#ConsumerPriceInflation#

1.34k Xem

157 Thảo luận

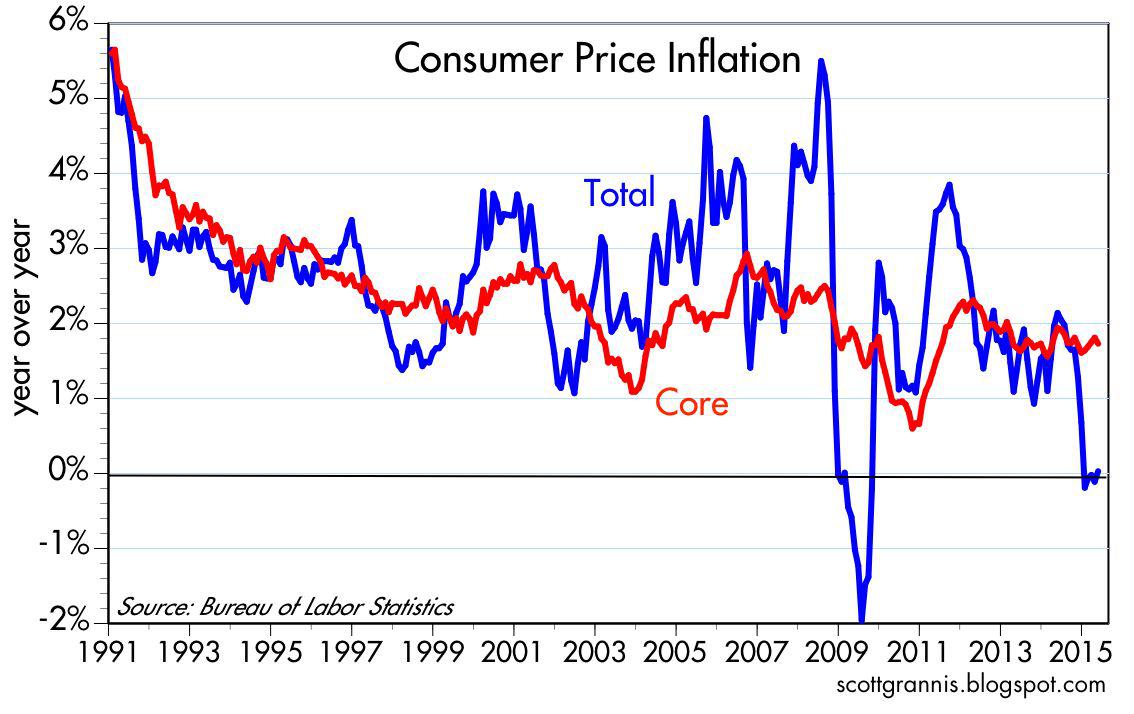

U.S. Inflation - As measured by the headline, CPI rose by much lower than expected 4.59% in December (against exp 5%) primarily on lower vegetable prices. Food inflation eased to 3.51% y-o-y in December from 9.5% in November 2020.

