Bạn nghĩ gì về điều này!

Best Forex Broker in USA 2022: Top US Forex Brokers List

The foreign exchange market, also known as the Forex market or the FX market, is also one of the global markets that witnesses a trading volume of almost $6.6 trillion every day. Foreign exchange refers to exchanging one currency trading with another for different reasons that include tourism, inter

- Fernandez Morgan :I started my investment with $100 and I made $1450 in just 3days of trading with Henriella Geoffrey fxtrade on Instagrám

What Is The US Dollar Index And How Can You Trade It?

What is the US Dollar Index? The US Dollar Index (DXY, DX, USDX) measures the value of the United States dollar relative to a basket of other currencies, including the currencies of some of the US’s major trading partners. The Dollar Index rises when the US dollar gains strength compared to the othe

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

Trading Safe Haven Assets

#OPINIONLEADER# Where does money flow in times of financial stress and why? Safe haven assets are financial instruments or commodities that investors turn to in times of stress. We’re not talking about personal stress, not in this article, anyway, but the type of stress seen in the wi

- Fernandez Morgan :Invest $100 and earn $8500 weekly with Henriella Geoffrey fxtrade @Instagrám and recover your funds as well

- jesh49 :To Get Professional Trading services with good trading signals, ℭOMMUNℑℭATE. 𝗸𝗮𝘁𝗵𝗿𝘆 on ⒾⓃⓈⓉⒶⒼⓇⒶⓂ 𝗸𝗮𝘁𝗵𝗿𝘆𝗻 𝗰𝗮𝗿𝗹𝘀𝗼𝗻0

- 雄鹿之角 :🍺

- Becky Kate :sharing is caring

有技术没有本钱?看过来!

什么是外汇中的自营交易? 在外汇交易中,除了通过经纪商使用自己的资金交易以外,还有一种方法是通过自营外汇交易公司使用自营资金交易。 外汇自营公司是一种评估交易者技能(通常以交易挑战的方式)并将其交易资金分配给合作交易者的公司。这种公司设有一段时间的挑战(评估)期,其目的是了解交易者是否合格,以及他们是否有能力按照公司的资金管理规则进行交易。 与自营公司交易通常会涉及一些费用,有可能是用于获得公司评估的入场费,也有可能是为了能够持续用公司资金交易而支付的月费。 外汇交易者通过自营公司赚得的盈利通常会按方案(例如80% 60%/40%)分配。 总体而言,如果交易者确信自己能够盈利,那么外汇自营公司

- GordonPiskS :我又找到了几个: City Traders Imperium Lux Trading Firm Fidelcrest Topstep Audacity Capital Forex Traders UK

- 奇盈合欢散 :这还要行情配合 我以前考过1次 停留在60%,现在重新再来 希望能过 如果行情一直震荡 很难过关😂

- 小雪球 :看不懂

Ulasan Pialang Berjangka: Premier Equity, We All Start Every Trade

PT Premier Equity Futures merupakan perusahaan pialang berjangka yang berdiri sejak tahun 2004, Premier Equity bergerak di bidang perdagangan kontrak derivatif komoditi, indeks saham dan foreign exchange. Premier Equity memiliki struktur operasional dan mengakomodir seorang nasabah untuk melakukan t

- Take Prof :👏👏

- anbiru :👏

Lợi nhuận từ việc theo dõi

977.47

USD

- Ký hiệu AUD/NZD

- Tài khoản giao dịch #3 1100046914

- Sàn giao dịch ICMarkets

- Giá Mở/Đóng 1.11493/1.11232

- Khối lượng Bán 1.02 Flots

- Lợi nhuận 171.81 USD

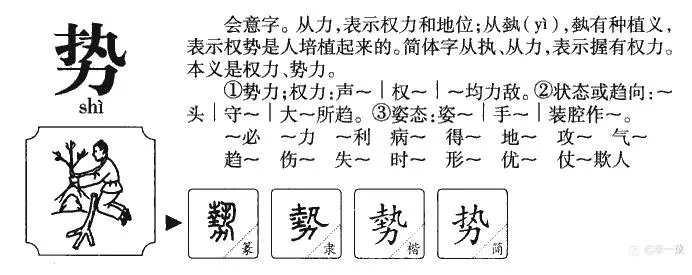

交易不光看“趋”,还要看“势”

