#FOMCMeetings#

1.73k Xem

316 Thảo luận

Federal Open Market Committee (FOMC) meeting refers to the 12 members of the FOMC who meet eight times a year to determine if there should be any changes to near-term monetary policy which they announce immediately afterwards.

Powell and the FOMC: Is it really about the fed funds rate?

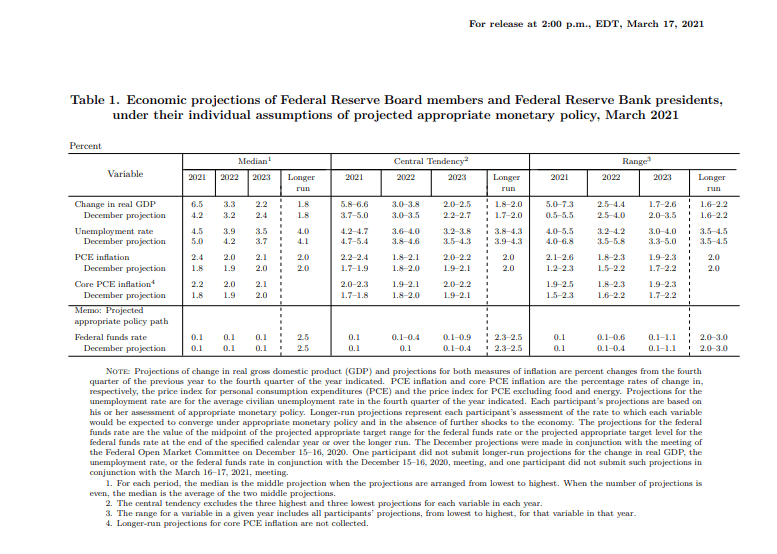

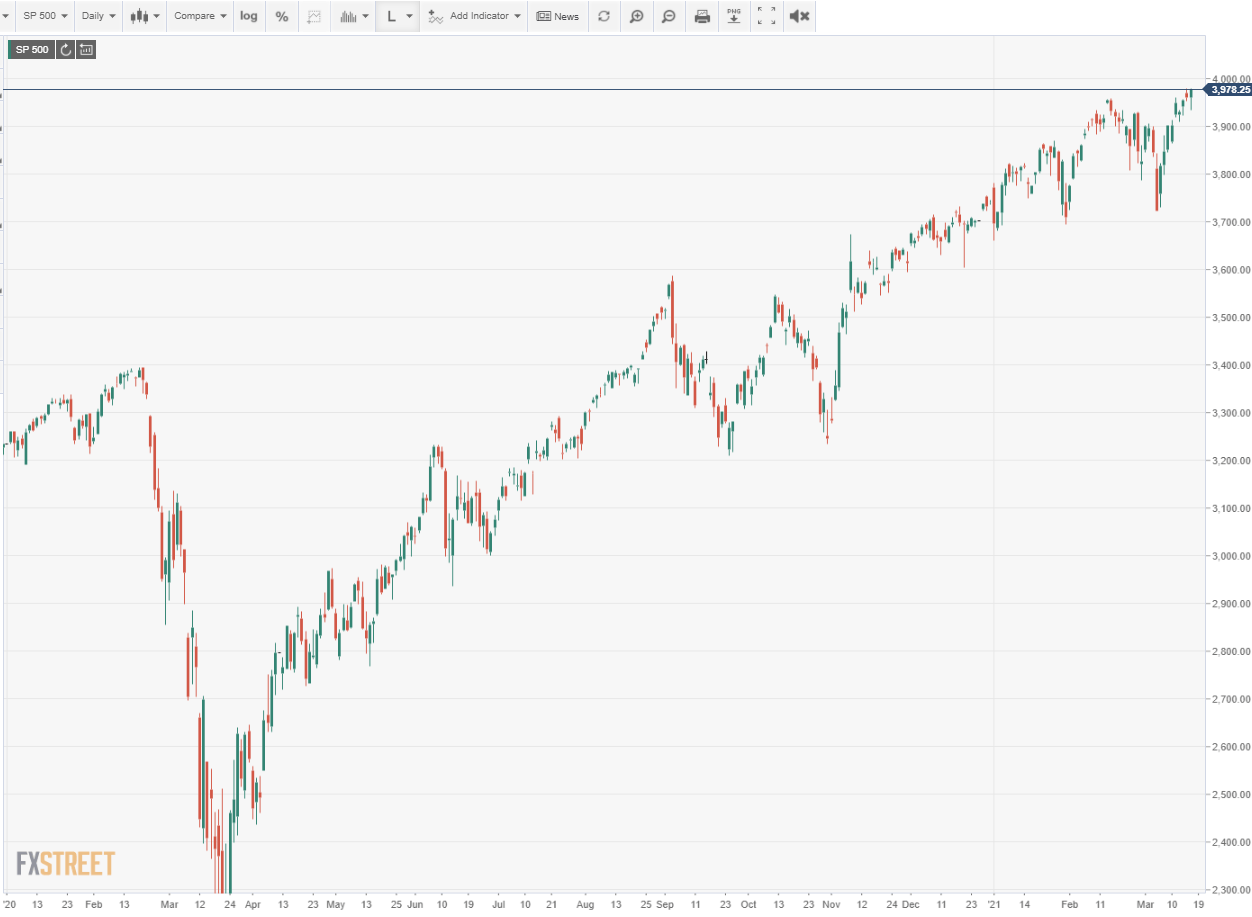

The Federal Reserve leaves rate and bond policies unchanged. Fed funds consensus shifts but the rate remains stable through 2023. Estimates for GDP expansion, inflation, and unemployment improve. Equities and bond yields move higher, dollar falls. The Federal Reserve executed a deft sleight of hand

FOMC - Probabilities of a rate hike?