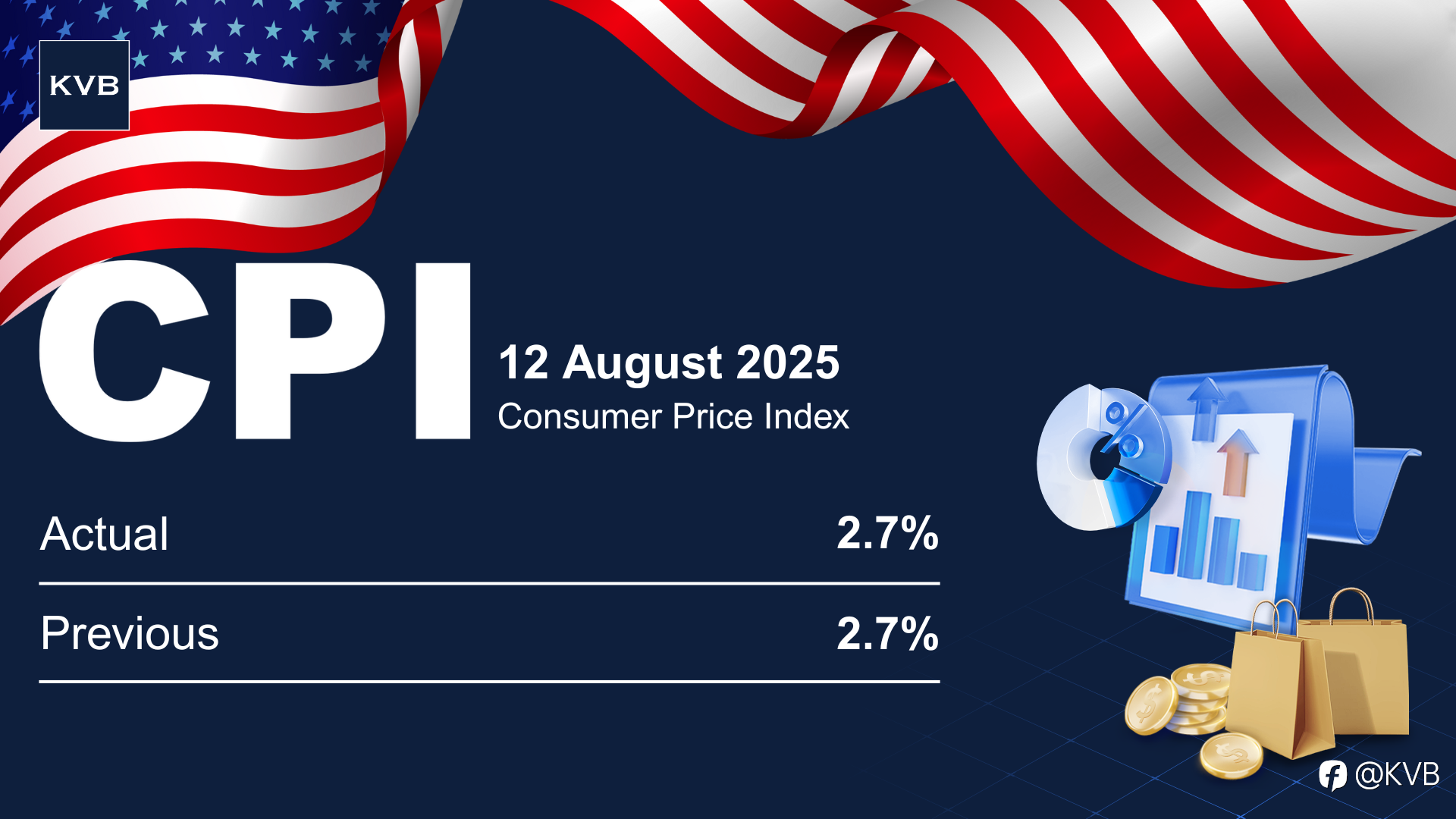

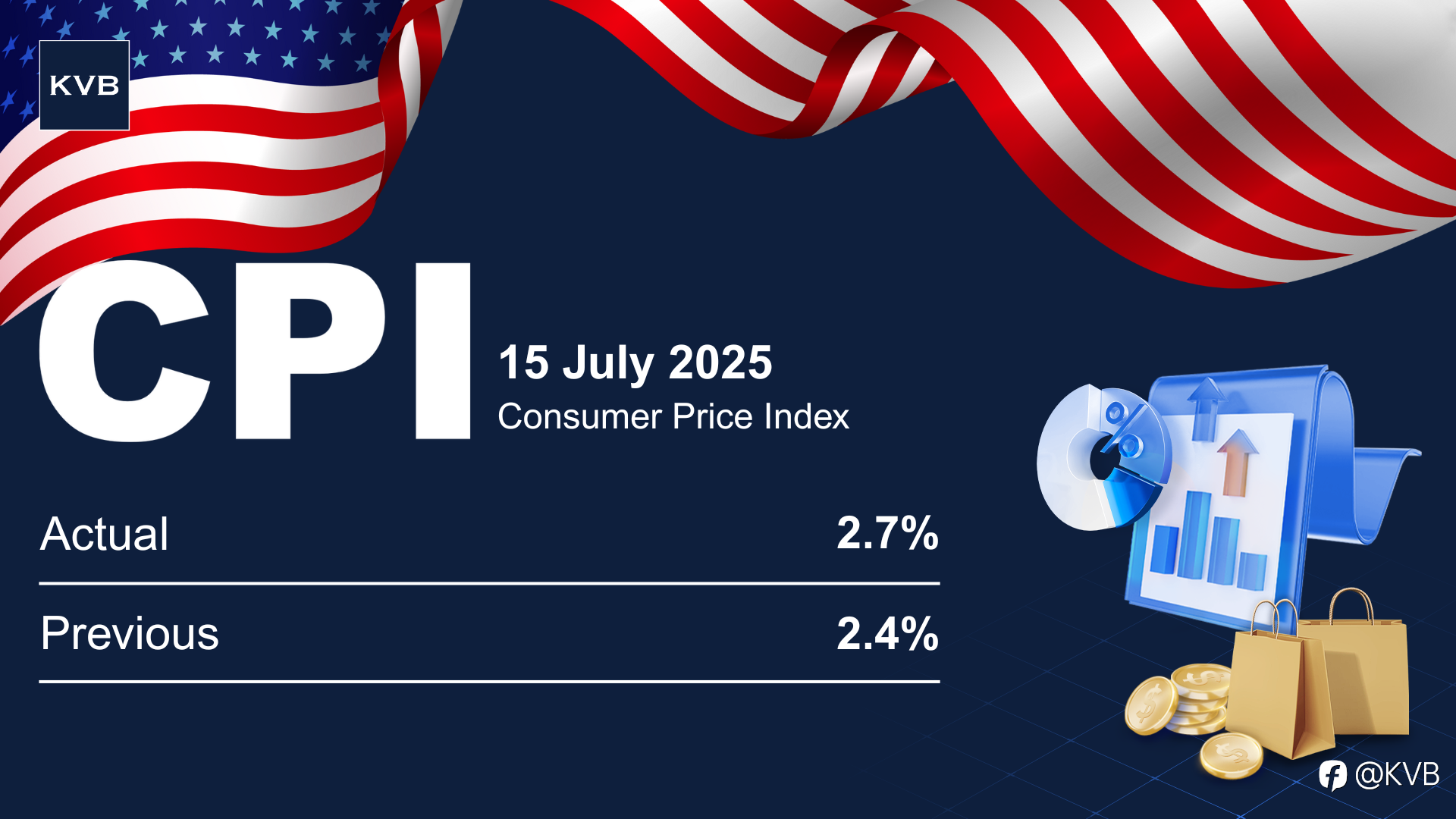

US Inflation Rises to 2.7% from 2.4% in June 🇺🇸

🟡 Headline CPI rose 0.3% MoM, lifting annual inflation to 2.7%, in line with forecasts. 🟡 Core CPI up 0.2% MoM, annual core inflation at 2.9%, matching estimates. 🟡 Tariffs may be impacting prices—apparel & home furnishings climbed, while vehicle prices fell. 🟡 President Trump renews pressur

