#Fedcuts100bps#

592 Xem

45 Thảo luận

The Federal Reserve announced an emergency rate cut of 100 basis points to a level of 0-0.25%, and announced the launch of a $ 700 billion expansion easing program. This move is the biggest operation in the history of the Federal Reserve. The gold gap opened higher to 1575, but is now giving up most of its gains. At the same time, US stock futures fell more than 7%, touching the fuse mechanism. The market is so volatile and everyone operates with caution. What's your opinion?

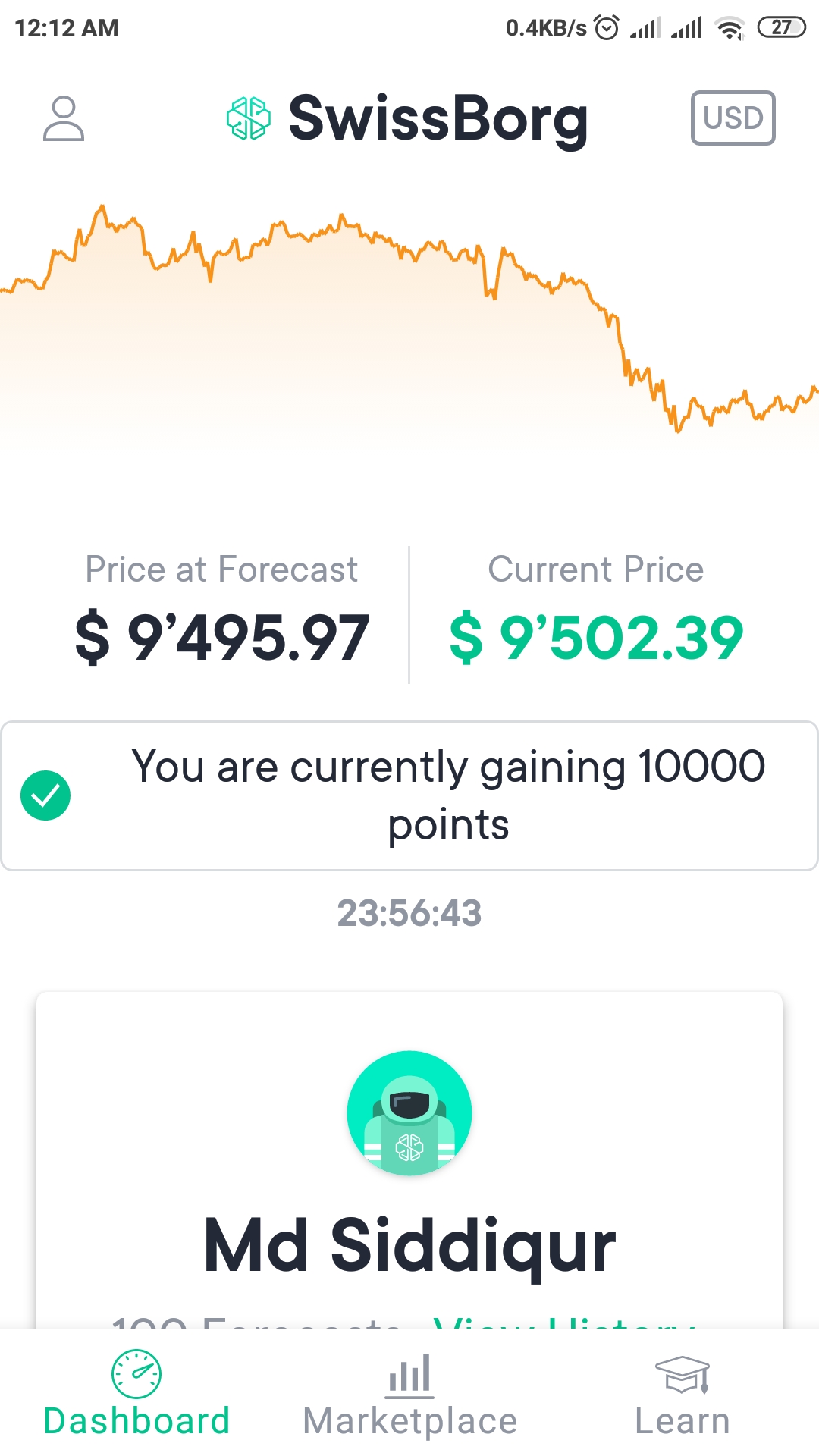

Fed move to zero rate regime, what will market react?

This early morning in South east Asia time, Fed has declared another emergency rate cut at the faster pace than the previous cut. -100 bp, and also start adding more liquidity of 700 bnusd through the new QE program. Will this cope the current situation or it just make more investor panic sent

