Bạn nghĩ gì về điều này!

Oil Retreats Over Demand Recovery Fears

Investing.com – Oil was down on Thursday morning in Asia, giving up some of its gains from the previous session. Investor worries about a stall in the black liquid’s demand recovery increased after California became the latest U.S. state to re-impose lockdown measures on Wednesday.

The measures incl

财经早餐:欧美多国核心数据出炉 油市两大月报来袭

本周(1月13日-19日当周)全球市场将迎来多个重磅经济数据,包括英国11月GDP、德国2019年GDP、美国、英国及德国12月CPI,美联储将公布褐皮书,且美联储多位官员将相继发表讲话,虽然上周出炉的美国12月非农就业报告欠佳,但该报告可能不会改变美联储的评估,即经济和货币政策都处于“良好状态。原油市场方面,EIA、OPEC均将公布月度原油市场报告,上周美伊紧张局势引发供应忧虑,国际油价剧烈波动,投资者们需密切留意后续进展。

周一(1月13日)需继续关注地缘紧张局势的进展,上周美伊进展局势引发金价和油价出现过山车行情。周末消息显示,两名美国军人在阿富汗的炸弹袭击中丧生,随后特朗普政府警告

USD/CAD edges lower toward 1.2660 as WTI clings to gains above $62

USD/CAD is falling for the fifth straight day on Wednesday. WTI is up more than 1% ahead of EIA's Crude Oil Stocks Change data. US Dollar Index stays quiet above 90.00 ahead of Powell's testimony. The USD/CAD pair closed the previous four trading days in the negative territory and continues to edge

WTI climbs to 2-day highs, approaches $61.00

The WTI reverses the recent weakness and regains $60.00. Immediate support emerged around Friday’s low at $58.60. The API, EIA reports come in later in the week. Crude oil prices regain the smile at the beginning of the week and push the barrel of West Texas Intermediate back above the key barrier a