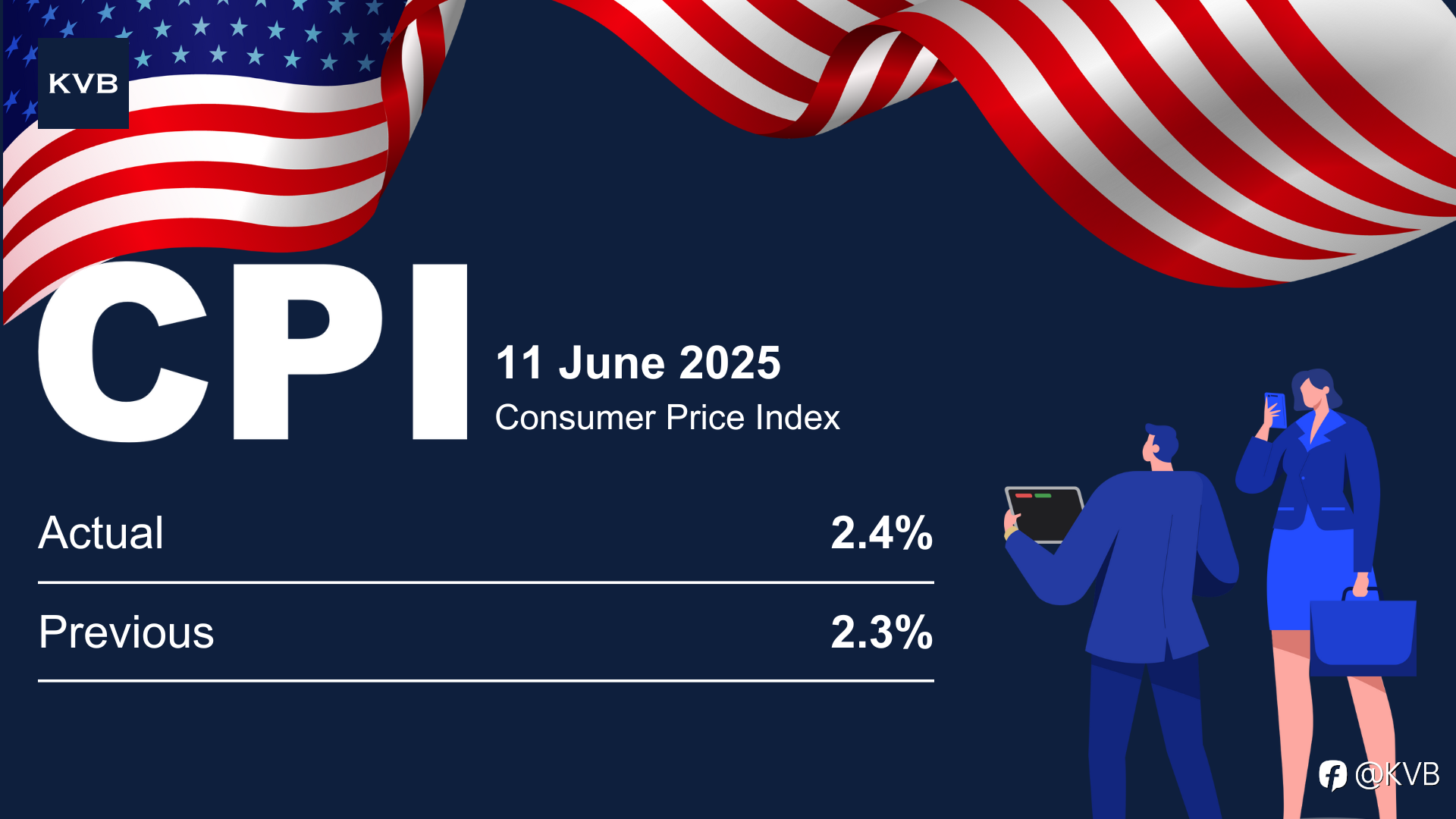

US Inflation at 2.4% | Core CPI Misses at 2.8%—Both Below Forecast

🔴 CPI Slowsdown: Consumer prices rose just 0.1% in the month, putting annual inflation at 2.4%. 🔴 Core Inflation Misses: Core CPI (ex-food & energy) increased only 0.1% MoM and 2.8% YoY—under forecasts of 0.3% and 2.9%. 🔴 Energy & Goods Decline: Falling energy costs and surprise drops in

US CPI Cools to 2.3% in April 🇺🇸

🔴 Inflation Slows: Consumer Price Index rose 2.3% YoY, easing from 2.4% in March and marking the lowest level in over 3 years. 🔴 Broad Price Decline: Categories like gasoline, groceries, apparel, used cars, and airline fares saw month-on-month price drops. 🔴 Inflation Risk Ahead: Economists warn