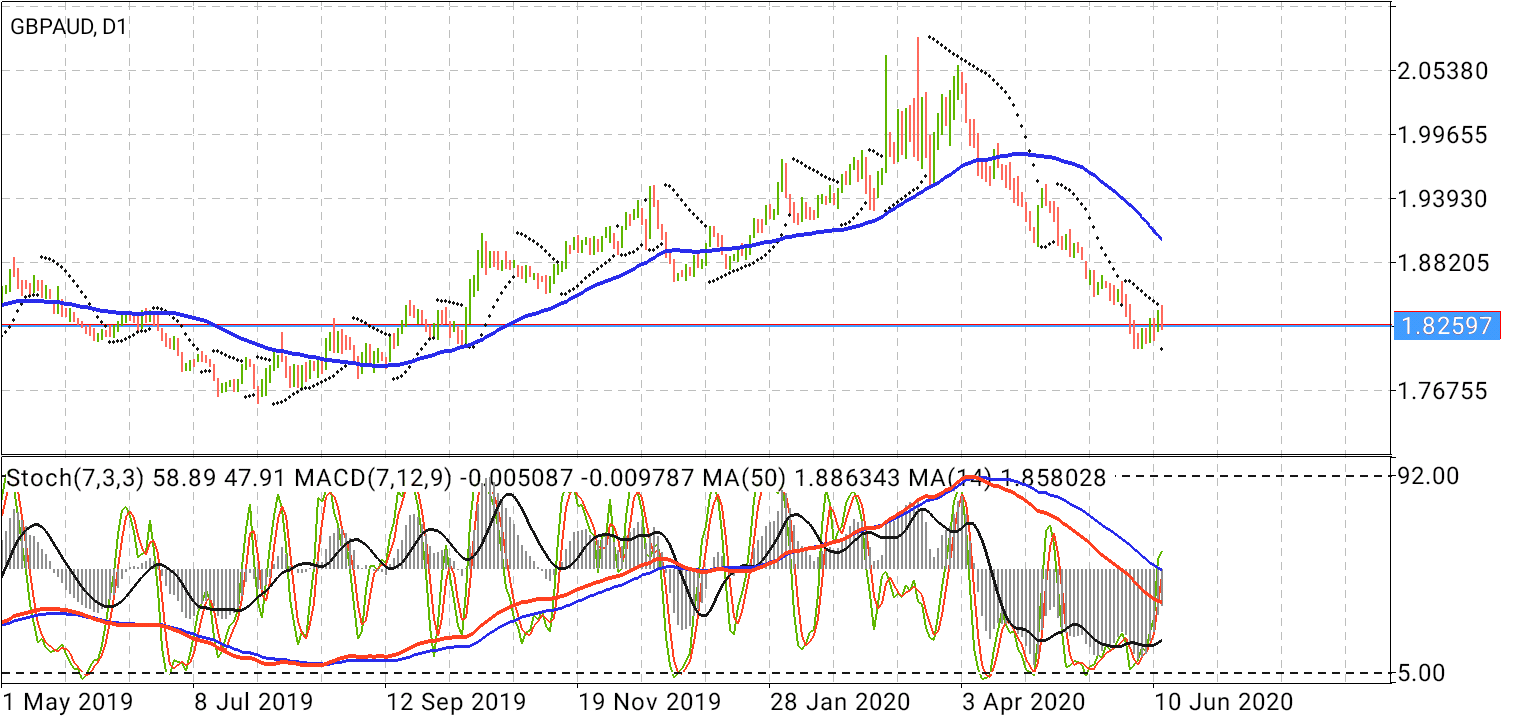

Gold drops under $1,540 amid global central bankers’ play, BOJ in spotlight

Gold prices remain on the back foot as global central bankers fight hard against coronavirus.

After Fed and RBNZ, BOJ announced a surprise emergency meeting at 03:00 GMT.

EU Finance ministers, G7 are in the pipeline as well.

With the global central bankers running the show, led by Fed and RBNZ, Gol

【Orbex基本面分析】美联储采取前所未有的政策措施

美联储为经济奋战随着新冠病毒危机继续主导市场,各国央行正采取越来越积极的行动,试图阻止全球经济滑入衰退。美联储整个月都在积极参与此类行动。随着一连串未经计划的降息和量化宽松政策的出台,市场环境开始感觉像是全球金融危机的黑暗时期。上周,美联储宣布了7500亿美元的量化宽松方案。在这之后的周末,他们确认将向银行和企业提供1万亿美元的资金。然而,随着市场继续下滑,美联储宣布了进一步的行动。在昨日发布的一份声明中,美联储宣布,目前将实施无限量化宽松,这是迄今为止最有力的尝试,力求支撑美国经济。声明中的关键内容:“联邦公开市场委员会正在采取进一步行动,通过解决国债和机构抵押贷款支持证券市场的紧张局势,支

Can't wait for another four days! Fed announces interest rate cut of 100 bps, the biggest move ever

The Federal Reserve announced an emergency cut in interest rates by 100 basis points to a level of 0-0.25%, and announced the launch of a $ 700 billion scale-up easing program.This was certainly the biggest move in Federal Reserve’s history. During the financial crisis of 2008, the Federal Reserve ’

Fed Cut Quick Analysis: Panic move exposes financial system's vulnerability, USD buying opportunity?

The Federal Reserve slashed interest rates to 0% and announced QE worth $700 billion.

The deep cut, coming on Sunday ahead of the market open, reveals the financial system's vulnerability.

The safe-haven dollar has dropped but may come into demand.

The Federal Reserve was unable to wait until its s

Monetary Policy is No Cure to Coronavirus Crash as Selloff in Europe Extends

Fed’s all-in easing, together with RBNZ and BoJ stimulus, provide no apparent support to market sentiment. Number of coronavirus cases continued to skyrocket, breaking 170,000 level today. More importantly, deaths totals hit 6,680. Selloff intensifies in European session with FTSE, DAX and CAC break