最近通过一些交易和分析,有感而发,在展开本文主题之前,先讲一点点题外话。 不少初入外汇圈子的人,应该都主动或被动地获知过一些入门常识,比如外汇市场透明度高,不存在人为操纵,多空双向获利模式,风险可控......其实,这些话听听就好,既然是入门,自然是要捡好听的给你讲。 现实情况是,外汇市场远比我们熟知的股市要鱼龙混杂得多,股市经过国内外上百年的发展,至少在券商分析师领域已然形成了一套严密成熟的研究体系和框架逻辑,像宏观、策略、行业、估值、定价等等研究,层次分明,结构清晰,至少在专业的领域看起来很专业,也确实有一定的信服力,更别说金融圈内更高端一点的期市、债市。 相比之下,外汇市场还从未形成成熟

- 杨子与汇市 :写的挺好的,交易的确要顺势而为,趋也就是方向,方向确定了,在就是什么时候做,是突破还是回调做

- 长期野心控制短期欲望 :🙋♂️

- 汇海一号 :辛苦了,感谢分享。也许只有我们放大格局,看清楚真正的势才能事半功倍👍👍

每月账户小结(2022/05)

本月是账户3的第28个月,收益和收益率双双为正,而且又一次月收益超过了月最大回撤: 由于优秀的风险收益比,和账户3同策略的达尔文本月在Darwinex的5158个达尔文中排到了第24位,获得官方9万多欧元的投资,这才是实力的象征: 已经连续4个月获得官方投资,加上之前的28.5万欧元的官方投资,目前官方总投资已经超过37万欧元: 这个账户去年才在达尔文上线,短短一年时间已经获得官方总计近60万欧元的投资。虽然账户3在这个社区的受众比较小,但由于风险较小,对于大资金来讲还是很受欢迎的,我自己的22万多欧元全部买了自己的达尔文,对自己的策略就是这么自信: 说起买卖自己达尔文这事还有点小伤心,3月份

- 蛟邑金鹰 :虽然是很佩服老兄的,不过看到买卖自己的达尔文时,我还是不厚道地笑了一下😄😄

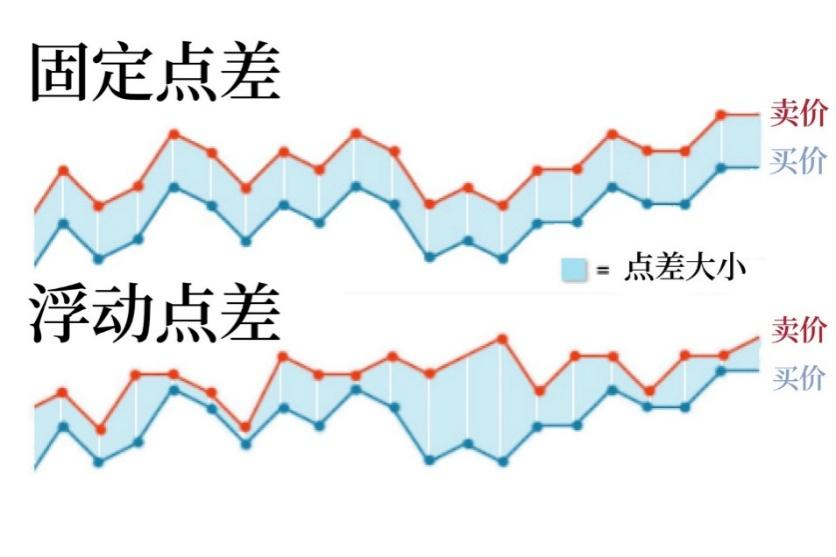

乐天证券暂停固定点差,投资者该如何选择点差模式?

近期,由于市场波动的原因,日本外汇和差价合约经纪商Rakuten Securities乐天证券对外宣布已暂停固定点差。 据小编了解,该公司此举是为了应对日元贬值,日本银行介入外汇市场以及英国新政府宣布发表经济政策后英镑波动流动性下降等...多个因素导致的外汇市场流动性下降。在这种情况下,点差往往会大幅扩大。该公司考虑到这种情况将在未来持续下去,才不得不做出暂时停止为乐天FX和乐天MT4的所有货币对提供固定点差的决定。 根据上述变化,该公司还暂停了从2022年9月6日以来一直在进行的乐天外汇点差降低活动。为的是避免因市场突然波动而造成的强制结算(止损),