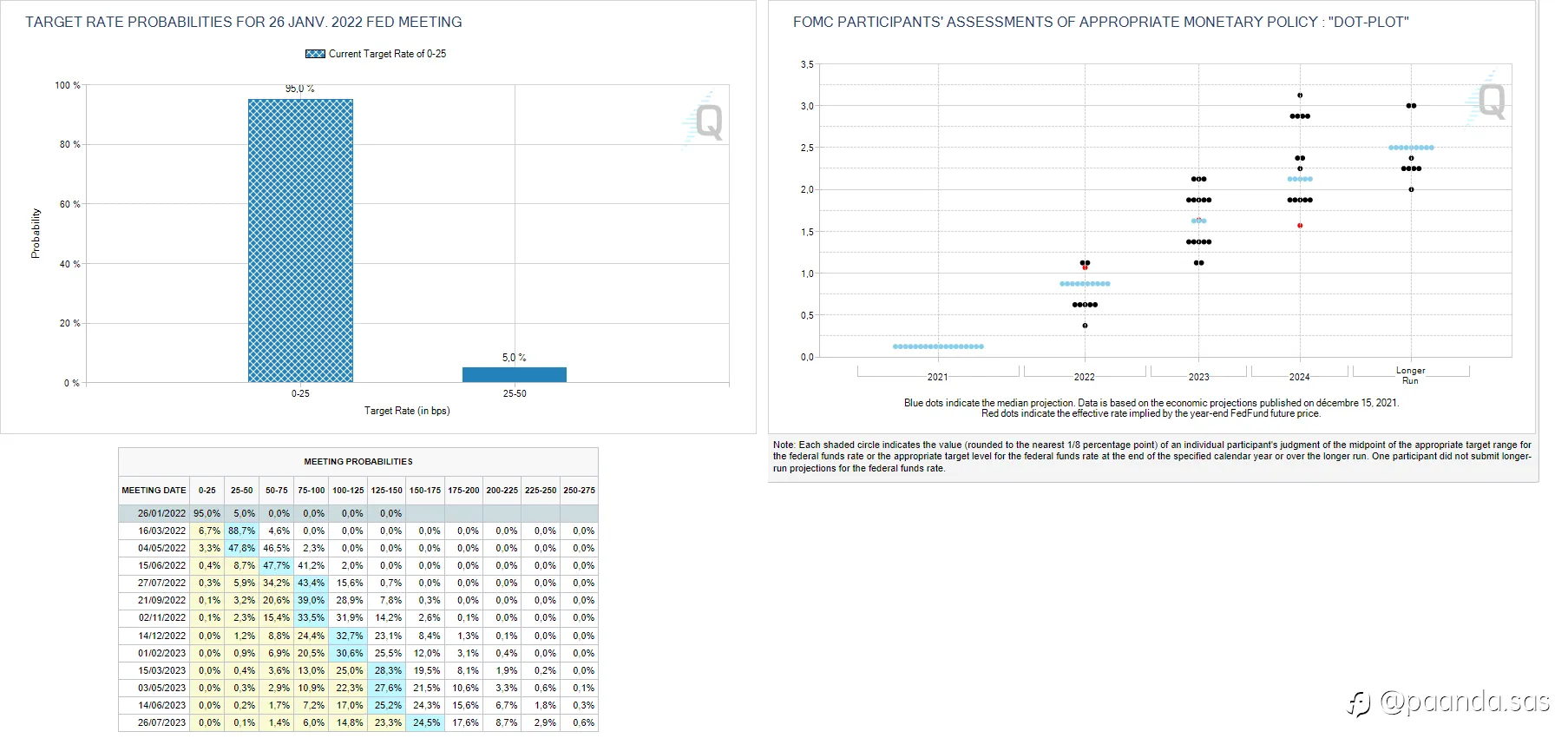

Hi everyone, Below a quick summary Pre-FOMC (26th january 2022) What are the probabilities of a rate hike? Probabilities recently plummeted... to 95% waiting for basically nothing new. 1... Allowing the US market to bounce back on 4200 support area (ES future - S&P500) The market is testing the

- Connor :wow really useful

FOMC Fireworks: Powell’s Next Move Could Ignite Your Trades

FOMC Preview: Will the Fed Hold or Hike? The Federal Open Market Committee (FOMC) meeting on May 6-7, 2025, is looming, and traders are on edge. With the Fed expected to hold the federal funds rate at 4.25%–4.50%, the real action will come from Chair Jerome Powell&r

- KarimElBawab :Missed that

FOMC Challenge: Predict to Win 50 FCOIN!

Followme FOMC Challenge 🚨 FOMC Forecast Challenge: Predict & Win 50 FCOIN! 🚨 The Federal Reserve’s next interest rate decision is imminent. In March, the Fed maintained rates at 4.25%–4.50% . With inflation easing to 2.4% and unemployment steady at 4.2% , the economic landsca

- Solo Leveling :A Inflation remains stubbornly above the 2% target, with the CPI at 2.4%. As there's no confirmation of a continued decline, the Fed needs to maintain its policy to ensure inflation comes under contr...

- KarimElBawab :I missed this!

Tantangan Prediksi FOMC: Tebak & Menangkan 50 FCOIN!

