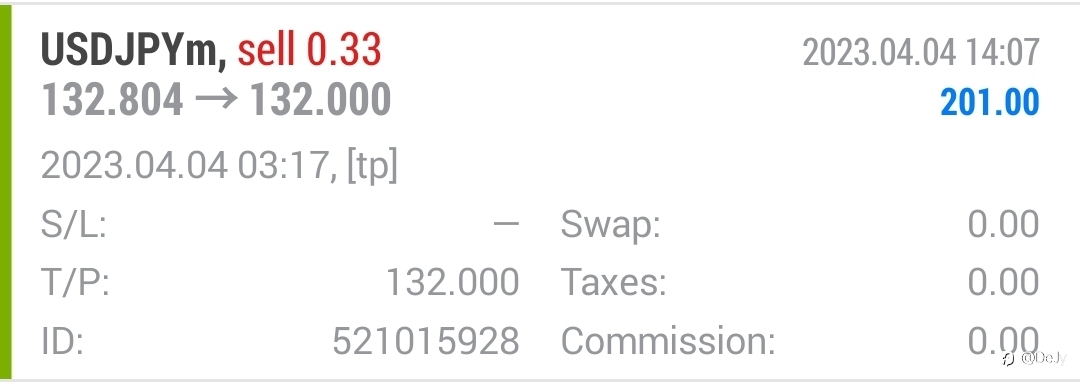

[[email protected]]USDJPY Shorts established. Oops! I did it again, always changing minds, becoming schizophrenic

#OPINIONLEADER# #USD/JPYhits10-monthhigh# #USD/JPY# #mytradingstory# Such a fast changing & chaotic market…😳 Extremely highly risky bets… Might be a key day bearish reversal with a&

- popefund :USDJPY fake break out

瑞鑫美日ea

实盘全自动运行10个月,收益300%,最大回撤30%,一次一单不加仓,每单带止损风险可控不爆仓,实现月月正回报[强]#USD/JPYhits10-monthhigh# #XAU/USD#

- 赚钱不爆仓 :收费的吗

关于薄利交易的一些思考

大家先想一想什么是薄利交易?薄利交易被认为是区间交易,不过是小区间交易,它的交易方法是见位做单,也就是大家熟知的遇阻力抛空,遇支撑做多。在大家了解了基本概念后,再想一个问题:是不是所有的货币对都适合薄利交易呢?是不是所有情况下都适合交易呢?我的答案是:No。只有波动低的货币对和息差较小的货币对才适合作为薄利交易的货币对,另外它只适合在非活跃时期交易。 我们都知道与美元相关的货币对存在着高波动性,根据上面讲到的薄利交易要素,因此直盘货币对基本上不适合薄利交易策略,毫无疑问剩下合适的就只有交叉货币对,而在这些交叉货币对中较为合适薄利交易的是EUR/GBP,EURCHF。息差与货币对波动之间存在着正