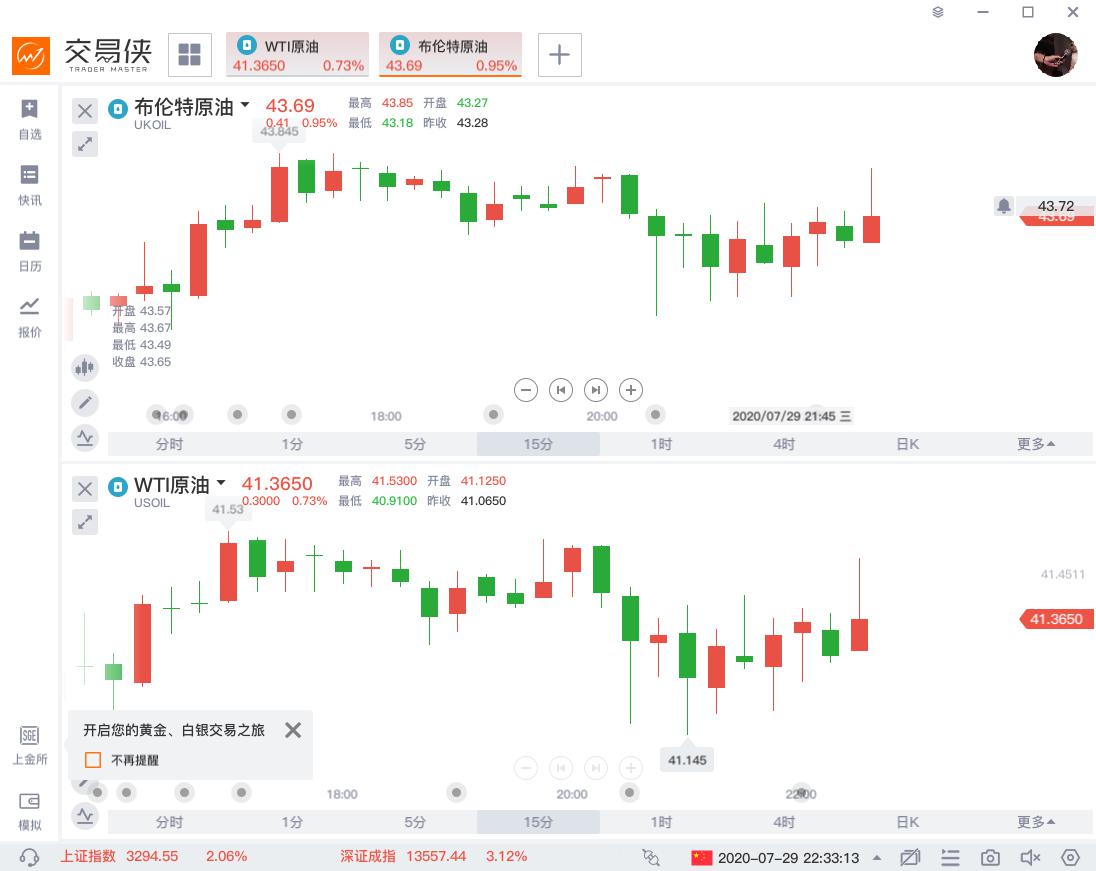

WTI consolidates recent gains near 25-week high above $43.50

WTI bulls catch a breather after rising to $43.86, the highest levels since early-March.

Higher than expected EIA stockpile draw, fears of hurricane Laura keeps the bulls hopeful.

Cautious sentiment ahead of the key US events probes further upside.

Following its run-up to the highest since March 06

【原油动态】美国EIA原油库存大降1061.2万桶,美油期货三分钟成交3.4亿美元

周三晚,美国至7月24日当周EIA原油库存录得-1061.2万桶,降幅创1月3日当周以来最大。

数据公布后,美、布两油短线走高近0.2美元,现分别报41.44美元/桶和43.78美元/桶。NYMEX最活跃9月WTI原油期货合约北京时间7月29日22:30-22:33 三分钟内买卖盘面瞬间成交8291手,交易合约总价值逾3.4亿美元。

不过分项数据却在拖后腿,美国汽油库存增加64.5万桶,预期为减少73.3万桶,美国汽油库存变化值连续3周录得下滑后本周录得增长。美国俄克拉荷马州库欣原油库存增加130.9万桶,变化值连续4周录得增长。美国上周精炼油库存增加50.3万桶,升至1982年12月以来

Oil prices slip on demand fears as U.S. virus cases surge

MELBOURNE (Reuters) - Oil prices dipped on Thursday after the United States recorded its biggest one-day spike in coronavirus cases and California reimposed some lockdown measures, stoking worries a resurgence in COVID-19 cases will stall a recovery in fuel demand.

U.S. West Texas Intermediate (WTI)

WTI slips below $39.00 to snap two-day winning streak

WTI extends pullback from four-day top of $40.04.

The EIA inventory fall, US-China tussle add strength to the post-Fed consolidation.

US economics, Sino-American story might entertain traders amid a light calendar.

WTI stays pressured near $38.75 amid the early Asian session on Thursday. The oil be

WTI slips below $39.00 to snap two-day winning streak

WTI extends pullback from four-day top of $40.04.

The EIA inventory fall, US-China tussle add strength to the post-Fed consolidation.

US economics, Sino-American story might entertain traders amid a light calendar.

WTI stays pressured near $38.75 amid the early Asian session on Thursday. The oil be

大利空!EIA报告暗示油市风险,小心多头盛宴戛然而止!

周三(6月3日)22:30公布的美国至5月29日当周EIA原油库存录得减少207.7万桶,前值为增加792.8万桶,预期增加303.8万桶。

今晨公布的API数据已经预示今晚的EIA库存报告会优于预期。美国截至5月29日当周API原油库存减少了48.3万桶,而市场预期为增加330万桶。

但EIA报告中的分项数据并不令人鼓舞,尤其是精炼油,当周:

俄克拉荷马州库欣原油库存减少179.3万桶,前值为减少339.5万桶;库欣原油库存变化值连续4周录得下滑;

汽油库存增加279.6万桶, 前值为下降72.4万桶,预期增加100万桶;

精炼油库存增加993.5万桶,前值为增加549.5万桶,预期增