Followme Tantangan FOMC 🚨 Tantangan Prediksi FOMC: Tebak & Menangkan 50 FCOIN! 🚨 Keputusan suku bunga berikutnya dari Federal Reserve sudah semakin dekat. Pada bulan Maret, The Fed mempertahankan suku bunga di 4,25%–4,50%. Dengan inflasi yang melandai menjadi 2,4% dan tingkat penganggura

Kejutan FOMC: Langkah Powell Berikutnya Bisa Memicu Trading Anda

Pratinjau FOMC: Akankah The Fed Menahan atau Naikkan Suku Bunga? Rapat Komite Pasar Terbuka Federal (FOMC) pada 6-7 Mei 2025 semakin dekat, dan para trader mulai tegang. The Fed diperkirakan akan mempertahankan suku bunga dana federal di 4,25%–4,50%, namun aksi sesungguhnya akan datang

What Happened Last Week in the Stock Market?📊

1️⃣ Nvidia up 5.03% from $109.02 TO $114.50 2️⃣ Berkshire Hathaway up 1.03% from $534.29 to $539.80 3️⃣ Super Micro Computer (SMCI) down 3.36% from $36.00 to $33.71 4️⃣ Disney up 1.45% from $91.17 to $92.49 Don’t miss out 👉Sign up now to start trading popular stocks: https://mykvb.com/register

明天凌晨FOMC会议无论是50BP还是75BP这已经不重要,重要的看点是点阵图和经济数据展望(20220615)

1. 对于当前市场而言50BP市场已经完全消化;5月CPI8.6之后,通胀见顶论不攻自破, 市场集中交易突如其来的75BP预期,但当前部分有所消化,无论哪一个决定都改变不了FED治理通胀的决心. 也就是鹰派态度可能会持续或强化 2. 重要的看点在于本次会议会公布点阵图,以及经济数据的展望(包含通胀数据和GDP数据),这对于捕捉FED对经济表现的信心也是至关重要,以及未来是否有衰退或放缓. 3. 当前各期限的收益率,无论是短端还是中长端, 自上周五CPI数据之后都出现了大幅度飙升, 背后计价的是FED的紧缩路径步伐加快,期限结构上中长端(5Y以上的利率)倒挂持续,但市场青睐的衰退指标US10-2