#SaudiOilPriceWar#

1.27k Xem

136 Thảo luận

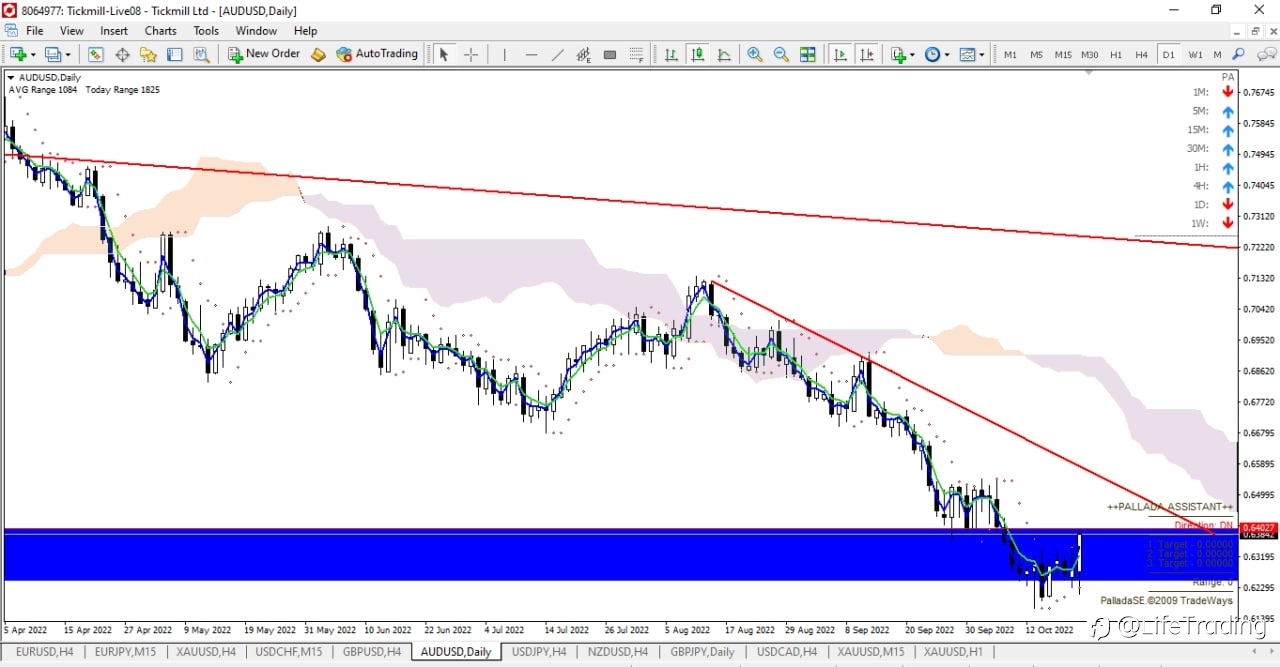

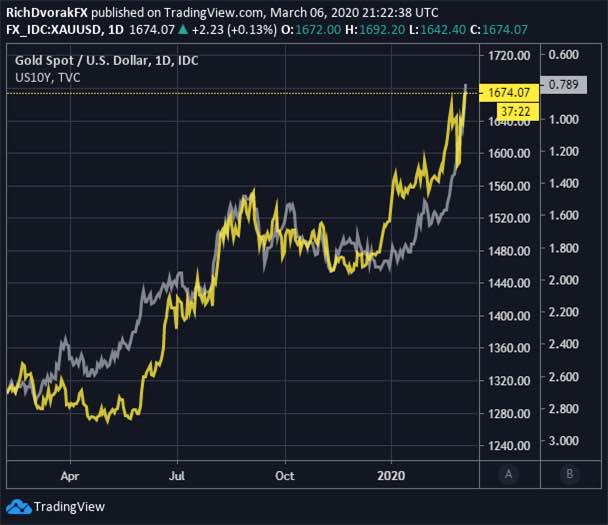

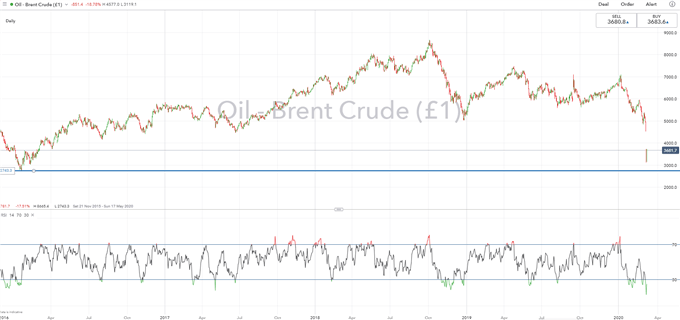

On Saturday, Saudi Arabia announced a significant reduction in the pricing of its major crude oil grades, the largest reduction in 20 years. The discount on the flagship Arab light crude oil sold to Northwest European refiners was extended to $8/barrel, with price as low as $10.25/barrel. WTI prices plunged 30% at the opening and gold broke $ 1700.

Red Sea crisis escalating already disrupted global supply chains

*News: Global Geopolitics* *First, trade wars and then Covid-led restrictions disrupted global supply chains.* • The conflict between Israel and Hamas has intensified and escalated across land and reached the sea level • Initially attacks by Yemen's Iran-aligned Houthi militants targeted only oil sh

- Mark Jeffrey :Trading with an expert is the best strategy for newbies and busy investor send a private message to Magdalena J Gabriel for good tips @Fb📚

【每日分析】英国今晚是否降息?宽松不再看通胀,欧洲政策大洗牌!

引言: 通胀高达4.1%,瑞典何以先行降息?央行政策路径分化,欧洲不再跟随美国!英国今晚会不会跟着瑞典降息? 正文: 继瑞士之后,同处欧洲的瑞典昨晚也宣布了降息,将基准利率从4.00%下调至3.75%,成为了全球第二个宽松的发达国家。奇怪的是,目前瑞典的通胀率还远远没有达到央行2%的目标。 通胀依旧很高 欧元区vs瑞典vs瑞士通胀同比 由图可见,瑞士的通胀率一年来始终保持在2%以下,选择降息是情有可原。反观瑞典,虽然4月数据还未发布(下周发布),但最新的3月通胀率却高达4.1%,过去一年的数据始终高于欧元区的平均水平。欧洲央行还没有动手,

【每日分析】鲍威尔都救不了美股,该涨不涨理应看跌!

鲍威尔一开口,市场抖三抖。美元暴跌,美股却涨不动了! 本周最重要的事件是今日凌晨发布的美联储利率决议以及紧跟其后的鲍威尔讲话。不过在讲到决议之前,首先需要明确一点。在决议发布之前,金融市场中的绝大多数人便已经在押注过去三个月的高通胀数据会让美联储改变政策态度。因此决议中鹰派的信号反而无法令行情波动,反倒是鸽派的态度容易让市场“惊讶”。 美联储12月利率预期 在利率决议和鲍威尔讲话期间,美债利率与美元暴跌,美联储到年底的降息预期触底反弹,押注降息2-3次的比例明显提高。毫无疑问,市场将本次决议解读为鸽派信号。那么这次决议到底鸽在哪里呢?总共有三点。 首先是放缓缩表。在本次利率决议中