#U.S.StocksClimbs#

153 Xem

18 Thảo luận

Stocks rose sharply on Wednesday, continuing a strong start to September for the market as traders took profits out of high-flying names like Apple and Tesla and snapped up shares in more beaten-down parts of the market.

- Jay Dengler :Hey dear 👋,message me privately

- Jay Dengler :trader Here is our investment plan converted in peso ₱5000 earns ₱500,000 Kindly inbox me for more information

Forex Today: Dollar beats only majors as markets cool, last NFP hints eagerly awaited

Here is what you need to know on Thursday, September 3:

The US dollar continues gaining ground against the euro, pound, yen, and also gold but is losing some ground to commodity currencies. Hopes for a coronavirus vaccine fuel markets and two hints towards Friday's jobs report are eyed after disappo

Chứng khoán Mỹ sắp đón cú huých 170 tỷ USD từ gói kích thích tài khóa?

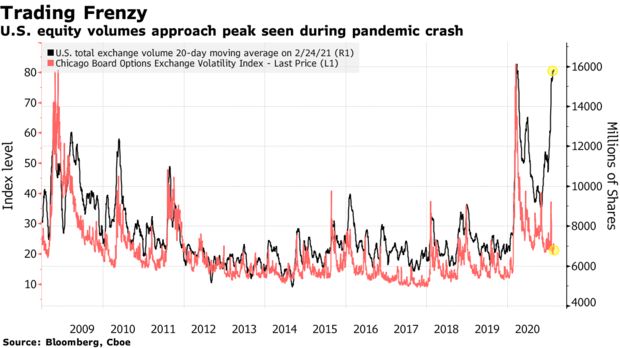

Việc phát tiền trực tiếp cho dân Mỹ từ gói kích thích (dự kiến là 1,900 tỷ USD) có thể mở ra cú huých 170 tỷ USD dòng vốn mới của nhà đầu tư nhỏ lẻ tới thị trường chứng khoán Mỹ, theo các chuyên gia tại Deutsche Bank. Cuộc thăm dò nhà đầu tư nhỏ lẻ cho thấy họ dự tính bỏ 37% khoản tiề

【Orbex基本面分析】特朗普仍在阻止拜登上台

美元指数仍然受压 美元指数昨日再次触顶90点关口后收跌。 尽管美国政府已经避免了关门,但在美国财政刺激方案正式出台后,投资者并没有表现出更多热情。 当我们接近白宫主人更替的时候,拜登说他的团队正面临着国防部和管理与预算办公室设置的障碍。 尽管特朗普政府表示他们已经完全透明,但这是否是他在政府最后几周的时间内最后一次试图制造混乱? 疫苗的推广帮助了欧元区发展 周一欧元上涨0.21%,因为欧洲国家开始为人们接种Covid-19疫苗。 早期预测显示,如果疫苗推广成功,2021年经济将以最快速度增长。 然而,疫情可能会留下明显的伤疤。预计19国集团的失业率将在四年多以来首次升至10%以上。 英国脱欧与

【Orbex技术分析】麦当劳第三季度财报超过预期

美国标志性快餐公司麦当劳(McDonald's)昨日公布第三季度财报,轻松超过华尔街预期。该公司公布第三季度每股收益为2.35美元,超过每股收益1.91澳元的预期。该公司还公布了54.2亿美元的收入,再次超过54亿美元的预期。美国销售强劲增长在财报电话会议上,麦当劳报告了Q3净收入17.6亿美元。这标志着相比一年前公布的16.1亿美元,增长势头强劲。然而,结果中也存在一些薄弱环节。尽管收入超过预期,但实际收入同比下降了2%,而全球同店销售额却下降了2.2%。同店销售额下降的原因是该集团国际市场复苏缓慢。然而,美国的同店销售额增长了4.6%。这在很大程度上要归功于9月份与全球说唱明星特拉维斯·斯

USD/CAD: Well bid above 1.3050 as WTI stays under $42, US dollar refreshes weekly high

USD/CAD refreshes intraday high amid broad USD strength.

Sluggish WTI, risk-tone sentiment adds to the pair’s strength.

US Jobless Claims, ISM Services PMI and Canadian trade numbers will be the key ahead of Friday’s job report.

USD/CAD extends the early-Asian recovery from 1.3037 to 1.3072, up 0.2

EUR/USD: China Caixin Services PMI and risk-on fails to draw bids

EUR/USD trades in the red near 1.1820 at press time versus 1.1856 in early Asia.

China's service sector PMI bettered estimates by a big margin.

Asian stocks cheer signs of continued recovery in China but fail to inspire USD bears.

EUR/USD remains depressed on Thursday with dollar bears sitting o