Gold Holds Near Record Highs Ahead of Key U.S. Data

Gold prices remain elevated near record levels around $4,300 per ounce as markets turn cautious ahead of major U.S. economic releases. The metal is holding firm in early Asian trade, reflecting a balance between expectations of Fed easing and easing geopolitical risks. The key focus is today’s U.S.

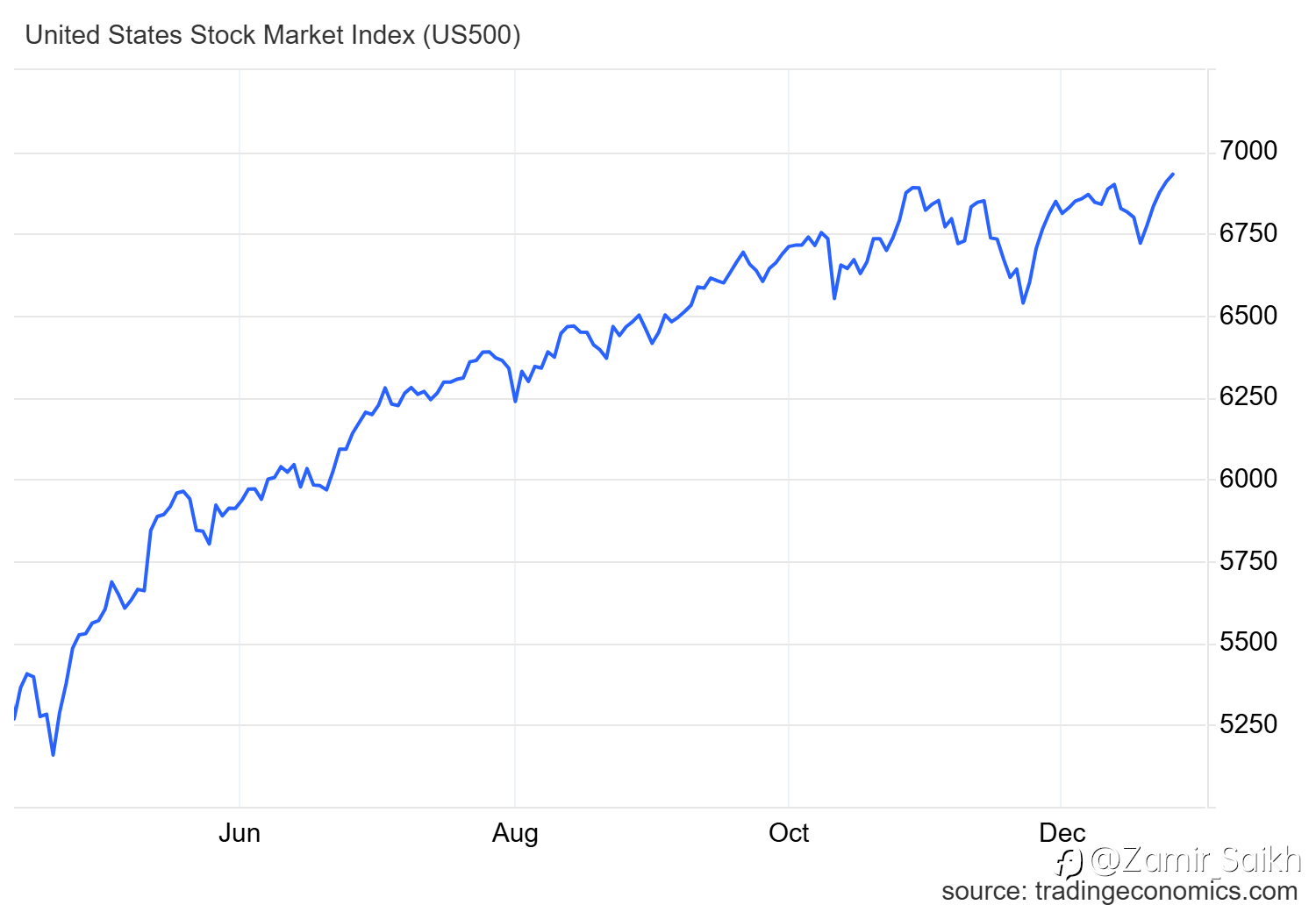

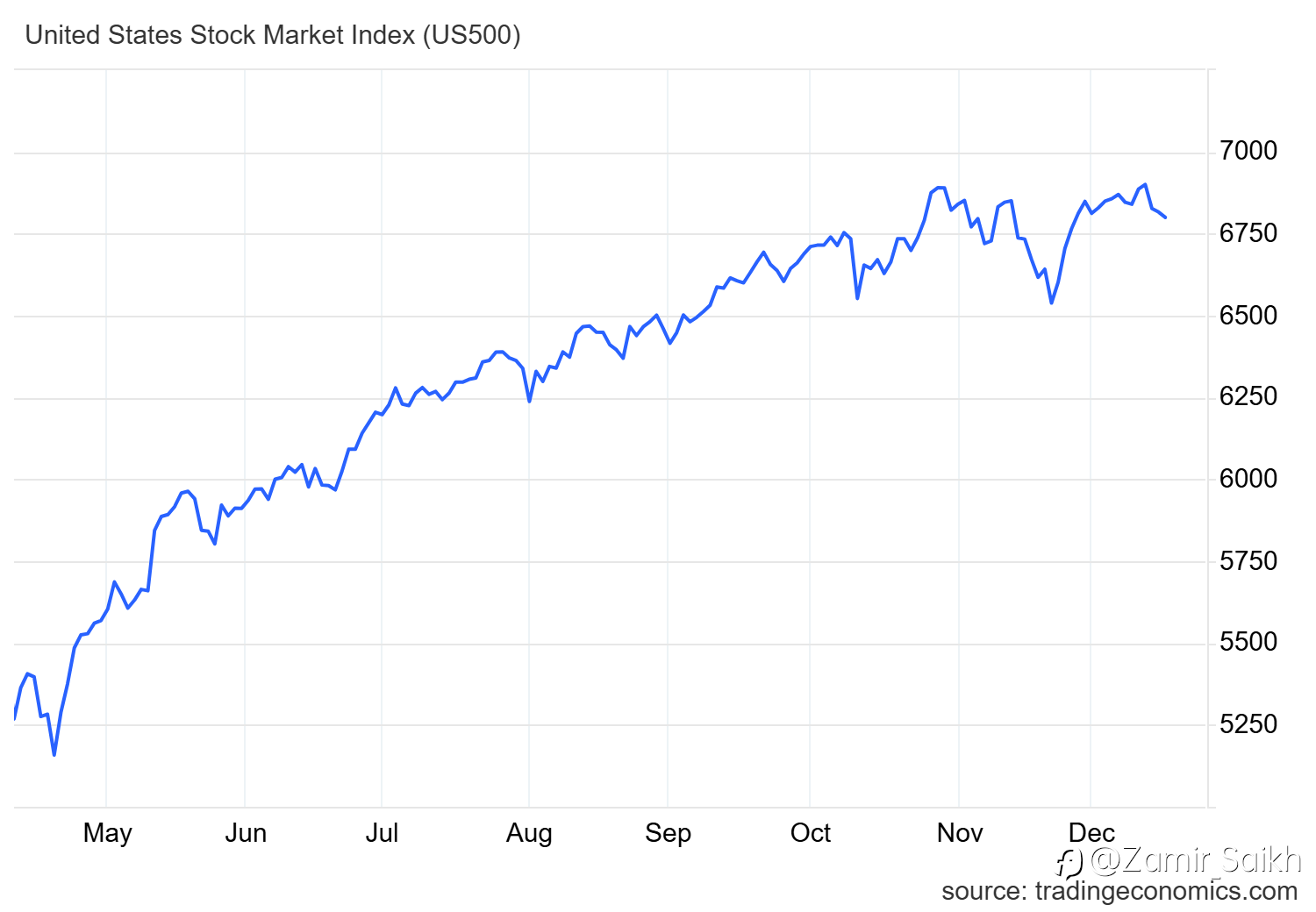

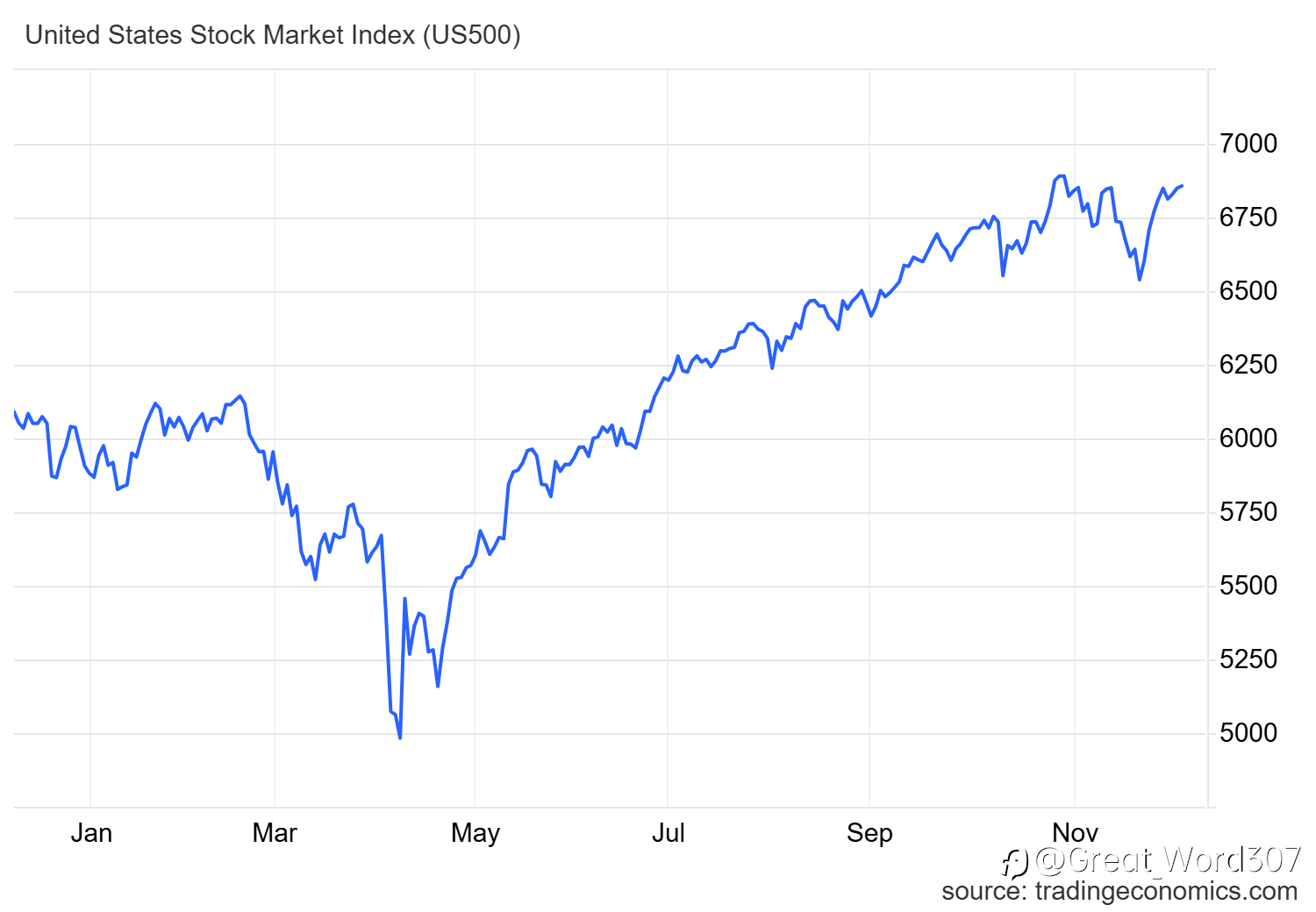

📈 Market analysis: JPMorgan Forecasts Strong 8% Growth for S&P 500, Lifts 2025 Target

JPMorgan raised its 2025 S&P 500 target to 6,500, up from its prior 2024 estimate of 4,200, citing U.S. economic strength, AI growth, and consumer resilience. It forecasts 10% earnings growth, with Fed rate cuts expected to sustain market momentum. 📘Read the full analysis here: https://www.kvbp